China’s stringent rules to curb COVID-19 are about to unleash another wave of summer chaos on supply chains between Asia, the US and Europe.

Beijing’s zero-tolerance approach amid an escalating virus outbreak brings the pandemic full circle, more than two years after its emergence in Wuhan upended the global economy. Shipping congestion at Chinese ports, combined with Russia’s war in Ukraine, risks a one-two punch that threatens to derail the recovery, already buffeted by inflation pressures and headwinds to growth.

Even if the virus is reined in, the disruptions will ripple globally — and extend through the year — as bunched-up cargo vessels start sailing again.

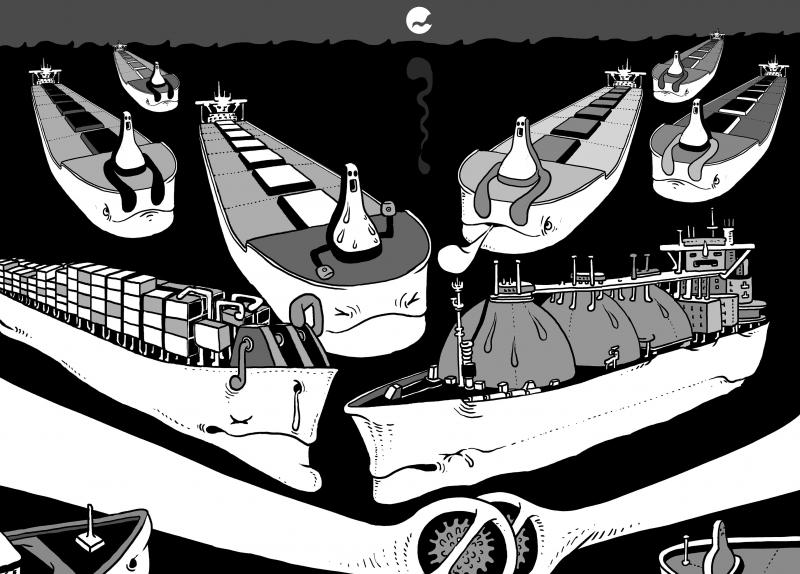

Illustration: Mountain People

“We expect a bigger mess than last year,” Jacques Vandermeiren, chief executive of the Port of Antwerp, Europe’s second busiest for container volume, said in an interview. “It will have a negative impact, and a big negative impact, for the whole of 2022.”

China accounts for about 12 percent of global trade and COVID restrictions have idled factories and warehouses, slowed truck deliveries and exacerbated container logjams. US and European ports are already swamped, leaving them vulnerable to additional shocks.

“Once product export activities resume and a large volume of vessels make their way to the US west coast ports, we expect waiting times to increase significantly,” said Julie Gerdeman, CEO of supply-chain risk analytics firm Everstream Analytics.

In the short run, the pileups would mean more costly headaches in the US$22 trillion arena for global merchandise trade, which slumped in 2020 and rebounded last year. Longer term, such chaos is redrawing the contours of a global economy tied together by cross-border commerce. For some corporate executives, reeling in far-flung production networks is no longer a patriotic political slogan — it is a business necessity given all the uncertainty.

“This has accelerated the pressing need for supply chains to become more regional,” Lorenzo Berho, CEO of Vesta, a Mexican developer of industrial buildings and distribution centers, said on a conference call last week.

The shift toward shorter supply chains to places like Mexico is under way to reduce exposure to Asia.

“Globalization as we know it may be coming to its end,” Berho said.

Key policymakers are coming around to the idea that a sea change in the developed world’s supply lines is necessary. US Secretary of the Treasury Janet Yellen calls her idea for more resilient trade linkages “friend-shoring” — a not-so subtle jab at China and Russia.

Much of the shift hinges on whether the COVID-19 pandemic has convinced consumers to accept higher prices for products made closer to home, and at least one consultant’s analysis says they are.

Relocating supply chains “might cost more, but if you can make smaller quantities that you can then sell at closer to full price, you can actually completely change the game,” said Brian Ehrig, a partner at the consulting firm Kearney and coauthor of a report this month that found 78 percent of CEOs are either considering reshoring or have done it already.

“My bet is that globalization will never die; however, it will evolve to a different form,” said Shay Luo, a Kearney principal who helped write the report.

Companies have weathered the roughest bouts of supply turmoil over the past year partly by raising prices — and consumers have largely absorbed the hit. In the near term, though, supplies from China pose a more menacing cloud than the questions about household demand.

Tesla Inc lost about a month of work during the Shanghai shutdown. Retailer Bed Bath & Beyond Inc earlier this month said an “abnormally high” level of inventory was in transit, unavailable or held at ports through the early part of this quarter.

Alcoa Corp, the aluminum giant that is a bellwether for the global economy, last week blamed transport snarls for higher inventories. Continental AG, Europe’s second-largest maker of auto parts, lowered its growth forecast for global production of passenger and light commercial vehicles to a range of 4 to 6 percent, from 6 to 9 percent previously.

Wang Xin (王馨), head of the Shenzhen Cross-Border E-Commerce Association, an organization representing about 3,000 exporters, said that even though a lockdown in that Chinese tech hub lasted only a week, “many sellers are suffering about a one-month delivery delay.”

It still takes an average of 111 days for goods to reach a warehouse in the US from the moment they are ready to leave an Asian factory, close to the record of 113 set in January and more than double the trip in 2019, San Francisco-based freight forwarder Flexport Inc said.

The westbound journey to Europe takes even longer — a near-record 118 days.

Longer lines of vessels seen off China’s coast are not helping. The line of cargo carriers has jumped after Shanghai, home to the world’s largest container port, initiated a citywide lockdown late last month to combat COVID-19 cases.

The total number of container ships in port and off the hub’s shared anchorage with nearby Ningbo stood at 230 as of Wednesday last week, a 35 percent increase from this time last year, Bloomberg shipping data showed.

Imported containers are waiting on average for 12.1 days at Shanghai’s port before they are picked up by truck and delivered to destinations inland, supply-chain data provider project44 said. The rate for Monday last week was almost triple the 4.6 days on March 28. Trucking shortages have crippled efforts to supply key inputs to factories and transport goods such as autos and electronics to the ships.

Air freight is also being affected, with deliveries into Shanghai Pudong International Airport backed up, Taipei-based air and ocean freight forwarder and logistics specialist Dimerco Express Corp said.

That congestion has spread to Shenzhen, as the city that borders Hong Kong has seen a sharp increase in shipments rerouted from Shanghai.

To ease congestion around Shanghai, sailings are being diverted to Ningbo and Taicang, Dimerco director of ocean freight Donny Yang said.

At the same time, the central government has instructed that highways be kept open and unobstructed.

Automakers and electronics manufacturers in China’s financial hub have been gradually resuming operations, as authorities have encouraged the use of closed-loop systems, in which workers live on site at their factories.

Still, ramping up production from a shutdown is not an instant process. Tesla restarted its Shanghai factory after a three-week closure, but it is uncertain how long the plant can operate with a limited supply of components.

“The change in COVID prevention policies in different cities has imposed an extraordinarily severe impact on logistics,” China Passenger Car Association secretary-general Cui Dongshu (崔東樹) said.

Economists at Goldman Sachs Group Inc said in a research note last week that supply-chain setbacks “have been somewhat worse than we anticipated, and we have adjusted our growth and inflation forecasts slightly in response in recent weeks.”

When the bottlenecks in Asia start to clear, it will likely bring a flood of containers just as a seasonal pickup in imports gets under way.

“Some companies may have already tried to ship their orders somewhere else or they canceled them,” said Stephanie Loomis, vice president of international procurement at freight forwarder CargoTrans Inc. “But my guess is we’re going to see an enormous backlog of freight come out of there like a buckshot.”

The total container-ship count for the US’ dual hub of Los Angeles and Long Beach reached at least 57 vessels on Wednesday last week, the highest since late February. A few other gauges like container dwell times are also creeping higher again.

Some of California’s backlog has merely shifted east in search of faster routes — shiploads of goods are lined up from New York City to Charleston, South Carolina.

Data from MarineTraffic recently showed a major reversal: The US east coast topped the west coast in the amount of container capacity that is waiting at anchor to offload.

The pileups in Europe are just as severe or worse, compounded by the proximity to the war in Ukraine. Key ports such as the Netherlands’ Rotterdam, Germany’s Hamburg, Belgium’s Antwerp and three in the UK are working at or above capacity, which means they are already struggling to accept more containers because they do not have space to store them.

European Central Bank President Christine Lagarde said in a speech on Friday last week that Europe’s integration in global value chains was even deeper than that of the US.

Trade as a share of the eurozone’s GDP rose to 54 percent in 2019 from 31 percent two decades earlier, she said, compared with the US’ 3 percentage point rise to 26 percent.

She also cited a recent survey that found 46 percent of German companies get significant inputs from China. Of those, almost half are planning to reduce that dependency. Russia’s invasion now means the search for the lowest-cost suppliers must be refocused around geopolitical alliances.

“We must work towards making trade safer in these unpredictable times, while also leveraging our regional strength,” Lagarde said. “Even industries that are not considered strategic are likely to anticipate the fracturing of the global trading order and adjust production themselves.”

Because much of what former US president Donald Trump says is unhinged and histrionic, it is tempting to dismiss all of it as bunk. Yet the potential future president has a populist knack for sounding alarums that resonate with the zeitgeist — for example, with growing anxiety about World War III and nuclear Armageddon. “We’re a failing nation,” Trump ranted during his US presidential debate against US Vice President Kamala Harris in one particularly meandering answer (the one that also recycled urban myths about immigrants eating cats). “And what, what’s going on here, you’re going to end up in World War

Earlier this month in Newsweek, President William Lai (賴清德) challenged the People’s Republic of China (PRC) to retake the territories lost to Russia in the 19th century rather than invade Taiwan. He stated: “If it is for the sake of territorial integrity, why doesn’t [the PRC] take back the lands occupied by Russia that were signed over in the treaty of Aigun?” This was a brilliant political move to finally state openly what many Chinese in both China and Taiwan have long been thinking about the lost territories in the Russian far east: The Russian far east should be “theirs.” Granted, Lai issued

On Sept. 2, Elbridge Colby, former deputy assistant secretary of defense for strategy and force development, wrote an article for the Wall Street Journal called “The US and Taiwan Must Change Course” that defends his position that the US and Taiwan are not doing enough to deter the People’s Republic of China (PRC) from taking Taiwan. Colby is correct, of course: the US and Taiwan need to do a lot more or the PRC will invade Taiwan like Russia did against Ukraine. The US and Taiwan have failed to prepare properly to deter war. The blame must fall on politicians and policymakers

Gogoro Inc was once a rising star and a would-be unicorn in the years prior to its debut on the NASDAQ in 2022, as its environmentally friendly technology and stylish design attracted local young people. The electric scooter and battery swapping services provider is bracing for a major personnel shakeup following the abrupt resignation on Friday of founding chairman Horace Luke (陸學森) as chief executive officer. Luke’s departure indicates that Gogoro is sinking into the trough of unicorn disillusionment, with the company grappling with poor financial performance amid a slowdown in demand at home and setbacks in overseas expansions. About 95