World stocks fell in volatile trading yesterday and gold hit record highs despite G7 and G20 pledges to bolster the global economy and European Central Bank (ECB) action on eurozone debt, which analysts said lacked punch.

European stock markets opened sharply lower then enjoyed strong gains before heading back into the red in midday trade, while Asian equities closed lower after big losses.

Concerns about weakening growth saw “safe haven” investment gold shoot to record highs above US$1,700 an ounce. The euro was down against the US dollar after initial gains, while oil slumped.

“It looks like we are in for another volatile week,” said Dermot O’Leary, economist at Goodbody Stockbrokers in Dublin.

London’s benchmark FTSE 100 index was down 1.83 percent by midday, Frankfurt plunged 2.66 percent and Paris gave up 2.35 percent.

The British market dived almost 10 percent last week on fears of another vicious global downturn, wiping about £150 billion (US$242.5 billion) from the combined value of the FTSE’s 100-listed companies, which include giants HSBC, Shell and Vodafone.

“Turbulence remains likely until such time as there are some concrete debt proposals from the US and the eurozone, where potential contagion remains an issue,” said analyst Richard Hunter at Hargreaves Lansdown Stockbrokers.

As nervous global markets re-opened, financial chiefs and central bankers of the G7 nations, which include Germany and the US, pledged to “take all necessary measures to support financial stability and growth.”

The G20 made a similar pledge.

Asian stocks tumbled as traders focused on last week’s historic downgrade of the US’ credit rating, which compounded concerns over the world’s biggest economy as well as the global outlook.

Taipei fell 3.82 percent, Tokyo closed down 2.18 percent, Hong Kong tumbled 2.11 percent, Seoul sank 3.82 percent and Sydney shed 2.91 percent.

“No one really fully understands the full implications of this credit downgrade, which is why we have seen the market sold off hard,” said Ben Potter, analyst at trading group IG Markets.

In foreign exchange deals, the euro fell from US$1.4282 to US$1.4266 on Friday.

With growing concern that eurozone debt could plunge the world into a new financial crisis, the ECB promised to make major purchases of eurozone government bonds.

The bank also said it would resume bond purchases after Italy and Spain had announced new measures to control their finances and boost their economies, and France and Germany pushed for full and rapid implementation of a plan to avoid future crises.

Madrid stock prices were flat after jumping more than 3 percent early yesterday, while Milan fell 0.48 percent after initially rocketing 4 percent.

The pressure on Italian and Spanish government debt meanwhile eased sharply in early trade.

Taiwan is projected to lose a working-age population of about 6.67 million people in two waves of retirement in the coming years, as the nation confronts accelerating demographic decline and a shortage of younger workers to take their place, the Ministry of the Interior said. Taiwan experienced its largest baby boom between 1958 and 1966, when the population grew by 3.78 million, followed by a second surge of 2.89 million between 1976 and 1982, ministry data showed. In 2023, the first of those baby boom generations — those born in the late 1950s and early 1960s — began to enter retirement, triggering

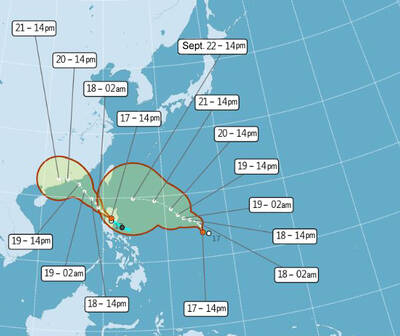

One of two tropical depressions that formed off Taiwan yesterday morning could turn into a moderate typhoon by the weekend, the Central Weather Administration (CWA) said yesterday. Tropical Depression No. 21 formed at 8am about 1,850km off the southeast coast, CWA forecaster Lee Meng-hsuan (李孟軒) said. The weather system is expected to move northwest as it builds momentum, possibly intensifying this weekend into a typhoon, which would be called Mitag, Lee said. The radius of the storm is expected to reach almost 200km, she said. It is forecast to approach the southeast of Taiwan on Monday next week and pass through the Bashi Channel

NO CHANGE: The TRA makes clear that the US does not consider the status of Taiwan to have been determined by WWII-era documents, a former AIT deputy director said The American Institute in Taiwan’s (AIT) comments that World War-II era documents do not determine Taiwan’s political status accurately conveyed the US’ stance, the US Department of State said. An AIT spokesperson on Saturday said that a Chinese official mischaracterized World War II-era documents as stating that Taiwan was ceded to the China. The remarks from the US’ de facto embassy in Taiwan drew criticism from the Ma Ying-jeou Foundation, whose director said the comments put Taiwan in danger. The Chinese-language United Daily News yesterday reported that a US State Department spokesperson confirmed the AIT’s position. They added that the US would continue to

The number of Chinese spouses applying for dependent residency as well as long-term residency in Taiwan has decreased, the Mainland Affairs Council said yesterday, adding that the reduction of Chinese spouses staying or living in Taiwan is only one facet reflecting the general decrease in the number of people willing to get married in Taiwan. The number of Chinese spouses applying for dependent residency last year was 7,123, down by 2,931, or 29.15 percent, from the previous year. The same census showed that the number of Chinese spouses applying for long-term residency and receiving approval last year stood at 2,973, down 1,520,