The UK would reap an extra £4.7 billion (US$6.65 billion) annually by adopting US President Joe Biden’s proposal for a new global minimum corporation tax rate of 21 percent, the Institute for Public Policy Research (IPPR) Centre for Economic Justice has said.

The think tank has urged the British government to embrace and push for Biden’s proposals at the forthcoming G7 summit, arguing that the global system would be fairer and allow the UK to raise billions in vital revenue.

Biden has set out plans, based on long-gestating proposals by the Organisation for Economic Co-operation and Development (OECD), to force the world’s biggest multinational companies to pay taxes to national governments based on the sales the companies generate in each country, and to establish a global minimum rate to deter firms from shifting profits abroad and to reduce international undercutting on tax.

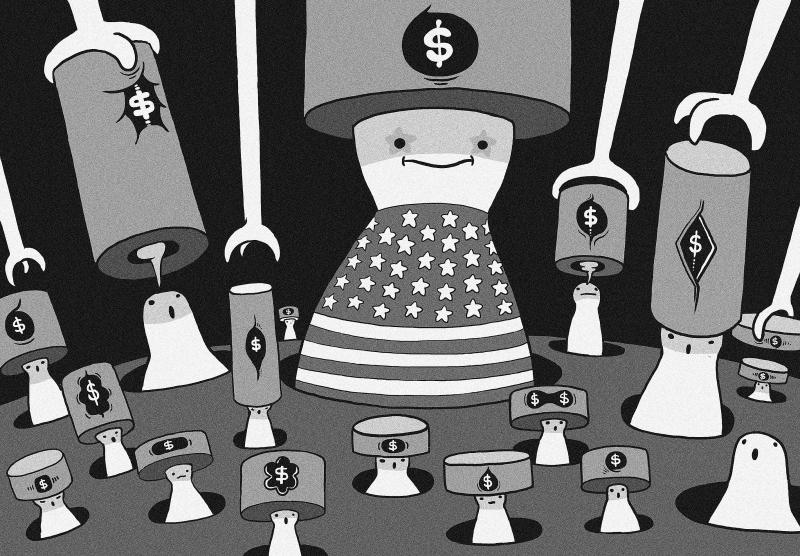

Illustration: Mountain People

The US initially proposed a minimum global corporate tax rate of 21 percent, but has since signaled that it could accept a 15 percent minimum.

Five of the other G7 members have already indicated that they will back the proposals, but the UK has yet to do so, despite British Chancellor of the Exchequer Rishi Sunak having set out plans in this year’s budget to raise the UK’s corporation tax rate from 19 percent to 25 percent by 2023.

The IPPR says that the UK, while hosting the G7 meeting in Cornwall this month, could take an opportunity for global leadership by backing a new global minimum rate of 21 percent, and help define a new consensus on fair and transparent taxation and investment, to aid a post-COVID-19-pandemic recovery.

It calculates that a global minimum of 21 percent corporation tax would generate increased UK tax receipts of £4.7 billion, sufficient to fund the rebuilding of the National Health Service and care system — which the IPPR recently costed at £2 billion.

The alternative proposal for a 15 percent rate would only raise approximately half as much — about £9 billion — and would retain “the race to the bottom on tax,” it said.

While opponents have argued that the minimum rate would undermine national sovereignty, the IPPR said that the UK’s sovereignty is more affected by companies that are able to avoid taxation by shifting their profits to offshore havens.

The Biden plan includes proposals to ensure that firms cannot move profits to a country with a lower tax rate.

Companies that pay full taxes in the UK would not face higher bills either, given the new UK corporation tax rate.

Instead, it would prevent multinational firms from offshoring their profits to tax havens, in an unfair advantage over companies operating solely in the UK, the IPPR said.

George Dibb, the head of the IPPR Centre for Economic Justice, said that the UK government, as hosts of the G7 meeting, could shape the global economic consensus, but warned: “The window of opportunity may be narrow. Failure to reach consensus has held these negotiations up for years, until the new US administration kick-started the process again.”

“The UK should not miss the opportunity to seize global leadership on the issue,” Dibb said.

“For years, big businesses all around the world have avoided taxes, to the tune of [US]$500 billion per year, at the expense of all those domestic businesses that do pay their fair taxes,” IPPR senior economist Carsten Jung said.

“Fixing this will restore the level playing field for all UK businesses, and it will address one of the big economic injustices of our time,” Jung said.

A British Treasury spokesperson said that the government could back minimum tax rates, but as part of the proposed package under discussion at the OECD.

“Reaching an international agreement on how large digital companies are taxed has been a priority for the chancellor since he took office,” the spokesperson said. “Our consistent position has been that it matters where tax is paid and any agreement must ensure digital businesses pay tax in the UK that reflects their economic activities.”

“We welcome the US’ renewed commitment to tackling the issue and agree that minimum taxes might help to ensure businesses pay tax — as long as they are part of that package approach,” the spokesperson said.

G7 finance ministers are due to meet in London this week.

Reuters reported that a draft communique shows they will pledge next month to reach an “ambitious” deal on a minimum global corporate tax.

Jan. 1 marks a decade since China repealed its one-child policy. Just 10 days before, Peng Peiyun (彭珮雲), who long oversaw the often-brutal enforcement of China’s family-planning rules, died at the age of 96, having never been held accountable for her actions. Obituaries praised Peng for being “reform-minded,” even though, in practice, she only perpetuated an utterly inhumane policy, whose consequences have barely begun to materialize. It was Vice Premier Chen Muhua (陳慕華) who first proposed the one-child policy in 1979, with the endorsement of China’s then-top leaders, Chen Yun (陳雲) and Deng Xiaoping (鄧小平), as a means of avoiding the

The last foreign delegation Nicolas Maduro met before he went to bed Friday night (January 2) was led by China’s top Latin America diplomat. “I had a pleasant meeting with Qiu Xiaoqi (邱小琪), Special Envoy of President Xi Jinping (習近平),” Venezuela’s soon-to-be ex-president tweeted on Telegram, “and we reaffirmed our commitment to the strategic relationship that is progressing and strengthening in various areas for building a multipolar world of development and peace.” Judging by how minutely the Central Intelligence Agency was monitoring Maduro’s every move on Friday, President Trump himself was certainly aware of Maduro’s felicitations to his Chinese guest. Just

As the Chinese People’s Liberation Army (PLA) races toward its 2027 modernization goals, most analysts fixate on ship counts, missile ranges and artificial intelligence. Those metrics matter — but they obscure a deeper vulnerability. The true future of the PLA, and by extension Taiwan’s security, might hinge less on hardware than on whether the Chinese Communist Party (CCP) can preserve ideological loyalty inside its own armed forces. Iran’s 1979 revolution demonstrated how even a technologically advanced military can collapse when the social environment surrounding it shifts. That lesson has renewed relevance as fresh unrest shakes Iran today — and it should

On today’s page, Masahiro Matsumura, a professor of international politics and national security at St Andrew’s University in Osaka, questions the viability and advisability of the government’s proposed “T-Dome” missile defense system. Matsumura writes that Taiwan’s military budget would be better allocated elsewhere, and cautions against the temptation to allow politics to trump strategic sense. What he does not do is question whether Taiwan needs to increase its defense capabilities. “Given the accelerating pace of Beijing’s military buildup and political coercion ... [Taiwan] cannot afford inaction,” he writes. A rational, robust debate over the specifics, not the scale or the necessity,