European stocks fell for the first week in seven as earnings from GlaxoSmithKline PLC to Akzo Nobel NV disappointed investors, sparking concern the worst of the profits slump may not be over.

ICAP PLC sank 11 percent as the world’s largest broker of trades between banks lost 85 percent of its business in the most active part of the mortgage-bond market in six weeks. Drugmaker GlaxoSmithKline lost 3.1 percent as earnings missed analysts’ estimates. Akzo Nobel fell 5.6 percent as the world’s biggest maker of paints posted a first-quarter loss on sliding demand.

“There is still a lot of bad news to come out from the economy,” said Lothar Mentel, London-based chief investment officer at Octopus Investments Ltd, which manages the equivalent of about US$1.1 billion.

Investors should be “prepared for a bumpy ride until the end of the year,” he said in a Bloomberg Television interview.

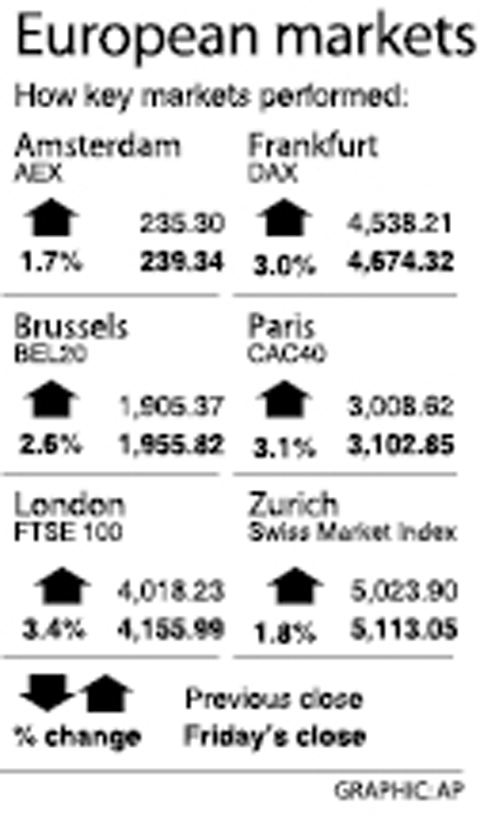

The Dow Jones STOXX 600 Index slid 0.6 percent to 195.82, ending the longest streak of weekly gains on the measure since 2006. The gauge has rallied 24 percent since March 9 as investors speculated US Treasury Secretary Timothy Geithner’s plan to finance the purchase of as much as US$1 trillion in illiquid assets from banks will help to pull the global economy out of the economic slump.

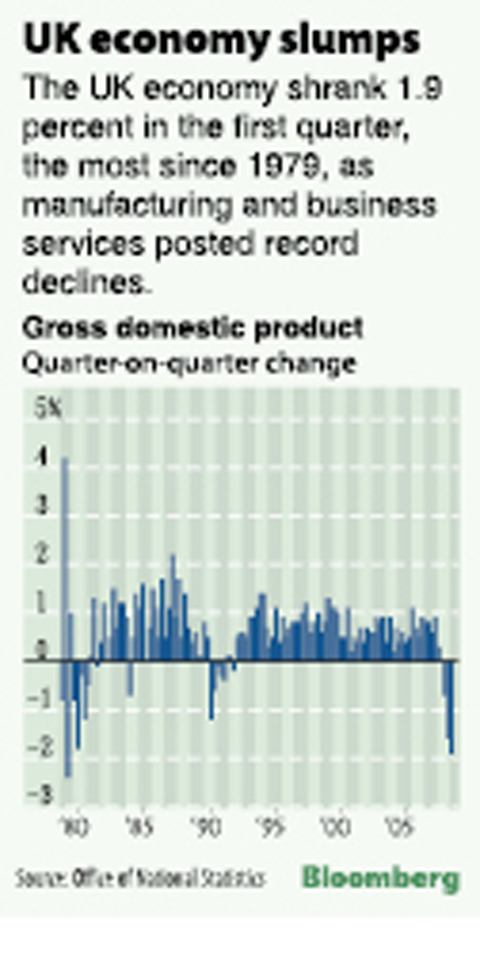

The UK economy shrank more than economists forecast in the first quarter, marking the biggest contraction since the rise of then-British prime minister Margaret Thatcher in 1979 as manufacturing and business services posted record declines.

Earnings at 55 of the companies in the STOXX 600 that have reported earnings so far since April 7 declined by an average of 25 percent, according to data compiled by Bloomberg.

Credit Suisse Group AG and Debenhams PLC were among companies that gave investors positive surprises when they reported first-quarter results this week.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said it plans to ship its new 1 megawatt charging systems for electric trucks and buses in the first half of next year at the earliest. The new charging piles, which deliver up to 1 megawatt of charging power, are designed for heavy-duty electric vehicles, and support a maximum current of 1,500 amperes and output of 1,250 volts, Delta said in a news release. “If everything goes smoothly, we could begin shipping those new charging systems as early as in the first half of next year,” a company official said. The new