After a week of eye-popping gains, Wall Street is pondering whether the rebound from a vicious sell-off points to a real recovery from the economic and financial turmoil or a new “bear trap.”

Markets appear to have come to terms with the notion of a recession in the US and global economies, but the key question for traders now is whether the heavy doses of medicine from governments around the world will lead to quick recovery.

The coming week, however, will be marked by the US presidential election on Tuesday and key data, particularly from the struggling auto sector.

The Dow Jones Industrial Average showed a stunning rebound of 11.29 percent for the week, the best since 1998, led by Monday’s 10 percent surge.

But that failed to make up for the panic selling of earlier in the month, leaving the blue-chip index down a hefty 14 percent for last month and nearly 30 percent for the year.

The broad-market Standard & Poor’s 500 index vaulted 10.49 percent on the week to 968.75, but fell 17 percent last month. The technology-heavy NASDAQ composite advanced 10.88 percent to 1,720.95, but lost 18 percent in the month.

The strong gains still left the market deep in the red after one of the ugliest months in Wall Street history.

“Investors were pricing in a very severe recession, if not depression, and right now we’re going through a relief rally,” Standard & Poor’s analyst Sam Stovall said.

“Investors feel that stock prices might have overdone it to the downside,” he said.

Joachim Fels at Morgan Stanley said authorities in the US and elsewhere are taking the aggressive actions needed to stem the crisis, including interest rate cuts and moves to pump vast amounts of liquidity into the financial system.

“In our view, even highly unorthodox measures such as zero interest rates, direct central bank lending to the private sector, heavy government interference with private banks’ lending policies or large-scale bank nationalizations cannot be excluded,” Fels said.

“In short, we believe that the authorities will do whatever it takes to prevent a depression,” he said.

“While a global recession appears unavoidable, we believe that markets have gone too far in pricing in a multi-year deflationary outcome,” Fels said.

Christine Li at Economy.com said markets were more focused on central bank actions to cut rates around the world, on top of a variety of initiatives to ease a global credit squeeze.

Bonds fell over the week as investors appeared to take a bit more risk.

The yield on the 10-year Treasury bond rose to 3.970 percent from 3.697 percent a week earlier, and that on the 30-year bond increased to 4.369 percent against 4.087 percent. Bond yields and prices move in opposite directions.

Right-wing political scientist Laura Fernandez on Sunday won Costa Rica’s presidential election by a landslide, after promising to crack down on rising violence linked to the cocaine trade. Fernandez’s nearest rival, economist Alvaro Ramos, conceded defeat as results showed the ruling party far exceeding the threshold of 40 percent needed to avoid a runoff. With 94 percent of polling stations counted, the political heir of outgoing Costa Rican President Rodrigo Chaves had captured 48.3 percent of the vote compared with Ramos’ 33.4 percent, the Supreme Electoral Tribunal said. As soon as the first results were announced, members of Fernandez’s Sovereign People’s Party

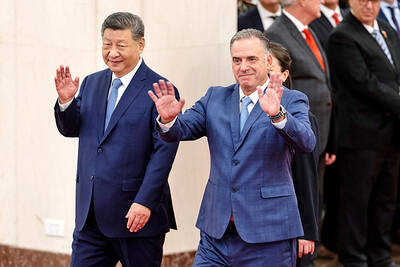

EMERGING FIELDS: The Chinese president said that the two countries would explore cooperation in green technology, the digital economy and artificial intelligence Chinese President Xi Jinping (習近平) yesterday called for an “equal and orderly multipolar world” in the face of “unilateral bullying,” in an apparent jab at the US. Xi was speaking during talks in Beijing with Uruguayan President Yamandu Orsi, the first South American leader to visit China since US special forces captured then-Venezuelan president Nicolas Maduro last month — an operation that Beijing condemned as a violation of sovereignty. Orsi follows a slew of leaders to have visited China seeking to boost ties with the world’s second-largest economy to hedge against US President Donald Trump’s increasingly unpredictable administration. “The international situation is fraught

MORE RESPONSIBILITY: Draftees would be expected to fight alongside professional soldiers, likely requiring the transformation of some training brigades into combat units The armed forces are to start incorporating new conscripts into combined arms brigades this year to enhance combat readiness, the Executive Yuan’s latest policy report said. The new policy would affect Taiwanese men entering the military for their compulsory service, which was extended to one year under reforms by then-president Tsai Ing-wen (蔡英文) in 2022. The conscripts would be trained to operate machine guns, uncrewed aerial vehicles, anti-tank guided missile launchers and Stinger air defense systems, the report said, adding that the basic training would be lengthened to eight weeks. After basic training, conscripts would be sorted into infantry battalions that would take

GROWING AMBITIONS: The scale and tempo of the operations show that the Strait has become the core theater for China to expand its security interests, the report said Chinese military aircraft incursions around Taiwan have surged nearly 15-fold over the past five years, according to a report released yesterday by the Democratic Progressive Party’s (DPP) Department of China Affairs. Sorties in the Taiwan Strait were previously irregular, totaling 380 in 2020, but have since evolved into routine operations, the report showed. “This demonstrates that the Taiwan Strait has become both the starting point and testing ground for Beijing’s expansionist ambitions,” it said. Driven by military expansionism, China is systematically pursuing actions aimed at altering the regional “status quo,” the department said, adding that Taiwan represents the most critical link in China’s