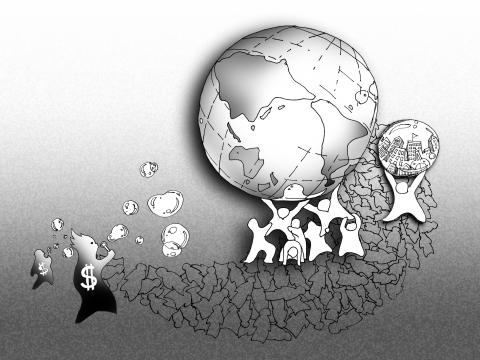

You might think that we have been living in a post-bubble world since the collapse in 2006 of the biggest-ever worldwide real-estate bubble and the end of a major worldwide stock-market bubble the following year. However, talk of bubbles keeps reappearing — new or continuing housing bubbles in many countries, a new global stock-market bubble, a long-term bond-market bubble in the US and other countries, an oil-price bubble, a gold bubble and so on.

Nevertheless, I was not expecting a bubble story when I visited Colombia last month. However, once again, people there told me about an ongoing real-estate bubble and my driver showed me around the seaside resort town of Cartagena pointing out, with a tone of amazement, several homes that had recently sold for millions of dollars.

The Banco de la Republica, Colombia’s central bank, maintains a home price index for three main cities — Bogota, Medellin and Cali. The index has risen 69 percent in real (inflation-adjusted) terms since 2004, with most of the increase coming after 2007. That rate of price growth recalls the US experience, with the S&P/Case-Shiller Ten-City Home Price Index for the US rising 131 percent in real terms from its bottom in 1997 to its peak in 2006.

This raises the question: Just what is a speculative bubble? The Oxford English Dictionary defines a bubble as “anything fragile, unsubstantial, empty or worthless; a deceptive show. From 17th century onwards often applied to delusive commercial or financial schemes.”

The problem is that words like “show” and “scheme” suggest a deliberate creation, rather than a widespread social phenomenon that is not directed by any impresario.

Maybe the word bubble is used too carelessly.

Eugene Fama certainly thinks so. Fama, the most important proponent of the “efficient markets hypothesis,” denies that bubbles exist.

As he put it in a 2010 interview with John Cassidy for the New Yorker: “I don’t even know what a bubble means. These words have become popular. I don’t think they have any meaning.”

In the second edition of my book Irrational Exuberance, I tried to give a better definition of a bubble.

A “speculative bubble,” I wrote then, is “a situation in which news of price increases spurs investor enthusiasm, which spreads by psychological contagion from person to person, in the process amplifying stories that might justify the price increase.”

This attracts “a larger and larger class of investors, who, despite doubts about the real value of the investment, are drawn to it partly through envy of others’ successes and partly through a gambler’s excitement.”

That seems to be the core of the meaning of the word as it is most consistently used. Implicit in this definition is a suggestion about why it is so difficult for “smart money” to profit by betting against bubbles: The psychological contagion promotes a mindset that justifies the price increases, so that participation in the bubble might be called almost rational. However, it is not rational.

The story in every country is different, reflecting its own news, which does not always jibe with news in other countries.

For example, the current story in Colombia appears to be that the country’s government, now under the well-regarded management of Colombian President Juan Manuel Santos, has brought down inflation and interest rates to developed-country levels, while all but eliminating the threat posed by the Revolutionary Armed Forces of Colombia rebels, thereby injecting new vitality into the Colombian economy. That is a good enough story to drive a housing bubble.

Because bubbles are essentially social-psychological phenomena, they are, by their very nature, difficult to control. Regulatory action since the financial crisis might diminish bubbles in the future. However, public fear of bubbles may also enhance psychological contagion, fueling even more self-fulfilling prophecies.

One problem with the word bubble is that it creates a mental picture of an expanding soap bubble, which is destined to pop suddenly and irrevocably. However, speculative bubbles are not so easily ended; indeed, they may deflate somewhat, as the story changes, and then reflate.

It would seem more accurate to refer to these episodes as speculative epidemics. We know from influenza that a new epidemic can suddenly appear just as an older one is fading, if a new form of the virus appears, or if some environmental factor increases the contagion rate.

Similarly, a new speculative bubble can appear anywhere if a new story about the economy appears, and if it has enough narrative strength to spark a new contagion of investor thinking.

This is what happened in the bull market of the 1920s in the US, with the peak in 1929. We have distorted that history by thinking of bubbles as a period of dramatic price growth, followed by a sudden turning point and a major and definitive crash.

In fact, a major boom in real stock prices in the US after “Black Tuesday” brought them halfway back to 1929 levels by 1930. This was followed by a second crash, another boom from 1932 to 1937 and a third crash.

Speculative bubbles do not end like a short story, novel or play. There is no final denouement that brings all the strands of a narrative into an impressive final conclusion. In the real world, we never know when the story is over.

Robert Shiller is a professor of economics at Yale University.

Copyright: Project Syndicate

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s

During the “426 rally” organized by the Chinese Nationalist Party (KMT) and the Taiwan People’s Party under the slogan “fight green communism, resist dictatorship,” leaders from the two opposition parties framed it as a battle against an allegedly authoritarian administration led by President William Lai (賴清德). While criticism of the government can be a healthy expression of a vibrant, pluralistic society, and protests are quite common in Taiwan, the discourse of the 426 rally nonetheless betrayed troubling signs of collective amnesia. Specifically, the KMT, which imposed 38 years of martial law in Taiwan from 1949 to 1987, has never fully faced its

When a recall campaign targeting the opposition Chinese Nationalist Party (KMT) legislators was launched, something rather disturbing happened. According to reports, Hualien County Government officials visited several people to verify their signatures. Local authorities allegedly used routine or harmless reasons as an excuse to enter people’s house for investigation. The KMT launched its own recall campaigns, targeting Democratic Progressive Party (DPP) lawmakers, and began to collect signatures. It has been found that some of the KMT-headed counties and cities have allegedly been mobilizing municipal machinery. In Keelung, the director of the Department of Civil Affairs used the household registration system