It could have picked London or Hong Kong. Instead, the lingerie retailer that styles itself “the original sex symbol” chose the buttoned-down sheikdom of Abu Dhabi for the launch of its first international store.

Frederick’s of Hollywood, famed for its curve-cinching corsets and provocative push-up bras, opened up to little fanfare in the Emirati capital late last month. Another outpost offering the chain’s racy lingerie is set to open soon up the road in more freewheeling Dubai.

The choice of venue is revealing — not only about demand for risque unmentionables on the Arabian Peninsula, but also for what it says about the United Arab Emirates’ retail pull. In only a few short years, this South Carolina-sized desert country has emerged as an unlikely first port of call for retailers looking to test their brands overseas.

“Despite the outward conservative culture ... this is a very fashion-conscious market,’’ Frederick’s Chairman and CEO Thomas Lynch said in a recent interview. “They’re no less interested in what we have to offer.”

Other retailers seem to agree. Crate and Barrel, American Eagle Outfitters, Aeropostale, Pottery Barn and Bloomingdale’s each have launched their first stores outside North America in the UAE in the past couple of years.

Smaller companies are making the leap too. When Manhattan favorites Shake Shack and Magnolia Bakery decided to take their burgers and red velvet cupcakes overseas, the first city they turned to was Dubai.

Retailers and restaurant chains that once shied away from overseas markets are being seduced by the region’s deep-pocketed citizens and the growing track records of their Arab franchise partners, who take on many of the costs and much of the legwork that goes into transferring the brand abroad.

Frederick’s deal is a good example.

While financial details are private, Lynch said paying for the Gulf expansion is mainly up to the company’s Abu Dhabi-based partners, Safeer Establishment. Frederick’s is primarily providing “brand support” for an arrangement that envisions 10 stores across the region in the next three years, he said.

The UAE has other advantages too. It boasts plenty of high-quality retail space and few of the deeply entrenched local brands that can put retailers off expanding into mature markets like Europe. The country’s booming airlines have turned the Emirates into a global crossroads, funneling armies of guest workers — including Westerners — and millions of tourists into the country’s shopping malls each year.

That was part of the appeal for Bloomingdale’s, which opened its first international store in Dubai’s biggest shopping mall early last year.

“With all the tourists passing through there, it’s a great billboard for Bloomingdale’s,” chairman and CEO Michael Gould said.

Gould said it is tricky for many American retailers to translate their brands to Europe, as it is for European chains looking to enter the US. A market such as the Emirates, however, offers a “much more fertile environment. People have an opportunity to build something there,” he said.

A recent surge of new retailers, particularly from the US, has pushed Dubai into the No. 1 spot alongside London in terms of market penetration for major retail brands, according to a recent report by real estate firm CB Richard Ellis. On the national level, the UAE is in second place globally, just behind Britain and ahead of the US.

As the Gulf’s most liberal and internationally connected city, Dubai has traditionally been the first stop for chains looking to expand in the region. But as it becomes more saturated, CB Richard Ellis expects international retailers will increasingly target nearby Abu Dhabi and other Gulf markets such as Kuwait City and Doha, Qatar.

Michael Leighton, a retail consultant at CB Richard Ellis, said many American retailers have long resisted setting up franchises, which is effectively a requirement for doing business in the Gulf. The economic downturn helped changed that.

“As consumer spending has reduced in the US, they’ve been forced to adjust their business model,” he said. Setting up a franchise in the Gulf is “a very easy way of generating extra revenue ... People have to generate profits and balance the books, and in the US it’s very very hard at the moment,’’ he added.

The strategy is not without risks. Dubai’s economy was pummeled by the global economic downturn, which sent property prices plunging and exposed large levels of debt. Many retailers planned their regional expansions during the boom years late last decade and had to contend with leaner times when they eventually opened.

“When we made the deal, we made it right at the peak ... When we opened, it was certainly at a much more difficult time,’’ Bloomingdale’s Gould said. He said the Dubai store nonetheless beat the company’s first-year projections last year, and he insists this year is looking “just terrific.” He declined to give specifics.

Frederick’s expects its Gulf customers won’t be that different from those in the US — young, fashion-conscious women who keep a close watch on what’s happening on the red carpets of Hollywood, said Lynch, the CEO.

While the Abu Dhabi store offers saucy staples such as the Exxtreme Cleavage bra and even a pair of rhinestone-covered handcuffs, Lynch is eager to point out the company has lots more to offer, including swimwear and shoes.

Scantily dressed mannequins in the windows of its flagship Emirates store hint at the risque offerings inside, though the storefront is designed so passers-by can’t easily peer in. Inside, lingerie is grouped by color, with a relatively more modest bridal collection showcased in a lushly carpeted centerpiece section.

The set-up differs from US layouts and is designed to appeal to Gulf tastes, said Osama Rashad, retail manager for franchisee Safeer’s parent company.

He expects local women, who generally appear in public covered in full-length black cloaks and headscarves, and other Arabs will account for as much as two-thirds of sales.

“They know what they want,” he said. “They travel a lot. They know these brands. And they like to spend their money.”

Still, as savvy as the region’s shoppers may be, there are limits to what Frederick’s is willing to offer in its Arabian stores. Out for now, for example, are kinky dress-up costumes that are popular at Halloween.

“It’s an area that’s more conservative than Southern California. There’s no question,’’ Lynch said. “We’re not naive ... There are things that we traditionally carry on our Web site that we wouldn’t even think of carrying over there.”

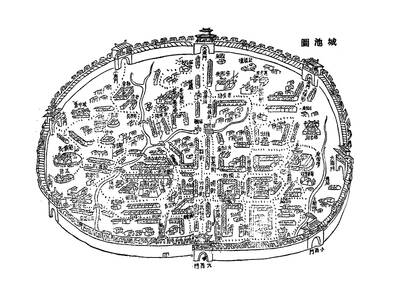

May 26 to June 1 When the Qing Dynasty first took control over many parts of Taiwan in 1684, it roughly continued the Kingdom of Tungning’s administrative borders (see below), setting up one prefecture and three counties. The actual area of control covered today’s Chiayi, Tainan and Kaohsiung. The administrative center was in Taiwan Prefecture, in today’s Tainan. But as Han settlement expanded and due to rebellions and other international incidents, the administrative units became more complex. By the time Taiwan became a province of the Qing in 1887, there were three prefectures, eleven counties, three subprefectures and one directly-administered prefecture, with

Taiwan Power Co (Taipower, 台電) and the New Taipei City Government in May last year agreed to allow the activation of a spent fuel storage facility for the Jinshan Nuclear Power Plant in Shihmen District (石門). The deal ended eleven years of legal wrangling. According to the Taipower announcement, the city government engaged in repeated delays, failing to approve water and soil conservation plans. Taipower said at the time that plans for another dry storage facility for the Guosheng Nuclear Power Plant in New Taipei City’s Wanli District (萬里) remained stuck in legal limbo. Later that year an agreement was reached

What does the Taiwan People’s Party (TPP) in the Huang Kuo-chang (黃國昌) era stand for? What sets it apart from their allies, the Chinese Nationalist Party (KMT)? With some shifts in tone and emphasis, the KMT’s stances have not changed significantly since the late 2000s and the era of former president Ma Ying-jeou (馬英九). The Democratic Progressive Party’s (DPP) current platform formed in the mid-2010s under the guidance of Tsai Ing-wen (蔡英文), and current President William Lai (賴清德) campaigned on continuity. Though their ideological stances may be a bit stale, they have the advantage of being broadly understood by the voters.

In a high-rise office building in Taipei’s government district, the primary agency for maintaining links to Thailand’s 108 Yunnan villages — which are home to a population of around 200,000 descendants of the Chinese Nationalist Party (KMT) armies stranded in Thailand following the Chinese Civil War — is the Overseas Community Affairs Council (OCAC). Established in China in 1926, the OCAC was born of a mandate to support Chinese education, culture and economic development in far flung Chinese diaspora communities, which, especially in southeast Asia, had underwritten the military insurgencies against the Qing Dynasty that led to the founding of