The government should not change labor pension fund management regulations to allow workers to select their own investment targets, workers’ rights advocates told a news conference in Taipei yesterday.

“We urge the Ministry of Labor to maintain its position on the issue and resist lobbying from securities investment firms, which have been coveting this fat cow [labor pension funds] for years,” Taiwan Labor Front secretary-general Son Yu-liam (孫友聯) said, adding that the group is also planning to petition lawmakers to resist the change.

At the center of the issue is the state-run Labor Pension Fund, which has accumulated about NT$3.1 trillion (US$105 billion) since the government implemented a new pension fund scheme that requires employers to co-pay for employee retirement funds.

Photo: CNA

Article 14 of the Labor Pension Act (勞工退休金條例) states that employers should deposit a monthly sum of no less than 6 percent of a worker’s monthly salary into the worker’s pension fund account, and that a worker may voluntarily deposit pension funds up to 6 percent of their monthly salary.

The voluntarily paid pension is not included in the tax on annual salaries.

Article 32 of the Enforcement Rules of the Labor Pension Fund Act (勞工退休金條例施行細則) stipulates that the accumulated returns on pension funds must not be lower than banks’ average interest rate for two-year savings deposits.

Of the 7.24 million workers who have registered for the new labor pension scheme, only about 830,000 people chose to have a fixed percentage of their wage deducted for savings in retirement fund accounts, Bureau of Labor Insurance statistics showed.

The average monthly salary of workers who voluntarily pay for their pension funds was about NT$63,655, bureau statistics showed.

In contrast, the average salary of all workers who chose the new pension scheme was about NT$42,253, the data showed.

“This shows that individuals who have high-paying jobs and have extra money to put aside would voluntarily pay for their pension funds,” Son said. “If these people are given the right to select their own investment targets, on top of the tax break and government-guaranteed investment returns, it would lead to an inverse distribution of social income.”

Securities investment firms have been seeking to boost the market by drawing funds from the Labor Pension Fund, which is risky, he said.

“They have also tried to sway public opinion through the media by accusing the government of inefficient management of the Labor Pension Fund,” Son said. “The truth is the Bureau of Labor Funds can manage the labor pension fund just as well as private fund managers. Lies about the government mismanaging the fund should stop.”

Securities investment firms can attract customers to their financial products by offering high returns on investment and zero processing fees, instead of trying to tap into the state-run pension fund, he said.

Of the NT$3.1 trillion labor pension fund, about 13 percent is managed by private firms, Taiwan Labor and Social Policy Research Association chief executive officer Chang Feng-yi (張烽益) said, adding that their management fees topped NT$1 billion last year.

“These firms keep telling people how corrupt government officials are and the advantages of letting people choose their own investment targets,” Chang said.

“However, it is easier to convict a corrupt official than a private fund manager accused of insider trading or breach of trust. Having private investment firms manage the pension fund is not a guarantee that it would be free of problems as they claim,” Chang said.

Taiwan Federation of Financial Unions secretary-general Han Shih-hsien (韓仕賢) said that the new pension fund scheme aims to ensure that workers can maintain a basic living standard when they retire, and that the goal of managing the pension fund is to make sure it grows “stably and conservatively.”

“We should not make any rash and risky investment decisions to simply boost the returns on the pension fund, as banks will not compensate retirees for investing in high-risk financial products,” he said.

The government should ensure that the fund is shielded from impacts from a global financial crisis or a pandemic, Han added.

Eight restaurants in Taiwan yesterday secured a one-star rating from the Michelin Guide Taiwan for the first time, while three one-star restaurants from last year’s edition were promoted to two stars. Forty-three restaurants were awarded one star this year, including 34 in Taipei, five in Taichung and four in Kaohsiung. Hosu (好嶼), Chuan Ya (川雅), Sushi Kajin (鮨嘉仁), aMaze (心宴), La Vie by Thomas Buhner, Yuan Yi (元一) and Frassi in Taipei and Front House (方蒔) in Kaohsiung received a one-star rating for the first time. Hosu is known for innovative Taiwanese dishes, while Chuan Ya serves Sichuan cuisine and aMaze specializes

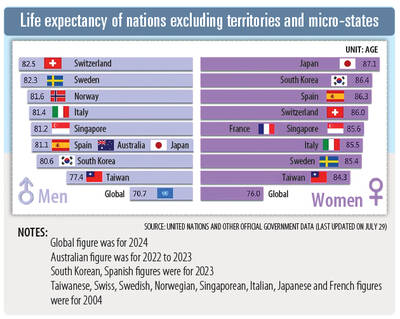

STATS: Taiwan’s average life expectancy of 80.77 years was lower than that of Japan, Singapore and South Korea, but higher than in China, Malaysia and Indonesia Taiwan’s average life expectancy last year increased to 80.77 years, but was still not back to its pre-COVID-19 pandemic peak of 81.32 years in 2020, the Ministry of the Interior said yesterday. The average life expectancy last year increased the 0.54 years from 2023, the ministry said in a statement. For men and women, the average life expectancy last year was 77.42 years and 84.30 years respectively, up 0.48 years and 0.56 years from the previous year. Taiwan’s average life expectancy peaked at 81.32 years in 2020, as the nation was relatively unaffected by the pandemic that year. The metric

Taitung County is to launch charter flights to Malaysia at the end of this year, after setting up flights to Vietnam and Thailand, the Taitung County Government said yesterday. The new charter flight services, provided by low-cost carrier Batik Air Malaysia, would be part of five-day tour packages for visits to Taitung County or Malaysia. The Batik Air charter flight, with about 200 seats, would take Malaysian tourists to Taitung on Dec. 30 and then at 12:35pm return to Kuala Lumpur with Taiwanese tourists. Another charter flight would bring the Taiwanese home on Jan. 3 next year, arriving at 5:30pm, before taking the

Taiwan High Speed Rail Corp. (THSRC) plans to ease strained capacity during peak hours by introducing new fare rules restricting passengers traveling without reserved seats in 2026, company Chairman Shih Che (史哲) said Wednesday. THSRC needs to tackle its capacity issue because there have been several occasions where passengers holding tickets with reserved seats did not make it onto their train in stations packed with individuals traveling without a reserved seat, Shih told reporters in a joint interview in Taipei. Non-reserved seats allow travelers maximum flexibility, but it has led to issues relating to quality of service and safety concerns, especially during