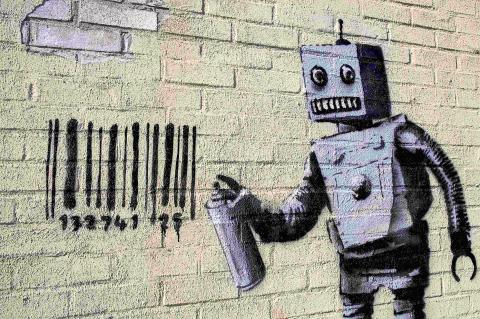

It may look more like a trading floor than an art show. Hundreds of well-heeled Londoners mill about, checking screens to see the latest trades and buy shares in initial public offerings. But the Banksy paintings and Shepard Fairey print point to a serious art gallery.

My Art Invest opened its doors in East London on Thursday, providing art collectors with a front for an online trading platform where they can buy shares in works by important street artists for as US$8.

“We want to democratize art,” Tom-David Bastok, My Art Invest’s 25-year-old French founder, told Reuters. “For me, it’s very, very, very important that everybody can put a foot in the art market.”

Photo: Reuters

He called My Art Invest “Gallery 2.0” and indeed, upon entering, would-be buyers are given iPads they can use to check the price and availability of shares, and make purchases.

A buyer who acquires one quarter of piece’s shares can take it home for three months.

Many in the young, artsy crowd liked the idea of being able to actually own works of fine art, but some viewed it as a step toward “commoditization” of culture.

“I like the idea, I like that artists are being recognized... but it does feed into this consumerism,” said Azziza Tillock, a 28-year-old Londoner who works in catering.

The global art market totaled US$65.9 billion last year, an increase of 8 percent and the highest level since 2007, according to a report by the European Fine Art Foundation.

Initial prices are set by My Art Invest, based on the market value and the more expensive a piece is, the more shares are issued. Once the initial offering is completed and all the shares are sold, owners can list their shares on the gallery’s secondary exchange for resale at any price they like.

ART AND FINANCE

My Art Invest does not monitor or manage the trades, choosing, like eBay, to let market forces play out.

“We are not a financial market but we try to be a cultural market,” said Bastok, who spent his youth accompanying his mother to art shows, after which they would buy canvases and paint to recreate their favorite works. He came up with the idea for My Art Invest while studying finance at Paris’s Ecole Superieure de Gestion et Finance and founded the company in Paris in 2011.

“I wanted to put my two favorite things, art and finance, into the same concept,” he said.

In France, the exchange traded a Jeff Koons sculpture called Blue Balloon Dog, with shares launched at 55 euros each and later trading at 200 euros, as well as Rome Pays Off by Jean-Michel Basquiat, whose shares climbed from 200 euros to 350 euros.

The average appreciation, however, is a more modest 30 percent in a period no longer than three years, says Bastok. That compares with an average return, according to My Art Invest, of about 4 percent over a period of five to 10 years in art investing.

Bastok is far from the first to start a financial vehicle for art investing. Back in 2001, ex-Christie’s advisor Philip Hoffman launched The Fine Art Fund Group in London. The art hedge fund no longer has any active funds, but still advises five pooled funds with assets under contract worth more than US$200 million, according to its Web site.

London is My Art Invest’s first international foray, but Bastok has plans for New York and Miami, and hopes to follow that with Shanghai and Hong Kong. The business makes money by trying to buy pieces at a discount and then takes a commission on every trade.

One of the most sought-after pieces in its collection is a stenciled painting on canvas by elusive UK artist Banksy called Heavy Artillery that features an elephant weighed down by a missile strapped to its back.

Its 1,000 shares were listed at 120 pounds (US$200) each.

Taiwan can often feel woefully behind on global trends, from fashion to food, and influences can sometimes feel like the last on the metaphorical bandwagon. In the West, suddenly every burger is being smashed and honey has become “hot” and we’re all drinking orange wine. But it took a good while for a smash burger in Taipei to come across my radar. For the uninitiated, a smash burger is, well, a normal burger patty but smashed flat. Originally, I didn’t understand. Surely the best part of a burger is the thick patty with all the juiciness of the beef, the

The ultimate goal of the Chinese Communist Party (CCP) is the total and overwhelming domination of everything within the sphere of what it considers China and deems as theirs. All decision-making by the CCP must be understood through that lens. Any decision made is to entrench — or ideally expand that power. They are fiercely hostile to anything that weakens or compromises their control of “China.” By design, they will stop at nothing to ensure that there is no distinction between the CCP and the Chinese nation, people, culture, civilization, religion, economy, property, military or government — they are all subsidiary

This year’s Miss Universe in Thailand has been marred by ugly drama, with allegations of an insult to a beauty queen’s intellect, a walkout by pageant contestants and a tearful tantrum by the host. More than 120 women from across the world have gathered in Thailand, vying to be crowned Miss Universe in a contest considered one of the “big four” of global beauty pageants. But the runup has been dominated by the off-stage antics of the coiffed contestants and their Thai hosts, escalating into a feminist firestorm drawing the attention of Mexico’s president. On Tuesday, Mexican delegate Fatima Bosch staged a

Would you eat lab-grown chocolate? I requested a sample from California Cultured, a Sacramento-based company. Its chocolate, not yet commercially available, is made with techniques that have previously been used to synthesize other bioactive products like certain plant-derived pharmaceuticals for commercial sale. A few days later, it arrives. The morsel, barely bigger than a coffee bean, is supposed to be the flavor equivalent of a 70 percent to 80 percent dark chocolate. I tear open its sealed packet and a chocolatey aroma escapes — so far, so good. I pop it in my mouth. Slightly waxy and distinctly bitter, it boasts those bright,