US President Donald Trump is taking a blowtorch to the rules that have governed world trade for decades. The “reciprocal’’ tariffs that he announced Wednesday last week are likely to create chaos for global businesses and conflict with America’s allies and adversaries alike.

Since the 1960s, tariffs — or import taxes — have emerged from negotiations between dozens of countries. Trump wants to seize the process.

“Obviously, it disrupts the way that things have been done for a very long time,’’ said Richard Mojica, a trade attorney at Miller & Chevalier. “Trump is throwing that out the window ... Clearly this is ripping up trade. There are going to have to be adjustments all over the place.’’

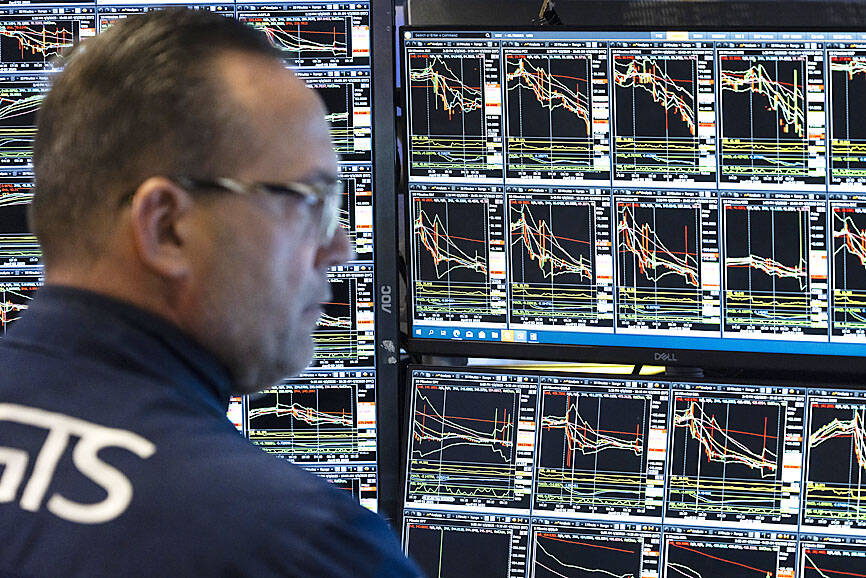

Photo: AFP 照片:法新社

Pointing to America’s massive and persistent trade deficits — not since 1975 has the US sold the rest of the world more than it’s bought — Trump charges that the playing field is tilted against US companies. A big reason for that, he and his advisers say, is because other countries usually tax American exports at a higher rate than America taxes theirs.

Trump has a fix: He’s raising US tariffs to match what other countries charge.

And he rolled out his reciprocal tariffs on April 2, calling the date “Liberation Day” because his protectionist policies aim to free the US economy from dependence on foreign goods.

Photo: EPA-EFE 照片:歐新社

Economists don’t share Trump’s enthusiasm for tariffs. They’re a tax on importers that usually get passed on to consumers. But it’s possible that Trump’s reciprocal tariff threat could bring other countries to the table and get them to lower their own import taxes.

HOW DID TARIFFS GET SO LOPSIDED?

America’s tariffs are generally lower than those of its trading partners. After World War II, the United States pushed for other countries to lower trade barriers and tariffs, seeing free trade as a way to promote peace, prosperity and American exports around the world. And it mostly practiced what it preached, generally keeping its own tariffs low and giving American consumers access to inexpensive foreign goods.

Photo: AP 照片:美聯社

Trump has broken with the old free trade consensus, saying unfair foreign competition has hurt American manufacturers and devastated factory towns in the American heartland. During his first term, he slapped tariffs on foreign steel, aluminum, washing machines, solar panels and almost everything from China. Democratic President Joe Biden largely continued Trump’s protectionist policies.

The higher foreign tariffs that Trump complains about weren’t sneakily adopted by foreign countries. The United States agreed to them after years of complex negotiations known as the Uruguay Round, which ended in a trade pact involving 123 countries.

As part of the deal, the countries could set their own tariffs on different products — but under the “most favored nation’’ approach, they couldn’t charge one country more than they charged another. So the high tariffs Trump complains about aren’t aimed at the United States alone. They hit everybody.

TARIFFS AND THE TRADE DEFICIT

Trump and some of his advisers argue that steeper tariffs would help reverse the US’ long-standing trade deficits.

But tariffs haven’t proven successful at narrowing the trade gap: Despite the Trump-Biden import taxes, the deficit rose last year to US$918 billion, the second-highest on record.

The deficit, economists say, is a result of the unique features of the US economy. Because the federal government runs a huge deficit, and American consumers like to spend so much, US consumption and investment far outpaces savings. As a result, a chunk of that demand goes to overseas goods and services.

The US covers the cost of the trade gap by essentially borrowing from overseas, in part by selling treasury securities and other assets.

“The trade deficit is really a macroeconomic imbalance,” said Kimberly Clausing, a University of California, Los Angeles (UCLA) economist and former Treasury official. “It comes from this lack of desire to save and this lack of desire to tax. Until you fix those things, we’ll run a trade imbalance.”

(AP)

美國總統唐納.川普正在毀壞數十年來世界貿易所依循的規則。他上週三所宣布的「對等」關稅,恐將對全球企業造成混亂,並讓美國與其盟友及對手產生衝突。

自1960年代以來,關稅(即進口稅)是由數十個國家談判所決定的。川普想要控制這個過程。

「這顯然破壞了長久以來的行事方法」,米勒-車瓦利耶(Miller & Chevalier)律師事務所的貿易律師理查.莫吉卡表示。「川普正在拋棄這種做法……這顯然是在破壞貿易。所有層面都必須有所調整」。

川普指出,美國長期以來一直都有巨大的貿易逆差——自1975年以來,美國對世界其他國家的出口額從未超過進口額——他指責稱,競爭環境對美國公司不利。川普及其顧問表示,一個重要原因是其他國家對來自美國的貨品所徵收的稅,通常比美國所徵收的關稅還高。

川普的解決辦法是:提高美國的關稅,使其與他國關稅相當。

他把推出對等關稅的4月2日星期三這天稱為「解放日」,因為他的保護主義政策旨在讓美國經濟擺脫對外國商品的依賴。

川普對關稅的熱情,經濟學家並不苟同。關稅是對進口商徵收的稅,通常會轉嫁給消費者。但川普的對等關稅威脅可能會迫使其他國家坐到談判桌前,降低自己的進口稅。

關稅為何變得如此不平衡?

美國的關稅通常低於其貿易夥伴的關稅。第二次世界大戰後,美國推動其他國家降低貿易壁壘及關稅,將自由貿易視為促進和平、繁榮,以及美國向世界各地出口的一種方式。美國基本上是言行一致,總體上保持較低的關稅,讓美國消費者能買到廉價的外國商品。

川普毀棄了先前的自由貿易共識,稱不公平的外國競爭傷害了美國製造業,並摧毀了美國中心地帶的工業城鎮。在他的第一個總統任期內,他對外國鋼鐵、鋁、洗衣機、太陽能板以及幾乎所有來自中國的產品強制課徵關稅。民主黨總統拜登在很大程度上延續了川普的保護主義政策。

川普所指控的外國徵收較高的關稅,並非外國暗中實施的。經過多年複雜的談判(即烏拉圭回合談判),美國終於同意了這些協議,並最終達成了有123個國家參與的一項貿易協定。

協議規定,各國可針對不同產品設定自己的關稅——但在「最惠國」政策下,各國不能對某國徵收比另一國更高的關稅。因此,川普所指控的高關稅並非只針對美國,所有國家皆受影響。

關稅與貿易逆差

川普和他的一些顧問認為,提高關稅將有助於扭轉美國長期存在的貿易逆差。

但關稅並未證明能成功縮小貿易差距:儘管川普和拜登都徵收了進口稅,但去年貿易逆差仍升至9,180億美元,為史上第二高。

經濟學家表示,赤字是美國經濟的獨特性所造成的。由於聯邦政府赤字龐大,而美國消費者喜歡大手大腳消費,因此美國人的消費和投資遠遠超過儲蓄。於是很大一部分需求轉向海外商品及服務。

美國主要透過向海外借款來填補貿易逆差的缺口,部分是以出售國債與其他資產來填補。

加州大學洛杉磯分校經濟學家、前財政部官員金柏莉.克勞辛表示:「貿易逆差實際上是一種總體經濟失衡」。「這是因為缺乏儲蓄意願和徵稅意願。除非這些問題得到解決,否則我們將面臨貿易失衡」。

(台北時報林俐凱編譯)

An automated human washing machine was one of the highlights at the Osaka Kansai Expo, giving visitors a glimpse into the future of personal hygiene technology. As part of the event, 1,000 randomly selected visitors were given the chance to try out this cleansing system. The machine operates as a capsule-like chamber where warm water filled with microscopic bubbles gently washes away dirt. The 15-minute process also includes a drying phase, removing the need for users to dry themselves manually. Equipped with advanced sensors, the device monitors the user’s biological data, such as their pulse, to adjust water temperature and other settings

Britain’s National Gallery announced on Sept. 9 that it will use a whopping £375m (US$510m) in donations to open a new wing that, for the first time, will include modern art. Founded in 1824, the gallery has amassed a centuries-spanning collection of Western paintings by artists from Leonardo da Vinci to J.M.W Turner and Vincent van Gogh — but almost nothing created after the year 1900. The modern era has been left to other galleries, including London’s Tate Modern. That will change when the gallery opens a new wing to be constructed on land beside its Trafalgar Square site that is currently

It is a universally acknowledged truth that Jane Austen, born in 1775, is one of the most beloved English novelists, and that her works still inspire readers today. She is renowned for her novels Pride and Prejudice, Emma, and Sense and Sensibility. Her stories often explore themes of love, marriage, and social status in late 18th-century British society and are written with wit and insight. To honor her legacy, the Jane Austen Festival is held every September in Bath, England. She lived there for several years, and the city is depicted in two of her novels. The festival began in 2001

Firefighters might face an increased risk of developing “glioma,” a type of brain cancer, due to certain chemicals encountered on the job. A recent study analyzed glioma cases and found clear connections between the genetic patterns of affected firefighters and their exposure to these harmful substances. The study found that firefighters exhibited significantly higher levels of specific mutational signatures in their glioma cells compared to individuals in other occupations. These signatures — unique patterns of genetic changes in DNA — help scientists trace the source of mutations. Earlier research has associated these mutations with certain chemicals found in fire