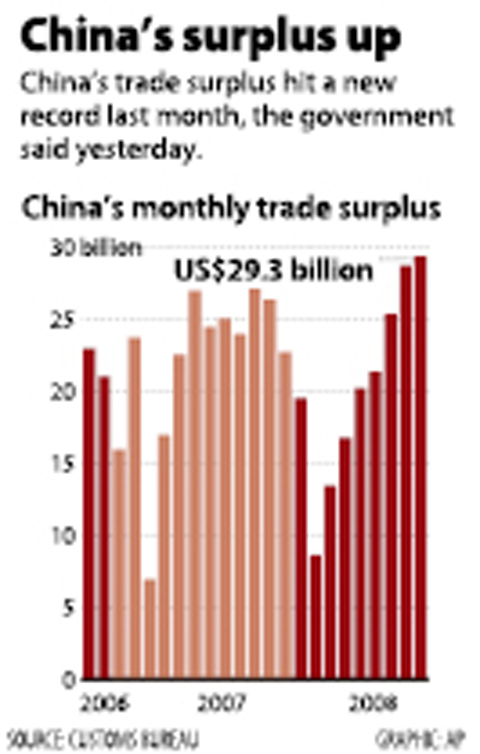

China’s trade surplus widened to a record last month as exports withstood the global economic slowdown and falling commodity prices reduced the import bill.

Exports rose 21.5 percent from a year earlier to US$136.4 billion after gaining 21.1 percent in August, the customs bureau said on its Web site. The trade surplus climbed to US$29.3 billion, a figure derived by deducting the value of imports from the number for exports.

China has stimulated the world’s fourth-biggest economy by cutting interest rates twice in a month to counter the financial crisis. The surplus swelled a record US$1.8 trillion in foreign-currency reserves, which may help the nation maintain growth of more than 9 percent as a global recession looms.

“It’s not a bad thing to have a relatively large trade surplus when there’s a global financial crisis,” said Wang Qian (王黔), an economist at J.P. Morgan in Hong Kong.

“China’s foreign-currency holdings will help the country to survive the crisis,” Wang said.

The median forecasts in a survey of 13 economists were for export growth of 20 percent and a trade surplus of US$24.5 billion. The previous record was US$28.7 billion in August.

Imports increased 21.3 percent to US$107.1 billion after climbing 23.1 percent in the previous month. Falling prices for commodities such as copper and oil have trimmed the value of inward shipments.

Export growth is down from 25.7 percent for all of last year.

“Although the numbers look like China’s exports are holding up, the volume growth of exports has slowed to below 10 percent,” Wang said.

“Export growth will continue to weaken as the economic slowdown spreads from developed economies to emerging markets,” Wang said.

Export growth to the US slowed by 4.6 percentage points from a year earlier to 11.2 percent in the first nine months, the customs bureau said.

Trade with India “surged,” it said, with imports and exports together jumping 54.9 percent in the first nine months from a year earlier.

“Maybe world demand is providing a last gasp,” said Ben Simpfendorfer, an economist with Royal Bank of Scotland Plc in Hong Kong.

“Look for a sharp slowdown in the fourth quarter. The final two months of the year will be particularly weak as electronics exports are typically shipped during this period and they are the export sector’s growth engine,” he said.

China’s latest cut in borrowing costs, which reduced the one-year lending rate to 6.93 percent, came last week as part of an emergency coordinated bid to thaw credit markets.

The US Federal Reserve, the European Central Bank and four other central banks also lowered borrowing costs.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

BUBBLE? Only a handful of companies are seeing rapid revenue growth and higher valuations, and it is not enough to call the AI trend a transformation, an analyst said Artificial intelligence (AI) is entering a more challenging phase next year as companies move beyond experimentation and begin demanding clear financial returns from a technology that has delivered big gains to only a small group of early adopters, PricewaterhouseCoopers (PwC) Taiwan said yesterday. Most organizations have been able to justify AI investments through cost recovery or modest efficiency gains, but few have achieved meaningful revenue growth or long-term competitive advantage, the consultancy said in its 2026 AI Business Predictions report. This growing performance gap is forcing executives to reconsider how AI is deployed across their organizations, it said. “Many companies