The shock suspension of the Ant Group Co (螞蟻集團) US$35 billion initial public offering (IPO) is just the beginning of a renewed campaign by China to rein in the fintech empire controlled by Jack Ma (馬雲).

Authorities are now setting their sights on Ant’s biggest source of revenue: its credit platforms that funnel loans from banks and other financial institutions to millions of consumers across China, people familiar with the matter said.

The China Banking and Insurance Regulatory Commission (CBIRC) plans to discourage lenders from using Ant’s platforms and has already asked some to ensure their portfolios are compliant with stringent draft regulations announced on Monday, said the people, who asked not to be identified as they were discussing private information.

Photo: AFP

The proposed measures, which call for platform operators to provide at least 30 percent of the funding for loans, would render many of Ant’s existing transactions non-compliant. The company currently keeps about 2 percent of loans on its own balance sheet, with the rest funded by third parties, or packaged as securities and sold on.

The full scope of China’s plans for Ant is unclear and it is possible that lenders could continue to work with the company once it complies with regulators’ requests.

Any suggestion that banks would stop using its platforms is “unsubstantiated,” Ant said in a response to questions from Bloomberg.

“Ant will continue to support bank partners to make independent credit decisions, and leverage Ant’s technology platforms to serve consumers and small businesses,” it said.

The CBIRC did not immediately respond to a request for comment.

“From the perspective of regulators and investors, they all need Ant to provide a better disclosure on the colending business,” said Chen Shujin (陳姝瑾), Hong Kong-based head of China financial research at Jefferies Financial Group Inc (富瑞金融). “Ant needs to be aligned with regulations going forward and show that its business model can help lower borrowing costs for the economy rather than raising them with some kind of monopoly.”

China halted Ant’s IPO on Tuesday after summoning Ma to a meeting on Monday to outline an array of concerns and new regulations.

The Chinese government is tightening its controls on Ant and other fast-growing financial firms after years of allowing them to operate without the capital and leverage requirements imposed on banks.

Authorities have not yet provided much detail about what prompted the turnabout on the IPO, beyond saying that it could not go ahead because of a “significant change” in the regulatory environment.

The halt came after Ma criticized the nation’s financial system and questioned global regulatory models at a conference last month, calling banks “pawn shops.”

China is still a “youth” and needs more innovation to build an ecosystem for the healthy development of local industry, Ma said.

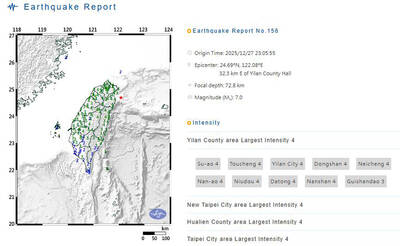

A magnitude 7.0 earthquake struck off Yilan at 11:05pm yesterday, the Central Weather Administration (CWA) said. The epicenter was located at sea, about 32.3km east of Yilan County Hall, at a depth of 72.8km, CWA data showed There were no immediate reports of damage. The intensity of the quake, which gauges the actual effect of a seismic event, measured 4 in Yilan County area on Taiwan’s seven-tier intensity scale, the data showed. It measured 4 in other parts of eastern, northern and central Taiwan as well as Tainan, and 3 in Kaohsiung and Pingtung County, and 2 in Lienchiang and Penghu counties and 1

A car bomb killed a senior Russian general in southern Moscow yesterday morning, the latest high-profile army figure to be blown up in a blast that came just hours after Russian and Ukrainian delegates held separate talks in Miami on a plan to end the war. Kyiv has not commented on the incident, but Russian investigators said they were probing whether the blast was “linked” to “Ukrainian special forces.” The attack was similar to other assassinations of generals and pro-war figures that have either been claimed, or are widely believed to have been orchestrated, by Ukraine. Russian Lieutenant General Fanil Sarvarov, 56, head

‘POLITICAL GAME’: DPP lawmakers said the motion would not meet the legislative threshold needed, and accused the KMT and the TPP of trivializing the Constitution The Legislative Yuan yesterday approved a motion to initiate impeachment proceedings against President William Lai (賴清德), saying he had undermined Taiwan’s constitutional order and democracy. The motion was approved 61-50 by lawmakers from the main opposition Chinese Nationalist Party (KMT) and the smaller Taiwan People’s Party (TPP), who together hold a legislative majority. Under the motion, a roll call vote for impeachment would be held on May 19 next year, after various hearings are held and Lai is given the chance to defend himself. The move came after Lai on Monday last week did not promulgate an amendment passed by the legislature that

FOREIGN INTERFERENCE: Beijing would likely intensify public opinion warfare in next year’s local elections to prevent Lai from getting re-elected, the ‘Yomiuri Shimbun’ said Internal documents from a Chinese artificial intelligence (AI) company indicated that China has been using the technology to intervene in foreign elections, including propaganda targeting Taiwan’s local elections next year and presidential elections in 2028, a Japanese newspaper reported yesterday. The Institute of National Security of Vanderbilt University obtained nearly 400 pages of documents from GoLaxy, a company with ties to the Chinese government, and found evidence that it had apparently deployed sophisticated, AI-driven propaganda campaigns in Hong Kong and Taiwan to shape public opinion, the Yomiuri Shimbun reported. GoLaxy provides insights, situation analysis and public opinion-shaping technology by conducting network surveillance