New York Stock Exchange Chairman Richard Grasso and his staff made surgical masks available to the 3,500 traders and employees at the biggest stock exchange as they came to work for the first time in six days on Monday.

The masks were protection against dust that still lingers on Broad Street from the destruction of the World Trade Center, six blocks away. The exchange tested its systems over the weekend to prepare to open after the devastation in lower Manhattan forced its longest shutdown since 1933.

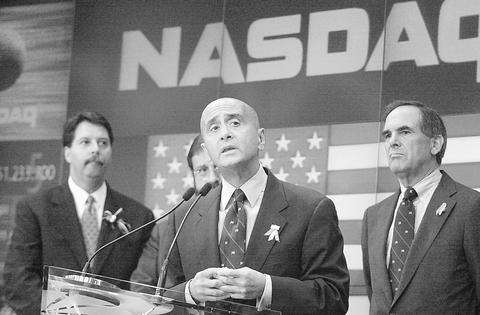

"Today, America goes back to business," Grasso said from a podium above the exchange floor before the market opened. "Anyone who bets against America is simply wrong."

PHOTO: BLOOMBERG

Grasso, Treasury Secretary Paul O'Neill, Mayor Rudolph Giuliani and other officials and members of New York City's fire, police and medical-emergency departments rang the opening bell a few minutes later than the usual 9:30am. That followed two minutes of silence for the victims of the attacks and the singing of God Bless America. The Dow Jones Industrial Average tumbled 685 points, its worst point decline ever.

"Today's market is not important," Grasso said. "It's the market years from now, two years from now." Grasso, 55, is used to taking the long view. He's spent his entire 33-year career at the Big Board, starting as a clerk after leaving the US Army.

That's unlike his predecessor, William Donaldson, who co-founded investment bank Donaldson, Lufkin & Jenrette.

It's not the only way Grasso sometimes differs from other Wall Street executives. In 1999, he met Marxist guerillas in the Colombian jungles. That year, he began shaving his head.

In his tenure as chief of the exchange, Grasso has worked to cultivate relationships with its 1,366 members, who range from brokers at full-service companies such as Merrill, Lynch & Co to traders at specialist firms such as LaBranche & Co.

A former staff member recalled seeing Grasso eating a salad in the exchange's wood-paneled Luncheon Club with one trader, only to spot him a few minutes later having soup with someone else.

``He has the greatest knowledge of the exchange of any chairman I've seen,'' said Robert Fagenson, vice chairman of Van der Moolen Specialists USA, the fifth-largest NYSE specialist firm.

Grasso has also shown a knack for generating publicity -- he had a wrestler carry him across the exchange floor in October 1999 to mark the first trading day of World Wrestling Federation Entertainment Inc.

That's helped keep the NYSE dominant. As of July 31, the market value of its companies was US$11.5 trillion, four times that of the NASDAQ Stock Market or Tokyo Stock Exchange.

A January study by Plexus Group, a Los Angeles research group, found that trading costs on the Big Board are as much as 40 percent lower than on the NASDAQ.

That said, Grasso hasn't always judged the mood of the exchange's members correctly. In 1999, as new electronic trading systems opened around the clock, Grasso pledged to extend the NYSE's hours. But when members opposed evening trading and rivals' after-hours business languished, the idea was dropped.

His co-workers consider Grasso more than anyone knows that stock trading is part of a network, not just a trading floor.

He's had other setbacks. A 1998 floor-broker trading scandal tarnished the exchange's reputation as the world's best-regulated stock market.

In June, Grasso had to face television cameras and explain how a software upgrade caused an 85-minute shutdown in the market.

NASDAQ accuses him of not playing fair. In 1999, the NYSE eased a rule that all but prohibited NYSE companies from switching to the NASDAQ while adding a requirement that the companies notify at least 35 of their largest shareholders and wait 20 to 60 days before leaving the exchange.

With those restrictions, the NASDAQ was able to lure just one company from the Big Board -- Aeroflex Inc, a Plainview, New York-based maker of communications equipment.

There were also flip-flops. In early 1997, Grasso opposed trading stocks in decimal increments, saying it would benefit professional traders at the expense of individuals. As competitors such as Bernard Madoff Investment Securities said they would trade in sixteenths of a dollar rather than eighths, Grasso relented.

The Big Board would not only trade in sixteenths, he said, it would introduce dollars-and-cents pricing, which began this year.

In the summer of 1999, as exchange members including Merrill announced investments in competing for-profit electronic trading systems such as Archipelago LLC, Grasso promised an initial public offering for the New York Stock Exchange. As the ECNs failed to cut into the exchange's 83 percent market share, talk of the IPO faded. The exchange remains a not-for-profit membership organization.

Grasso's conduct after the Trade Center attack stirred criticism from the nation's regional exchanges.

Some officials complained Grasso didn't participate in all the conference calls held to determine when trading would resume. Instead, NYSE regulatory chief Edward Kwalwasser attended. An NYSE spokesman declined to comment; Grasso wasn't made available for an interview.

On his exchange, he earned praise on last Tuesday. He used the public address system to urge staff and traders to remain calm last Tuesday, when terrorists flew two hijacked jetliners into the twin 110-story towers. Staffers passed out fruit and bottled water.

"I saw their reaction to his voice and I was impressed," said Bill Silver, an NYSE trader who was on the floor at the time. "He's a respected authority there and they trusted his judgment."

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

Renewed border fighting between Thailand and Cambodia showed no signs of abating yesterday, leaving hundreds of thousands of displaced people in both countries living in strained conditions as more flooded into temporary shelters. Reporters on the Thai side of the border heard sounds of outgoing, indirect fire yesterday. About 400,000 people have been evacuated from affected areas in Thailand and about 700 schools closed while fighting was ongoing in four border provinces, said Thai Rear Admiral Surasant Kongsiri, a spokesman for the military. Cambodia evacuated more than 127,000 villagers and closed hundreds of schools, the Thai Ministry of Defense said. Thailand’s military announced that

NO CONFIDENCE MOTION? The premier said that being toppled by the legislature for defending the Constitution would be a democratic badge of honor for him Premier Cho Jung-tai (卓榮泰) yesterday announced that the Cabinet would not countersign the amendments to the local revenue-sharing law passed by the Legislative Yuan last month. Cho said the decision not to countersign the amendments to the Act Governing the Allocation of Government Revenues and Expenditures (財政收支劃分法) was made in accordance with the Constitution. “The decision aims to safeguard our Constitution,” he said. The Constitution stipulates the president shall, in accordance with law, promulgate laws and issue mandates with the countersignature of the head of the Executive Yuan, or with the countersignatures of both the head of the Executive Yuan and ministers or