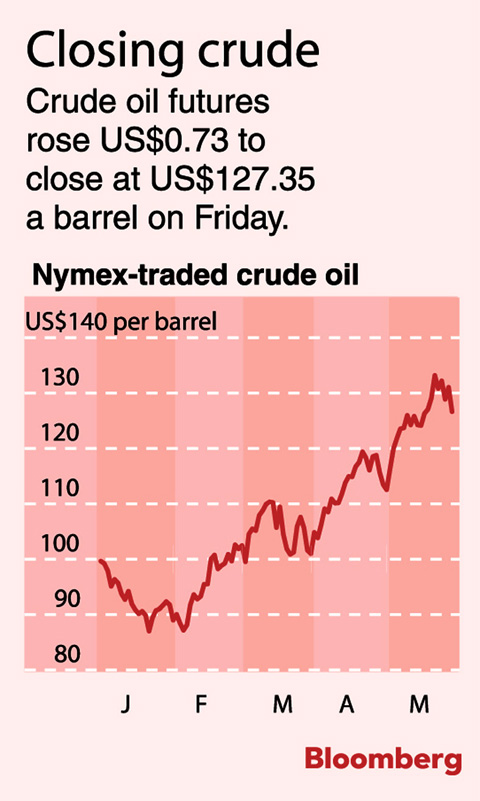

Oil futures seesawed broadly on Friday and finished up modestly as investors tried to determine whether recent price declines were temporary.

Overnight, light, sweet crude for July delivery fell below US$125 a barrel before rebounding to settle up US$0.73 at US$127.35 on the New York Mercantile Exchange. On Thursday, prices fell US$4.41, the biggest single-day price drop since March 19.

In London, July Brent crude rose US$0.89 to settle at US$127.78 a barrel on the ICE Futures Exchange.

High prices are cutting demand for gasoline; data from the US Energy Department and Federal Highway Administration and several surveys in recent days suggest US consumers are driving less. Jitters about falling demand have helped send oil prices sharply lower since they set a new record over US$135 a barrel last week.

Friday’s price uncertainty reflected a ongoing battle in the oil market between investors who feel prices have risen too far, and those who think global demand and tight supplies justify prices above US$130 — or even US$140.

“A US$4 drop just really looks like a buying opportunity to some people,” said Brad Samples, an analyst at Summit Energy Services Inc in Louisville, Kentucky.

PHOTO: AP

Andy Lebow, senior vice president at MF Global LLC in New York, said investors are uncertain whether the past week’s nearly US$10 price decline is a correction in a bull market, or a sign that the bull market has run its course.

Additional selling pressure came from a Commodity Futures Trading Commission (CFTC) investigation into possible price manipulation in oil futures markets. The CFTC also announced new rules designed to increase transparency of US and international energy futures markets.

But the dollar, which fell against the euro and British pound, gave investors reason to buy. Many investors buy commodities such as oil as a hedge against inflation when the greenback weakens. Also, a lower dollar makes oil less expensive to investors overseas.

If oil prices fall, US gasoline prices will eventually follow, analysts say. At the moment, there may be too much momentum left over from oil’s sharp rise in recent weeks to stop gasoline prices from hitting US$4 a gallon (US$1.05 a liter).

On the NYMEX, gasoline futures for June delivery rose to a trading record of US$3.52 on Thursday; on Friday, the contract rose US$0.0047 to settle at US$3.4089 a gallon.

The June gasoline contract expired at the end of trading on Friday; trading in expiring contracts is often volatile.

Also See: EDITORIAL: Fuel is crying for real competition

Also See: The key to our energy is balance

FORCED LABOR: A US court listed three Taiwanese and nine firms based in Taiwan in its indictment, with eight of the companies registered at the same address Nine companies registered in Taiwan, as well as three Taiwanese, on Tuesday were named by the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) as Specially Designated Nationals (SDNs) as a result of a US federal court indictment. The indictment unsealed at the federal court in Brooklyn, New York, said that Chen Zhi (陳志), a dual Cambodian-British national, is being indicted for fraud conspiracy, money laundering and overseeing Prince Holding Group’s forced-labor scam camps in Cambodia. At its peak, the company allegedly made US$30 million per day, court documents showed. The US government has seized Chen’s noncustodial wallet, which contains

SUPPLY CHAIN: Taiwan’s advantages in the drone industry include rapid production capacity that is independent of Chinese-made parts, the economic ministry said The Executive Yuan yesterday approved plans to invest NT$44.2 billion (US$1.44 billion) into domestic production of uncrewed aerial vehicles over the next six years, bringing Taiwan’s output value to more than NT$40 billion by 2030 and making the nation Asia’s democratic hub for the drone supply chain. The proposed budget has NT$33.8 billion in new allocations and NT$10.43 billion in existing funds, the Ministry of Economic Affairs said. Under the new development program, the public sector would purchase nearly 100,000 drones, of which 50,898 would be for civil and government use, while 48,750 would be for national defense, it said. The Ministry of

SENATE RECOMMENDATION: The National Defense Authorization Act encourages the US secretary of defense to invite Taiwan’s navy to participate in the exercises in Hawaii The US Senate on Thursday last week passed the National Defense Authorization Act (NDAA) for Fiscal Year 2026, which strongly encourages the US secretary of defense to invite Taiwan’s naval forces to participate in the Rim of the Pacific (RIMPAC) exercise, as well as allocating military aid of US$1 billion for Taiwan. The bill, which authorizes appropriations for the military activities of the US Department of Defense, military construction and other purposes, passed with 77 votes in support and 20 against. While the NDAA authorizes about US$925 billion of defense spending, the Central News Agency yesterday reported that an aide of US

NINE-IN-ONE ELECTIONS: Prosecutors’ offices recorded 115 cases of alleged foreign interference in the presidential election campaign from August 2023 to Dec. 13 last year The National Security Bureau (NSB) yesterday said that it has begun planning early to counter Chinese interference in next year’s nine-in-one elections as its intelligence shows that Beijing might intensify its tactics, while warning of continued efforts to infiltrate the government and military. The bureau submitted a report to the Legislative Yuan ahead of a meeting today of the Foreign Affairs and National Defense Committee. “We will research situations in different localities and keep track of abnormalities to ensure that next year’s elections proceed without disruption,” the bureau said. Although the project is generally launched during election years, reports of alleged Chinese interference