Here's a list of the priciest stocks in the market. I call it the "sky-high six."

Quite simply, the ranking features the six stocks that sell for the highest multiple of earnings per share. One purpose of the list is to generate ideas for short selling, which is betting that selected stocks will drop.

Not every company with a stratospheric price-earnings ratio deserves to be sold short. But, in my opinion, most deserve to be avoided.

A price-earnings ratio above 100 is often a sign investors have become infatuated with a stock and lost touch with reality.

To be eligible for the sky-high six, a company needs a market value of at least US$1 billion. Among the 1,213 stocks that qualify, the highest PE ratio belongs to LSI Logic Corp.

of Milpitas, California. (The ranking is based on Tuesday's closing prices.) LSI Logic, whose customers include Sun Microsystems Inc and Compaq Computer Corp, was a leader in putting a microprocessor, memory and logic on a single chip. Last year, it had sales of US$2.7 billion.

This week, Chief Executive Officer Wilfred Corrigan said he expects US$250 million in sales over the next three years from new agreements with Dell Computer Corp. and three other computer makers he didn't name.

LSI earned US$0.02 a share in the past four quarters.

The stock trades at US$19.24, giving it a PE ratio of 962. The average PE ratio for the S&P 500, by comparison, is 45.

You can argue that many PE ratios are high today because earnings are depressed. To deal with this period of declining corporate profits, I devised what I call the "steakhouse PE" and the "malt shop PE."

The steakhouse PE ratio is a company's price divided by its peak earnings, the best annual earnings it has ever had. For LSI, the steakhouse PE ratio is 16, based on the US$1.21 the company earned last year.

The "malt shop PE" is computed by dividing a company's stock price by the third-best earnings the company has posted in the past 10 years. LSI's third-best year was 1997, when it earned US$0.595 a share, making its malt-shop PE ratio 32.

I don't think LSI is a bad company or a bad stock, but its steakhouse and malt-shop p/e ratios are higher than I'd choose to pay.

Electronic Arts Inc, the largest US producer of video game software, earned US$0.06 a share in the past four quarters. At US$54.81, its PE ratio tallies 914.

Electronic Arts' steakhouse PE ratio is 56 and its malt-shop PE ratio is 82. That's a lot to pay for a company in a business as faddish as video game software.

Third among the sky-high six is Viacom Inc, with a nickel a share in trailing earnings and a stock price of US$41.95. That works out to a PE ratio of 839.

Viacom, whose collection of entertainment and publishing properties include Paramount Pictures, the CBS television network and an 82 percent interest in the Blockbuster video chain, has a steakhouse PE ratio of 64 based on peak earnings in 1993. Its malt-shop PE ratio is 98.

Like its rival AOL Time Warner Inc, Viacom is a sprawling empire of companies. Some day, I believe someone will take both empires apart, sell the pieces and make stockholders a lot of money. But my best guess is that such a day is far off.

The fourth highest PE ratio belongs to Medarex Inc, a biopharmaceutical company in Princeton, New Jersey that is working on anti-cancer drugs. Its earnings for the past four quarters were US$0.03 a share and the stock fetches US$22.11.

Medarex has had an annual loss since it became a publicly traded company in 1991, so I can't calculate its steakhouse or malt-shop PE ratio.

COR Therapeutics Inc, a stock that I have sold short in some client accounts, makes drugs for treating or preventing severe cardiovascular diseases. Last year, the South San Francisco-based company posted a loss of US$16.7 million on sales of US$104.7 million.

COR's earnings for the past four quarters totaled US$0.04 a share and the stock sells for US$21.79, so the PE ratio is 545. The company has not posted an annual profit since it went public in 1991.

Analysts expect COR to earn US$0.14 a share this year and US$0.72 a share next year. If they're right, the stock is at 30 times steakhouse earnings, which have yet to be served up.

Silicon Laboratories Inc, a maker of specialized integrated circuits used mostly in telecommunications, trades at 493 times trailing earnings of US$0.06 a share.

The steakhouse PE ratio is 67, based on last year's earnings of US$0.44 a share. The malt shop PE ratio can't be calculated because the company has been publicly traded only since March of last year.

Most of the companies in the sky-high six are good companies, and some are even excellent. But I doubt there is an outstanding stock in the bunch. My guess is that, as a group, they will perform substantially worse than the overall market.

I intend to track them and report on the sky-high six at least twice a year.

John Dorfman is president of Dorfman Investments in Boston. The opinions expressed are his own.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

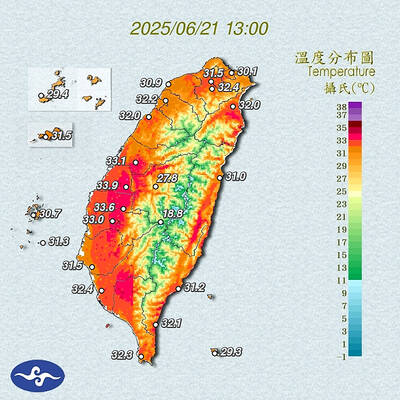

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist