The planned stock market debut of the world’s biggest online finance company, Ant Group (螞蟻集團) was suspended in Shanghai and Hong Kong yesterday, disrupting a record-setting US$34.5 billion initial public offering (IPO) that highlighted China’s recovery from the COVID-19 pandemic.

Management of the Shanghai stock exchange cited regulatory changes in Ant’s industry and a possible failure to meet disclosure requirements, but it offered no details.

Ant Group later said in a filing with the Hong Kong stock exchange that it would also suspend its listing there following its suspension in Shanghai.

Photo: EPA-EFE

The suspension comes one day after meeting between regulators and company executives, including Ant founder Jack Ma (馬雲), China’s richest entrepreneur.

Ant Group issued a statement late last night “sincerely apologizing” to investors for any inconvenience caused by the suspensions of the IPOs.

It said it would handle follow-up matters in accordance with the Hong Kong and Shanghai exchanges’ regulations and keep in close communication with the Shanghai exchange and relevant regulators.

US shares of Alibaba Group Holding Ltd (阿里巴巴), which was spun off Ant Group, tumbled more than 9.6% percent early yesterday, matching the company’s largest percentage decline since its first day of trading on the New York Stock Exchange.

In a joint statement, the People’s Bank of China, the China Banking and Insurance Regulatory Commission, the Securities Regulatory Commission and the State Administration of Foreign Exchange said they had conducted “regulatory interviews” with Ma, Ant Group chairman Eric Jing (井賢棟) and its president, Simon Hu (胡曉明).

Neither side disclosed details of the meeting.

“Views regarding the health and stability of the financial sector were exchanged,” Ant Group said in a prepared statement.

The company said it was “committed to implementing the meeting opinions,” but gave no details of what instructions the executives received.

“We will continue to improve our capabilities to provide inclusive services and promote economic development to improve the lives of ordinary citizens,” the company said.

The market debut of Ant, spun off from Alibaba Group, highlighted the rebound of China, the first major economy to return to growth after the COVID-19 pandemic began last December.

Ant Group operates Alipay (支付寶), the world’s biggest financial technology company and one of two dominant Chinese digital wallets in China, the other being rival Tencent Holdings Ltd’s (騰訊) WeChat Pay (微信支付).

The decision to go public simultaneously on exchanges in Shanghai and Hong Kong reflected the evolving nature of China’s fast-growing financial markets and their relationship to the country’s fledgling corporate giants such as Ant and Alibaba.

Ant Group’s shares were due to begin trade in Hong Kong and Shanghai tomorrow after it raised at least US$34.5 billion. Retail investors in Shanghai placed bids for nearly US$3 trillion worth of shares.

Additional reporting by Reuters

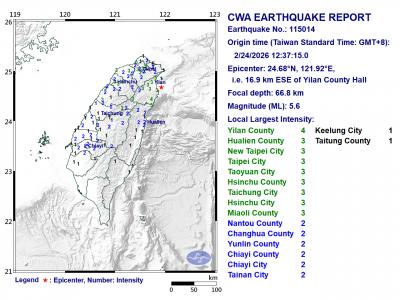

A magnitude 5.6 earthquake struck off the coast of Yilan County at 12:37pm today, with clear shaking felt across much of northern Taiwan. There were no immediate reports of damage. The epicenter of the quake was 16.9km east-southeast of Yilan County Hall offshore at a depth of 66.8km, Central Weather Administration (CWA) data showed. The maximum intensity registered at a 4 in Yilan County’s Nanao Township (南澳) on Taiwan’s seven-tier scale. Other parts of Yilan, as well as certain areas of Hualien County, Taipei, New Taipei City, Taoyuan, Hsinchu County, Taichung and Miaoli County, recorded intensities of 3. Residents of Yilan County and Taipei received

Taiwan has secured another breakthrough in fruit exports, with jujubes, dragon fruit and lychees approved for shipment to the EU, the Ministry of Agriculture said yesterday. The Animal and Plant Health Inspection Agency on Thursday received formal notification of the approval from the EU, the ministry said, adding that the decision was expected to expand Taiwanese fruit producers’ access to high-end European markets. Taiwan exported 126 tonnes of lychees last year, valued at US$1.48 million, with Japan accounting for 102 tonnes. Other export destinations included New Zealand, Hong Kong, the US and Australia, ministry data showed. Jujube exports totaled 103 tonnes, valued at

TRUST: The KMT said it respected the US’ timing and considerations, and hoped it would continue to honor its commitments to helping Taiwan bolster its defenses and deterrence US President Donald Trump is delaying a multibillion-dollar arms sale to Taiwan to ensure his visit to Beijing is successful, a New York Times report said. The weapons sales package has stalled in the US Department of State, the report said, citing US officials it did not identify. The White House has told agencies not to push forward ahead of Trump’s meeting with Chinese President Xi Jinping (習近平), it said. The two last month held a phone call to discuss trade and geopolitical flashpoints ahead of the summit. Xi raised the Taiwan issue and urged the US to handle arms sales to

BIG SPENDERS: Foreign investors bought the most Taiwan equities since 2005, signaling confidence that an AI boom would continue to benefit chipmakers Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) market capitalization swelled to US$2 trillion for the first time following a 4.25 percent rally in its American depositary receipts (ADR) overnight, putting the world’s biggest contract chipmaker sixth on the list of the world’s biggest companies by market capitalization, just behind Amazon.com Inc. The site CompaniesMarketcap.com ranked TSMC ahead of Saudi Aramco and Meta Platforms Inc. The Taiwanese company’s ADRs on Tuesday surged to US$385.75 on the New York Stock Exchange, as strong demand for artificial intelligence (AI) applications led to chip supply constraints and boost revenue growth to record-breaking levels. Each TSMC ADR represents