The US economy could suffer a massive hangover from the government’s efforts to rescue the financial system in the form of a soaring debt burden. But the alternatives look infinitely worse.

The US$700 billion the administration is seeking from Congress as the upper bounds of what it will need to take a mountain of bad loans off the books of financial firms is an eye-popping figure.

BIG BORROWER

To get the funds to buy up the bad mortgage loans that have threatened to bring the financial system to its knees, the government will have to borrow. And that borrowing will come at a time when the federal budget deficit is already soaring.

The deficit for this budget year, which ends on Sept. 30, is expected to rise to US$407 billion, a figure that is more than double the US$161.5 billion imbalance for last year, reflecting what the economic slowdown and this year’s US$168 billion economic stimulus program are already doing to the government’s books.

The administration of US President George W. Bush is estimating that the deficit for the budget year that begins on Oct. 1, which will cover the new president’s first year in office, will hit US$482 billion, a record in dollar terms.

And that forecast doesn’t include the US$200 billion the administration committed to spending two weeks ago when it took over the nation’s two biggest mortgage companies, Fannie Mae and Freddie Mac.

It doesn’t have any of the US$700 billion the administration is seeking to deal with the bad mortgage-backed securities that have been at the heart of the severe credit crisis the country has been struggling with since August last year.

The legislation Congress passed this summer that gave the authority to rescue Fannie and Freddie boosted the limit on the national debt by US$800 billion to US$10.6 trillion.

The legislation the administration is now seeking to authorize the financial system bailout, according to a draft, would boost that debt limit to US$11.3 trillion, up another US$700 billion.

DIZZYING FIGURES

It is the rapidly rising debt that is cause for concern. The government is already spending more than US$400 billion a year just to pay interest on the national debt. The higher that debt goes, the higher the government’s borrowing costs and the less it has to spend on other programs.

Republican presidential candidate Senator John McCain and Democratic rival Senator Barack Obama are both making campaign promises about what new programs they will implement once in office, promises that could be severely constrained by the costs of a financial bailout.

The escalating borrowing also means that the government is competing with the private sector for loans, driving up interest rates. And then there is the matter of the country’s large trade imbalances, which mean the US has to borrow US$2 billion a day from foreigners.

Foreigners may not want to lend as much to the US if there are concerns that all the borrowing could weaken the dollar’s value against other currencies.

But even with all these threats, economists said the government has to take decisive action because the alternative of letting the financial system slide into even deeper problems which could jeopardize the routine loans that businesses and consumers need was simply not an option.

“It was critical to arrest the downward slide in financial markets,” said Sung Won Sohn, an economist at California State University, Channel Islands.

The dire situation was dramatically demonstrated this past week when the US Federal Reserve, working with the central banks of other nations, poured billions of dollars into the financial system without any significant impact because of the fear keeping banks from lending.

The financial system has already been staggered with US$500 billion in losses from the mortgage mess and the IMF has estimated the ultimate price could be US$1 trillion.

What the administration’s plan would do is at least establish a price for the mortgage-backed securities, which at the moment no one wants to own.

Officials who have briefed Congress on US Treasury Secretary Henry Paulson’s plan have said that one approach would be for the government to buy the toxic debt through a reverse auction process in which companies wanting to unload their mortgage-backed securities would propose a price to the government — say US$0.50 on the dollar — and those offering the lowest price would win the bid.

By establishing a price for assets no one currently wants to buy, it could allow a market to develop and allow financial firms to get on with the effort of taking their losses and getting the damaged assets off their books.

“This could go a long way toward solving these problems,” said Mark Zandi, chief economist at Moody’s Economy.com.

And the final cost to the government? No one knows for sure, but Zandi said if the experience with cleaning up all the assets left over from the savings and loan mess is any guide, it should be less than the US$700 billion that the administration is seeking.

Also See: US crisis may slow reforms in China

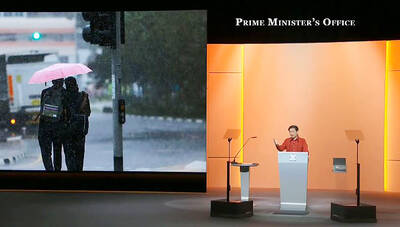

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

CLAMPING DOWN: At the preliminary stage on Jan. 1 next year, only core personnel of the military, the civil service and public schools would be subject to inspections Regular checks are to be conducted from next year to clamp down on military personnel, civil servants and public-school teachers with Chinese citizenship or Chinese household registration, the Mainland Affairs Council (MAC) said yesterday. Article 9-1 of the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例) stipulates that Taiwanese who obtain Chinese household registration or a Chinese passport would be deprived of their Taiwanese citizenship and lose their right to work in the military, public service or public schools, it said. To identify and prevent the illegal employment of holders of Chinese ID cards or