The Cabinet yesterday approved a proposal to extend a 50 percent tax cut for day trading transactions for another three years, saying that the measure has played an important role in invigorating the local stock market’s turnover and liquidity.

The bill, which must still be approved by the legislature, was the result of cross-ministerial negotiations a day earlier to iron out differences between the Ministry of Finance and the Financial Supervisory Commission (FSC).

The commission had pushed for a five-year extension to boost the local exchange and benefit the national treasury, but the ministry favored a shorter extension, as critics have questioned the fairness of the tax cut and voiced concerns over a potential speculation frenzy.

Photo: CNA

An ongoing stock rout hastened consensus-building, but failed to reverse the retreat in the TAIEX, which yesterday shed another 2.68 percent, or 450.87 points, to 16,375.40 on turnover of NT$431.276 billion (US$15.42 billion), Taiwan Stock Exchange data showed.

The volume this month tumbled from a daily average of NT$652.3 billion last month, it showed.

The ministry yesterday said it approved a proposal to extend the tax cut because trading has not grown out of control, but rather substantially energized the local exchange after the tax rate was reduced from 0.003 percent to 0.0015 percent.

Daily turnover was a modest NT$98.75 billion in 2016, with day trading generating NT$10.57 billion, or 9.6 percent, the FSC said.

The practice grew rapidly to NT$37.46 billion per day, accounting for 22.3 percent of TAIEX turnover of NT$154.41 billion in the first year after the tax cut in April 2017, the commission said.

The data showed that the tax cut had a positive impact on the relationship between day trading and daily turnover, which merited an extension of the scheme to maintain the health of the local stock market, the FSC said.

Day trading soared to 45 percent of daily turnover last month and contributed NT$451 million per day to the state coffers, much higher than NT$56 million before the tax cut, the ministry said.

Day trading accounts spiked this year, with 100,000 accounts added from January to April, 200,000 in May and 212,400 last month, data showed, as a nationwide level 3 COVID-19 alert drove interest in securities investments.

The FSC said that day trading could help lower investment risks, as it allows investors to correct mistakes on the same day.

The ministry first agreed to a tax cut for a year and later extended it through the end of this year to help the local capital market.

The ministry and the commission said they would meet with lawmakers to facilitate the passage of the tax cut.

The Central Election Commission has amended election and recall regulations to require elected office candidates to provide proof that they have no Chinese citizenship, a Cabinet report said. The commission on Oct. 29 last year revised the Measures for the Permission of Family-based Residence, Long-term Residence and Settlement of People from the Mainland Area in the Taiwan Area (大陸地區人民在台灣地區依親居留長期居留或定居許可辦法), the Executive Yuan said in a report it submitted to the legislature for review. The revision requires Chinese citizens applying for permanent residency to submit notarial documents showing that they have lost their Chinese household record and have renounced — or have never

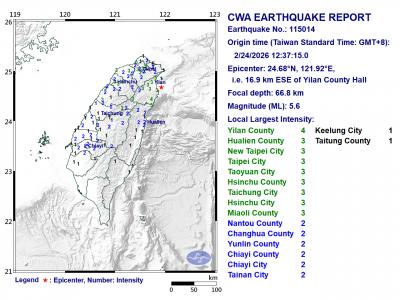

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents