British bank Lloyds TSB on Thursday agreed to buy rival HBOS for £12.2 billion (US$21.8 billion) as the raging global financial storm claimed another victim.

The share price of HBOS rocketed 50.9 percent to 222 pence in reaction to the takeover bid, pitched at 232 pence per share and aimed at creating Britain’s third-largest bank behind Royal Bank of Scotland and HSBC in first place.

“Lloyds TSB and HBOS announce that they have reached agreement on the terms of a recommended acquisition by Lloyds TSB of HBOS,” the pair said in a statement.

Analysts estimate that up to 40,000 jobs could be lost from the banks’ combined 145,000 staff following the deal and that hundreds of branches could close. HBOS has 1,100 on Britain’s high streets and Lloyds TSB 1,900.

British Business Secretary John Hutton is effectively extending Britain’s Enterprise Act to ensure that the deal goes through “on public interest grounds,” his department said in a statement shortly after the deal.

The landmark all-share merger, effectively a rescue plan for Britain’s biggest mortgage lender, comes after HBOS shares plummeted in recent trading following days of global stock market chaos and economic gloom.

Lloyds TSB shareholders would own 56 percent of the issued share capital under the acquisition and existing HBOS shareholders 44 percent.

HBOS, or Halifax Bank of Scotland, is the latest global bank to fall foul of the ongoing credit crunch following the collapse of US group Lehman Brothers, the sale of Merill Lynch and the rescue of insurer AIG earlier this week.

“This is the right transaction for HBOS and its shareholders,” HBOS chairman Dennis Stevenson said in the release.

“Against the backdrop of the very high levels of volatility our industry is experiencing, the combined group will be one of the strongest players in the UK financial services sector,” he said.

Analysts and regulators expressed hope that the rescue takeover deal would draw a line under persistent questions about the funding of HBOS that have dogged its share price.

The value of shares in HBOS — created by the merger of Bank of Scotland and Halifax in 2001 — had slumped 55 percent so far this week.

Many market watchers had feared that HBOS could have faced the same fate as Northern Rock — which was nationalized earlier this year after experiencing severe funding problems and a run on its branches late last year.

HBOS and Lloyds TSB together hold nearly a third of Britain’s savings and mortgage market, but competition watchdogs will not block the deal, which was expected to be completed toward the end of the year or early next year.

The deal was described by regulator the Financial Services Authority as “a welcome move as it is likely to enhance stability within financial markets and improve confidence among customers and investors.”

Also See: Morgan Stanley may be next in trouble

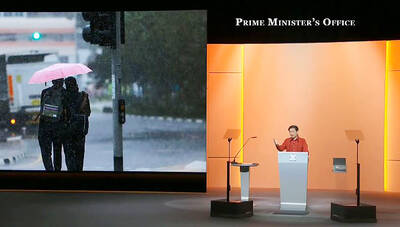

In his National Day Rally speech on Sunday, Singaporean Prime Minister Lawrence Wong (黃循財) quoted the Taiwanese song One Small Umbrella (一支小雨傘) to describe his nation’s situation. Wong’s use of such a song shows Singapore’s familiarity with Taiwan’s culture and is a perfect reflection of exchanges between the two nations, Representative to Singapore Tung Chen-yuan (童振源) said yesterday in a post on Facebook. Wong quoted the song, saying: “As the rain gets heavier, I will take care of you, and you,” in Mandarin, using it as a metaphor for Singaporeans coming together to face challenges. Other Singaporean politicians have also used Taiwanese songs

NORTHERN STRIKE: Taiwanese military personnel have been training ‘in strategic and tactical battle operations’ in Michigan, a former US diplomat said More than 500 Taiwanese troops participated in this year’s Northern Strike military exercise held at Lake Michigan by the US, a Pentagon-run news outlet reported yesterday. The Michigan National Guard-sponsored drill involved 7,500 military personnel from 36 nations and territories around the world, the Stars and Stripes said. This year’s edition of Northern Strike, which concluded on Sunday, simulated a war in the Indo-Pacific region in a departure from its traditional European focus, it said. The change indicated a greater shift in the US armed forces’ attention to a potential conflict in Asia, it added. Citing a briefing by a Michigan National Guard senior

CHIPMAKING INVESTMENT: J.W. Kuo told legislators that Department of Investment Review approval would be needed were Washington to seek a TSMC board seat Minister of Economic Affairs J.W. Kuo (郭智輝) yesterday said he received information about a possible US government investment in Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and an assessment of the possible effect on the firm requires further discussion. If the US were to invest in TSMC, the plan would need to be reviewed by the Department of Investment Review, Kuo told reporters ahead of a hearing of the legislature’s Economics Committee. Kuo’s remarks came after US Secretary of Commerce Howard Lutnick on Tuesday said that the US government is looking into the federal government taking equity stakes in computer chip manufacturers that

CLAMPING DOWN: At the preliminary stage on Jan. 1 next year, only core personnel of the military, the civil service and public schools would be subject to inspections Regular checks are to be conducted from next year to clamp down on military personnel, civil servants and public-school teachers with Chinese citizenship or Chinese household registration, the Mainland Affairs Council (MAC) said yesterday. Article 9-1 of the Act Governing Relations Between the People of the Taiwan Area and the Mainland Area (臺灣地區與大陸地區人民關係條例) stipulates that Taiwanese who obtain Chinese household registration or a Chinese passport would be deprived of their Taiwanese citizenship and lose their right to work in the military, public service or public schools, it said. To identify and prevent the illegal employment of holders of Chinese ID cards or