If there is one issue that has taken center stage at this year’s UN climate change conference, it is money. Delegates, climate advocates and the rapidly increasing number of private-sector attendees at COP27 are discussing who should pay for climate change, and how.

The focus on money is past due. While the annual climate talks are ultimately about cutting greenhouse gas pollution, the transition to a net zero economy requires massive financing, as will adapting to a world of rising average temperatures and sea levels, increasingly frequent and severe extreme weather, and all the other costly effects of burning fossil fuels.

Ever since COP15 in Copenhagen in 2009, a key figure in the debate has been US$100 billion. That is how much the world’s advanced economies promised to provide to developing countries every year by 2020.

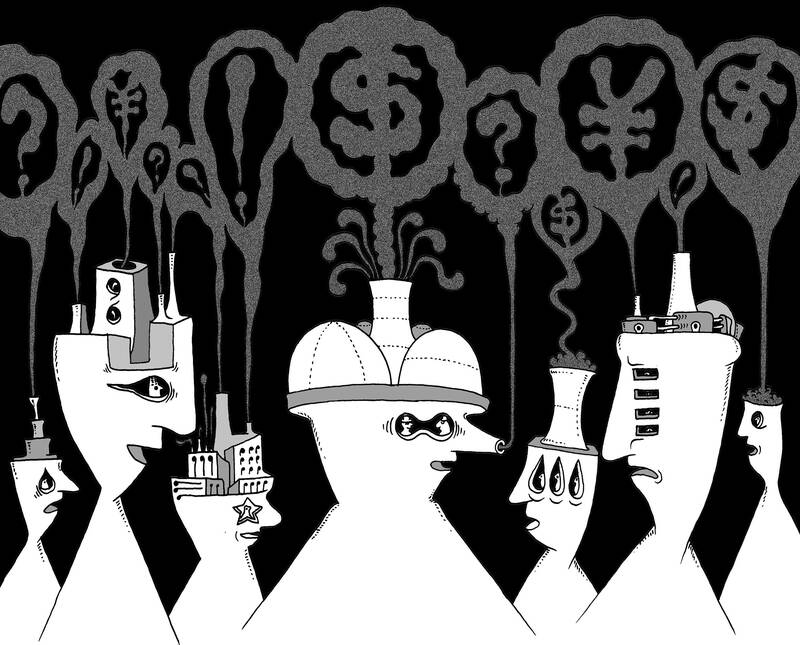

Illustration: Mountain People

However, it was never clear whether this target referred only to public money, or whether it could include a mix of public and private flows. While most of the Global South interpreted it as a commitment of public funds, most of the Global North preferred the broader definition. If one takes the latter view, the rich world was already on track to providing US$97 billion in annual climate finance flows in 2011, a widely cited study from the Climate Policy Initiative showed.

And yet, 13 years on from the 2009 pledge, few would make the mistake of mixing public and private funding, while everyone recognizes that the global energy transition will require not billions but trillions of US dollars per year.

Ahead of the COP26 talks in Glasgow, Scotland, last year, UN Special Envoy for Climate Action and Finance Mark Carney said that at least US$100 trillion of external finance would be “needed for the sustainable energy drive over the next three decades if it is to be effective.”

There is also considerable convergence among international bodies, consultancies and banks around this number. Massive amounts of private spending will need to be directed away from fossil fuel investments and toward low-carbon infrastructure, energy and transportation.

However, that does not let governments off the hook. Public funds are the lever for rechanneling private money at the necessary pace and scale.

The US’ Inflation Reduction Act, the Infrastructure Investment and Jobs Act, and the Creating Helpful Incentives to Produce Semiconductors and Science Act are good examples of this lever in action. The idea is that about US$500 billion in government investments would encourage many hundreds of billions more in private flows.

Yet while those sums (and similar policies elsewhere) could jump-start a global clean energy race, all the public investments and most of the private ones will be spent domestically in the US. That leaves the Global South still wanting.

The global picture fits a similar pattern. As annual foreign direct investment dwarfs development aid, much of the money to cut carbon, methane and other greenhouse gas pollution will come from private sources, regardless of what governments agree to do.

Unlocking these funds would require what climate negotiators call “creative” solutions, which means: “We know that much more money is needed, but we cannot be the ones who provide it.”

US Special Presidential Envoy for Climate John Kerry came to COP27 with a proposal to use carbon credits to fill at least some of the financing gap. Under this approach, rich countries and companies would get some credit not just for cutting their own pollution, but for paying others to do so.

The idea is not new. The US proposed a similar system ahead of COP3 in Kyoto, Japan, in 1997. At the time, much of the rest of the world, including the EU, opposed the plan. Yet, ironically, the EU now has the world’s largest carbon market, while the US, aside from California and a dozen northeastern states, does not. To this day, it is still politically impossible at the national level in the US to make polluters pay for their carbon pollution.

That is why the administration of US President Joe Biden has instead focused on spending money to aid the energy transition at home, and it is why Kerry is proposing a voluntary carbon credit system.

Carbon credits, especially voluntary ones, are no substitute for meaningful efforts by companies and countries to cut their own pollution.

For one, carbon credit systems have plenty of problems of their own. While California’s carbon market trades billions of US dollars in credits per year, it has also allowed about US$400 million in apparently fraudulent forest offsets into its system.

If California’s mandatory market struggles this much with compliance, just imagine the problems that would plague a voluntary global system.

The US and other rich, large polluters still have a responsibility to pony up direct aid on a much larger scale than they are currently doing. That goes for unconditional aid to help the poor weather climate change and for funding to help them cut their own pollution.

Germany and Austria deserve credit for leading the charge with promises of 170 million euros (US$175.7 million) and 50 million euros respectively in aid for the most vulnerable countries.

A new commitment from the US, the EU and Germany to invest US$500 million in renewables in Egypt is also a good step (even though the gas thus freed appears to be set for export to the EU).

Given that these sums all fall in the millions of US dollars, they still miss the mark by orders of magnitude.

There is clearly something to the idea of hitching billions of US dollars in much-needed aid flows to private financial flows in the trillions of US dollars. The first order of business is for governments to help guide trillions of US dollars in private investments toward the Global South.

“Creative” solutions should focus on making loans and investments less risky for private investors, with rich governments and multilateral funds providing loan guarantees and other assurances to help reduce sovereign credit and other risks.

Carbon credits could similarly play a role in helping scale up sorely needed investments, provided that voluntary carbon credits are seen only as a stepping stone to making polluters pay to cut their own pollution.

Ultimately, building more momentum behind the global clean energy revolution is what really matters. If allowing rich companies to boast of their green credentials means that they will fund more clean energy in the Global South, that is not a bad thing.

Often, the best way to ensure that necessary work is done is not to care too much about who takes the credit.

Gernot Wagner is a climate economist at Columbia Business School.

Copyright: Project Syndicate

In their recent op-ed “Trump Should Rein In Taiwan” in Foreign Policy magazine, Christopher Chivvis and Stephen Wertheim argued that the US should pressure President William Lai (賴清德) to “tone it down” to de-escalate tensions in the Taiwan Strait — as if Taiwan’s words are more of a threat to peace than Beijing’s actions. It is an old argument dressed up in new concern: that Washington must rein in Taipei to avoid war. However, this narrative gets it backward. Taiwan is not the problem; China is. Calls for a so-called “grand bargain” with Beijing — where the US pressures Taiwan into concessions

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s

During the “426 rally” organized by the Chinese Nationalist Party (KMT) and the Taiwan People’s Party under the slogan “fight green communism, resist dictatorship,” leaders from the two opposition parties framed it as a battle against an allegedly authoritarian administration led by President William Lai (賴清德). While criticism of the government can be a healthy expression of a vibrant, pluralistic society, and protests are quite common in Taiwan, the discourse of the 426 rally nonetheless betrayed troubling signs of collective amnesia. Specifically, the KMT, which imposed 38 years of martial law in Taiwan from 1949 to 1987, has never fully faced its