The Supreme Court on Thursday ordered former CTBC Financial Holding Co vice chairman Jeffrey Koo Jr (辜仲諒) to be retried after overturning a High Court ruling that acquitted him on charges of breach of trust in a financial embezzlement case involving an offshore “paper company” named Red Fire Development.

The Supreme Court cited inadequate reasoning in the High Court’s decision, which had cleared Koo, 60, of allegations under the Banking Act (銀行法) and the Criminal Code despite causing significant financial losses to CTBC Bank.

However, it upheld the High Court’s ruling that acquitted Koo of money laundering and stock price manipulation. The decision is final.

Photo: CNA

Koo stepped down as vice chairman of CTBC Financial after he and other executives in the financial firm, including former CTBC Financial chief financial officer Perry Chang (張明田) and former CTBC Bank chief financial manager Lin Hsiang-hsi (林祥曦), were indicted in the case, nicknamed the “Red Fire” case, in 2006.

CTBC Bank in 2004 bought US$390 million worth of structured notes linked to Mega Financial Holding Co from issuer Barclays Bank PLC on instructions from Koo.

The purchase was made without approval from the bank’s board of directors, while the transaction was aimed at obtaining a stake in Mega Financial, prosecutors said.

However, CTBC Bank sold the structured securities at a lower price to Red Fire Development in what prosecutors deemed a “non-arm’s length” deal.

Koo and his executives manipulated Mega Financial’s share prices so Red Fire Development, which had been capitalized at just US$1, earned about NT$1 billion (US$31.32 million) in profit, the prosecutors said.

After the transaction, Red Fire Development wired the proceeds to several other offshore companies so that the illegal funds would not be traced, they added.

The prosecutors said Red Fire Development was not part of CTBC Financial and that Koo’s move to dispose of the structured bonds aimed to enable the paper company to make profits and caused a massive financial loss to the firm.

The High Court in December also found Chang and Lin not guilty of breach of trust, money laundering and stock price manipulation.

Koo, Chang and Lin were not found to have disposed of the structured bonds to Red Fire Development for their own interests, the High Court said in its ruling last year, adding that the transaction did not demonstrate their intent to hurt CTCB Financial’s interests.

However, the Supreme Court has ordered a retrial of Chang and Lin for breach of trust.

The Taipei District Court in 2010 found Koo guilty in the Red Fire case, citing the Securities and Exchange Act (證券交易法) and the Banking Act, handing Koo a nine-year sentence.

After an appeal, the High Court in 2013 ruled on the case, sentencing Koo to nine years and eight months in jail and imposing a fine of NT$150 million.

Then the Supreme Court in 2014 struck down the 2013 High Court ruling and ordered a retrial.

The High Court in 2018 handed Koo a sentence of three years and six months after he returned his illegal income from the scandal.

The High Court in 2021 reheard the case after a trial order from the Supreme Court, and ruled that Koo and his executives were not guilty of breach of trust or stock price manipulation.

The High Court in 2022 was ordered by the Supreme Court to rehear the case again and in December last year found Koo not guilty of breach of trust, money laundering and stock price manipulation.

Koo, the oldest son of the late CTBC Financial founder Jeffrey Koo Sr (辜濂松), rejoined the board of directors of CTBC Financial in May after being appointed as one of the new directors.

A year-long renovation of Taipei’s Bangka Park (艋舺公園) began yesterday, as city workers fenced off the site and cleared out belongings left by homeless residents who had been living there. Despite protests from displaced residents, a city official defended the government’s relocation efforts, saying transitional housing has been offered. The renovation of the park in Taipei’s Wanhua District (萬華), near Longshan Temple (龍山寺), began at 9am yesterday, as about 20 homeless people packed their belongings and left after being asked to move by city personnel. Among them was a 90-year-old woman surnamed Wang (王), who last week said that she had no plans

China might accelerate its strategic actions toward Taiwan, the South China Sea and across the first island chain, after the US officially entered a military conflict with Iran, as Beijing would perceive Washington as incapable of fighting a two-front war, a military expert said yesterday. The US’ ongoing conflict with Iran is not merely an act of retaliation or a “delaying tactic,” but a strategic military campaign aimed at dismantling Tehran’s nuclear capabilities and reshaping the regional order in the Middle East, said National Defense University distinguished adjunct lecturer Holmes Liao (廖宏祥), former McDonnell Douglas Aerospace representative in Taiwan. If

TO BE APPEALED: The environment ministry said coal reduction goals had to be reached within two months, which was against the principle of legitimate expectation The Taipei High Administrative Court on Thursday ruled in favor of the Taichung Environmental Protection Bureau in its administrative litigation against the Ministry of Environment for the rescission of a NT$18 million fine (US$609,570) imposed by the bureau on the Taichung Power Plant in 2019 for alleged excess coal power generation. The bureau in November 2019 revised what it said was a “slip of the pen” in the text of the operating permit granted to the plant — which is run by Taiwan Power Co (Taipower) — in October 2017. The permit originally read: “reduce coal use by 40 percent from Jan.

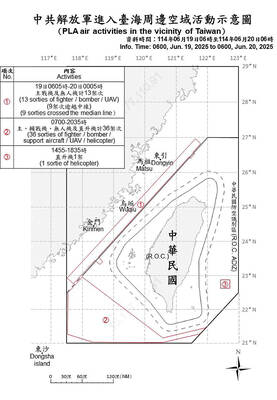

‘SPEY’ REACTION: Beijing said its Eastern Theater Command ‘organized troops to monitor and guard the entire process’ of a Taiwan Strait transit China sent 74 warplanes toward Taiwan between late Thursday and early yesterday, 61 of which crossed the median line in the Taiwan Strait. It was not clear why so many planes were scrambled, said the Ministry of National Defense, which tabulated the flights. The aircraft were sent in two separate tranches, the ministry said. The Ministry of Foreign Affairs on Thursday “confirmed and welcomed” a transit by the British Royal Navy’s HMS Spey, a River-class offshore patrol vessel, through the Taiwan Strait a day earlier. The ship’s transit “once again [reaffirmed the Strait’s] status as international waters,” the foreign ministry said. “Such transits by