The historic Belgian city of Leuven is known for its centuries-old university and as the headquarters of brewing giant Anheuser-Busch InBev NV. Less so as the location of a semiconductor research organization that is now the center of both political and industry attention.

The Interuniversity Microelectronics Center, or imec, may be Belgium’s best-kept secret, but it’s in global demand for its work on the future of computer chips, with applications in areas from genome sequencing to autonomous driving.

It’s also increasingly in the sights of governments as chips become political weapons in the US-China tech conflict. Crippling industry shortages during the pandemic have meanwhile set off a scramble for access to advanced research as the US, China, Japan and Europe all seek greater self-reliance in semiconductor production.

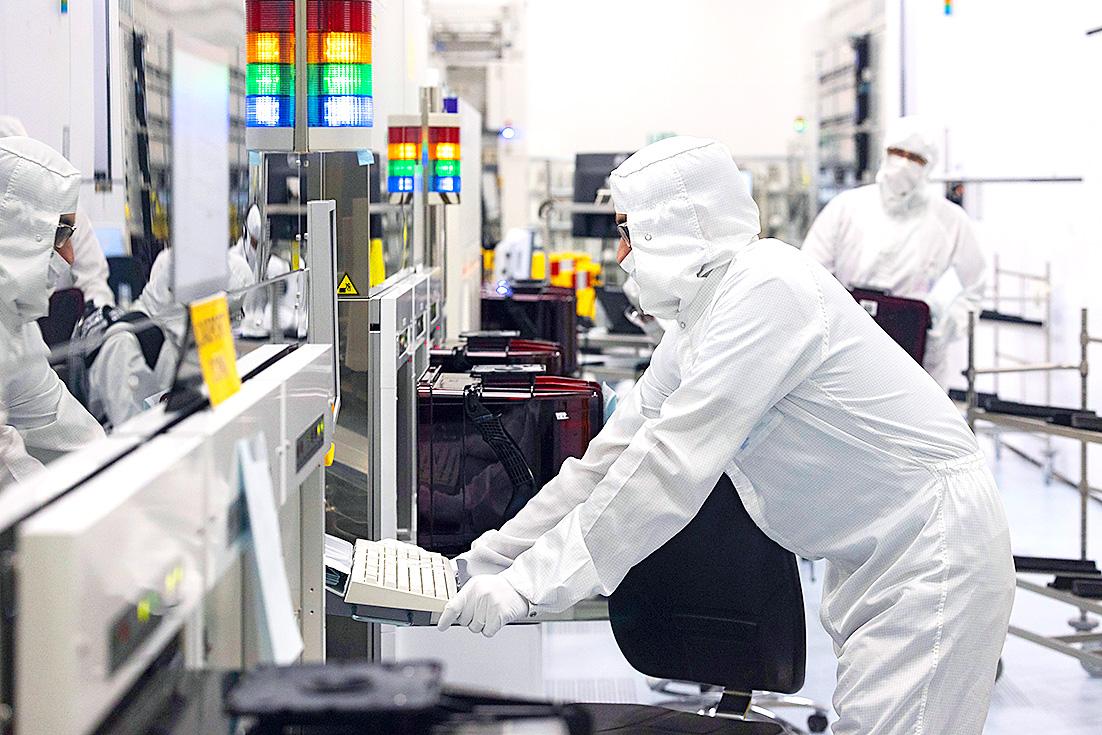

Photo: Bloomberg

POLITICAL ATTENTION

The European Commission is consulting with imec on its plans to build out the continent’s chip capacity. A South Korean ministerial delegation visited this month. It was name-checked in last month’s White House review of the US supply chain alongside ASML NV of the Netherlands, which has a virtual monopoly on the machines needed to make the most advanced chips. In the words of one Washington observer, imec is one of those places very few people know about but which everyone should.

“We have never been so much in the spotlight as today,” Chief Executive Officer Luc Van den hove said in an interview in his office on the 15th floor of the futuristic imec tower, with 360 degree views of countryside just outside the historic town center. “We have received much more attention than ever before from the politicians: local politicians, European politicians, US politicians.”

Photo: Bloomberg

Chinese politicians, too. Premier Li Keqiang (李克強) visited in October 2018 — before tensions over trade with the Trump administration expanded to chips — and stressed the “vast business opportunities” of working with “the world’s largest market,” according to an account of the visit posted on the Chinese government’s Web site.

Imec had previously joined with Huawei Technologies and Qualcomm Inc to help China’s biggest chipmaker, SMIC, set up an R&D company. But within eight months of Li’s visit the US Commerce Department added Huawei to its entity list and a cascade of export controls ensued, targeting China’s access to US chip technology.

Today, imec participates in a scholarship program to fund post-doc researchers from China and, according to local media reports, in February became a member of the Wuxi municipal semiconductor industry association in Jiangsu province, a key chip-production area. But its presence in China is less than five people, and it doesn’t do any R&D there, according to Van den hove.

Photo: Bloomberg

“The situation three or four years ago when that happened was very different from the situation today,” Van den hove said of the Li visit, when asked about the insertion of politics into the industry.

He added imec adheres strictly to export regulations, including those imposed by Washington, and insisted imec’s research capacity hasn’t been harmed by the political strains.

“But we also have to be realistic and face the facts that these geopolitical tensions at this moment are increasing.”

Photo: Bloomberg

Imec was founded in 1984 by the regional government of Flanders, and now has about 4,500 staff including research students. Some 75 percent of funding comes from its partners among the main chipmaking giants, from Intel Corp and Taiwan Semiconductor Manufacturing Co, to Samsung Electronics Co and Applied Materials Inc.

LEADING RESEARCH HUB

It has enjoyed a key relationship over the past thirty years with ASML, using the company’s lithography machines to become the leading research hub for what’s known as scaling: making chips with ever-smaller and more powerful features. Its facilities include a US$3 billion “pilot line,” that allows researchers to work on chipmaking processes that are typically two-to-three generations ahead of the current leading-edge manufacturing. So whereas the most advanced chips in the world are measured at 5 nanometers, or billionths of a meter, imec is already working on 2 nanometers and below.

Germany’s Fraunhofer institutes and CEA-Leti of France also conduct chip research in Europe, while TSMC cites the Semiconductor Research Corporation of the US as a partner alongside imec. But the scope of the latter’s research is regarded as giving it a lead.

“Europe has two jewels,” Intel CEO Pat Gelsinger said in an interview in May. “One is ASML, the most advanced lithography, and the other is imec, the most advanced semiconductor research in the world.”

That work also makes it a target of industrial theft. Flemish newspaper De Tijd reported in 2018 that a Chinese researcher at imec was deported by Belgian authorities on suspicion of espionage. Van den hove confirmed the report, although he said the events occurred some time before then.

“But this is not the first case, we’ve had other cases with other people where they don’t behave according to our code of conduct and our values,” he said, adding that incidents are not confined to citizens of any one country.

Governments, too, are operating in an atmosphere of heightened sensitivity over technology.

The UK is now undertaking a national security review of the takeover of Britain’s biggest chip plant by Chinese-owned Nexperia NV. The Dutch government has yet to grant an export license to ASML to ship one of its most advanced machines to China, and the US has made clear it favors the technology remaining in the Netherlands.

The Biden administration is likely focusing on imec in discussions with the European Union about broadening the US alliance in the tech standoff with China, said Martijn Rasser, director of the technology and national security program at the Center for a New American Security in Washington.

“I would be stunned if they’re not,” said Rasser, who formerly worked on technology and innovation at the Central Intelligence Agency. “Imec is really a unique facility.”

The US State Department had no immediate comment when asked about contacts with imec.

Asked if the Biden administration has reached out, Van den hove said there were “many discussions going on, on many of these topics,” but declined to say with whom. Imec, he added, is keen to “contribute in a positive way to progressing our industry, and so whatever we can do to support that, we will entertain those discussions.”

COMPOUND SEMICONDUCTORS

One area of future focus is the field of compound semiconductors. China is piling funding into developing what it calls third-generation chips, fabricated from compound materials such as gallium nitride, in an attempt to establish a lead without being dependent on US silicon-based technology. Van den hove is skeptical the field will ever be more than a niche market for certain applications rather than a replacement for silicon.

“I don’t think standalone compound semiconductors is a huge market,” he said. “We believe silicon is the perfect platform.”

Moore’s Law, which holds that the number of components on a silicon chip will double every two years, “is by no means slowing down,” albeit the means of achieving it will change to combine innovations such as new designs and types of transistors. That’s as well as continuing to go smaller: “we will go sub-one nanometer,” he said.

Van den hove sounded upbeat on the potential for the industry beyond existing areas. Chip technology could improve food production and monitoring, for example, he said. Then there are applications in life sciences which will create “an enormous boom,” in five years. “By combining some of these leading edge technologies you can do phenomenal new things,” he said.

That’s even in the face of growing geopolitical headwinds.

“Many things are happening in the world at this moment, but I think it’s very important that we remain calm,” said Van den hove. “The opportunities are so big.”

Behind a car repair business on a nondescript Thai street are the cherished pets of a rising TikTok animal influencer: two lions and a 200-kilogram lion-tiger hybrid called “Big George.” Lion ownership is legal in Thailand, and Tharnuwarht Plengkemratch is an enthusiastic advocate, posting updates on his feline companions to nearly three million followers. “They’re playful and affectionate, just like dogs or cats,” he said from inside their cage complex at his home in the northern city of Chiang Mai. Thailand’s captive lion population has exploded in recent years, with nearly 500 registered in zoos, breeding farms, petting cafes and homes. Experts warn the

The unexpected collapse of the recall campaigns is being viewed through many lenses, most of them skewed and self-absorbed. The international media unsurprisingly focuses on what they perceive as the message that Taiwanese voters were sending in the failure of the mass recall, especially to China, the US and to friendly Western nations. This made some sense prior to early last month. One of the main arguments used by recall campaigners for recalling Chinese Nationalist Party (KMT) lawmakers was that they were too pro-China, and by extension not to be trusted with defending the nation. Also by extension, that argument could be

Aug. 4 to Aug. 10 When Coca-Cola finally pushed its way into Taiwan’s market in 1968, it allegedly vowed to wipe out its major domestic rival Hey Song within five years. But Hey Song, which began as a manual operation in a family cow shed in 1925, had proven its resilience, surviving numerous setbacks — including the loss of autonomy and nearly all its assets due to the Japanese colonial government’s wartime economic policy. By the 1960s, Hey Song had risen to the top of Taiwan’s beverage industry. This success was driven not only by president Chang Wen-chi’s

Last week, on the heels of the recall election that turned out so badly for Taiwan, came the news that US President Donald Trump had blocked the transit of President William Lai (賴清德) through the US on his way to Latin America. A few days later the international media reported that in June a scheduled visit by Minister of National Defense Wellington Koo (顧立雄) for high level meetings was canceled by the US after China’s President Xi Jinping (習近平) asked Trump to curb US engagement with Taiwan during a June phone call. The cancellation of Lai’s transit was a gaudy