Conservatives often make a big show of worrying about the debt burden that we are passing on to our children. This moral argument featured prominently in congressional Republicans’ refusal to support a routine increase to the US debt ceiling. Republicans are supposedly so committed to reducing spending that it is willing to hold the global economy hostage and risk permanent damage to the US’ reputation.

No one argues that we should not think about future generations. The real question is what current policies and fiscal commitments will better serve the interests of our children and grandchildren. Viewed from this perspective, it is clear that it is the Republicans who are exhibiting a reckless disregard for the consequences of their actions.

Anyone with economic bona fides knows that one must always look at both sides of the balance sheet. What really matters is the difference between assets and liabilities. If debt increases, but assets rise even more, the country is better off — and so, too, are future generations. This is true whether one invests in infrastructure, education, research or technology. But even more important is natural capital: the value of our environment, water, air, and soil. If our air and water are polluted and our soil is contaminated, we are passing on a greater burden to our children.

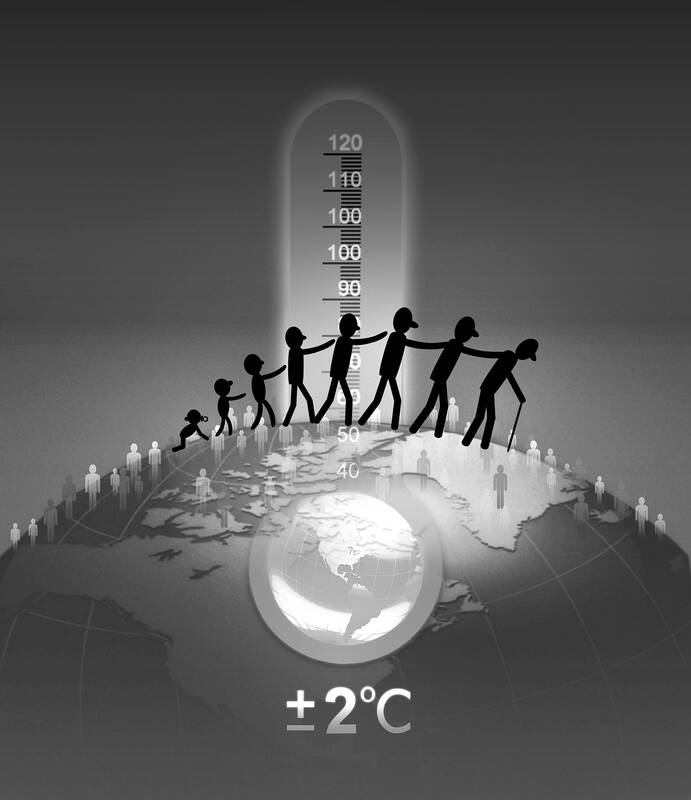

Illustration: Yusha

Financial debt is just something we owe to each other. It is a matter of pieces of paper that can be shuffled around to adjust entitlements to goods and services. If we default on our debt, our reputation would be tarnished, but our physical, human and natural capital would remain unchanged. Bondholders would find themselves poorer than they thought, and some taxpayers might end up richer than they would be if the debt was repaid, but our overall “wealth” would not have changed.

“Environmental debt” is different. It is a burden that cannot be eliminated with the stroke of a bankruptcy judge’s pen. Damage done today might take decades to repair and require spending money that could have been used to enrich the country. By the same token, wise spending to protect and rehabilitate the environment — like investments to reduce greenhouse-gas emissions — would leave future generations better off even if financed by debt.

Suppose we could estimate the direct benefits of such investments — for example, the increased output (or the reduced costs of repairing damage caused by wildfires, hurricanes and other extreme weather events), and the value of improved health and longevity from reduced air pollution — in money terms. What rate of return should we demand?

The US government is trying to answer this question, and whatever it comes up with will have far-reaching consequences. If we require a high rate of return (as former US president Donald Trump’s administration did when it set the bar at as much as 7 percent per year), there would be little investment in climate-change mitigation, and future generations would roast in a world where temperatures have increased by 3°C or more.

Given the inevitable consequences of inaction, investments in climate mitigation should be seen as a kind of insurance. The payoffs are highest when the effects of climate change are most adverse, and when the value of money is particularly high. The required returns on “insurance investments” ought to be lower than the safe real (inflation-adjusted) interest rate. That rate has actually been negative in recent years; but even taking a much longer-term perspective, it has been around 1 percent, plus or minus 0.5 percent. The appropriate “discount rate” therefore should be markedly lower than 7 percent, lower even than the 2.5 to 5 percent rate used by former US president Barack Obama’s administration, and possibly even negative.

To consider the matter from another angle, we can ask what discount rate is required to achieve the internationally agreed goal of limiting global warming to 1.5 to 2°C. Allowing temperatures to rise permanently beyond this threshold poses unacceptable risks. The fires, hurricanes, floods, droughts, frosts and other disasters that we have been enduring are merely a preview of what this future would hold. Calculations using high discounts — even the discounts used by the Obama administration — would not enable us to meet the 1.5°C goal.

We could also view the matter from the perspective of “future generations.” What value do we place on our children? What are their rights? If we value them as much as we value ourselves (and there is no ethical reason not to), we must account for how damage done to the environment today would affect their well-being. Since we are obviously living beyond planetary limits, we have an urgent moral obligation to reduce all forms of pollution.

Around the world, children and young adults are demanding that today’s leaders enact the policies needed to preserve their future. They are claiming this as a basic right, and in some jurisdictions — including the US, where a federal judge in Oregon recently ruled that a constitutional climate lawsuit filed by 21 young Americans can proceed and a similar suit is already proceeding against the state of Montana — children are going to court to fight for their interests. Should their elders not be doing the same?

Joseph Stiglitz, a Nobel laureate in economics, is university professor at Columbia University and a member of the Independent Commission for the Reform of International Corporate Taxation.

Copyright: Project Syndicate

George Santayana wrote: “Those who cannot remember the past are condemned to repeat it.” This article will help readers avoid repeating mistakes by examining four examples from the civil war between the Chinese Communist Party (CCP) forces and the Republic of China (ROC) forces that involved two city sieges and two island invasions. The city sieges compared are Changchun (May to October 1948) and Beiping (November 1948 to January 1949, renamed Beijing after its capture), and attempts to invade Kinmen (October 1949) and Hainan (April 1950). Comparing and contrasting these examples, we can learn how Taiwan may prevent a war with

A recent trio of opinion articles in this newspaper reflects the growing anxiety surrounding Washington’s reported request for Taiwan to shift up to 50 percent of its semiconductor production abroad — a process likely to take 10 years, even under the most serious and coordinated effort. Simon H. Tang (湯先鈍) issued a sharp warning (“US trade threatens silicon shield,” Oct. 4, page 8), calling the move a threat to Taiwan’s “silicon shield,” which he argues deters aggression by making Taiwan indispensable. On the same day, Hsiao Hsi-huei (蕭錫惠) (“Responding to US semiconductor policy shift,” Oct. 4, page 8) focused on

Taiwan is rapidly accelerating toward becoming a “super-aged society” — moving at one of the fastest rates globally — with the proportion of elderly people in the population sharply rising. While the demographic shift of “fewer births than deaths” is no longer an anomaly, the nation’s legal framework and social customs appear stuck in the last century. Without adjustments, incidents like last month’s viral kicking incident on the Taipei MRT involving a 73-year-old woman would continue to proliferate, sowing seeds of generational distrust and conflict. The Senior Citizens Welfare Act (老人福利法), originally enacted in 1980 and revised multiple times, positions older

Nvidia Corp’s plan to build its new headquarters at the Beitou Shilin Science Park’s T17 and T18 plots has stalled over a land rights dispute, prompting the Taipei City Government to propose the T12 plot as an alternative. The city government has also increased pressure on Shin Kong Life Insurance Co, which holds the development rights for the T17 and T18 plots. The proposal is the latest by the city government over the past few months — and part of an ongoing negotiation strategy between the two sides. Whether Shin Kong Life Insurance backs down might be the key factor