What will the next year bring for the world economy? What will happen to production in the developing world, and in the rich industrial core? Indeed, do we even still dare to maintain that distinction anymore? After all, most rich countries have entered a post-industrial age, while developing countries now have -- or soon will -- as great a share of their population working in "industry" as the world's rich nations.

In the US, the fears of nine months ago that America's economy might succumb to deflation have been dispelled. What remains is a sense of tremendous opportunity wasted.

Ever since George W. Bush took office, America's annual real GDP growth has averaged 2.3 percent -- a pace that would have been acclaimed as normal and satisfactory when his father or Ronald Reagan was president, but that after the Clinton boom now seems tawdry and sluggish. Indeed, it is clear that the American economy could have grown much faster than it has.

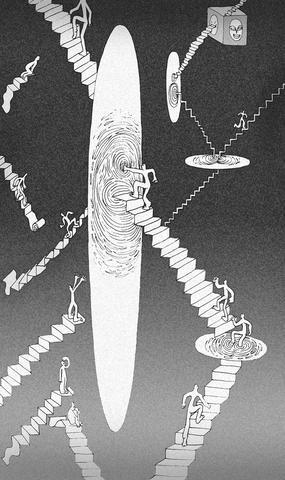

ILLUSTRATION MOUNTAIN PEOPLE

The US Bureau of Labor Statistics reports a drop in the employment-to-population ratio from 64.4 percent in 2000 to 62.3 percent today, together with a decline in non-farm payroll employment in this period from 131.8 million to 130.2 million. Underlying the business cycle, the rapid progress of the information-technology revolution is pushing American productivity growth ahead as fast as -- or faster than -- ever. Had the Federal Reserve been more aggressive in pushing interest rates down, or had Bush and Congress passed tax cuts aimed at boosting short-term demand and employment, the US economy would have grown at a pace not seen in a generation and a half.

Will America's economy grasp its opportunity to grow rapidly over the next year? Probably. Unless stagnant employment causes a sudden cutback in household consumption, tax rebates and low interest rates should push the US economy ahead at a 4 percent growth rate over the next year.

This may or may not be enough to produce lots of payroll jobs and significantly cut the unemployment rate, but it will be enough growth for the US to continue to be the fastest growing component of the world economy's post-industrial core. But the post-industrial core's economy as a whole will continue to be like an airplane with only one working engine. Real GDP growth in Japan and western Europe is unlikely to reach even half the pace seen in the US.

However, the absence of rapid growth in western Europe and Japan is not a great handicap for developing countries, because Europe and Japan were never all that open to imports from developing countries to begin with. Solid demand growth in the US will provide increased demand for developing-country exports -- albeit not at the prices that prevailed when the dollar was stronger.

More importantly, the developing world has little to fear from sudden panic on Wall Street. American domestic interest rates are so low and the fear of a large further decline in the dollar so great that it is nearly impossible to envision a sudden withdrawal of capital from developing countries to the post-industrial core. So 2004 is unlikely to see a repeat of the capital flight that hit Mexico in 1995 or East Asia in 1997-98. If hysteria hits world capital markets, the excitement is much more likely to come in the form of capital flight from the US.

More important than short-run cycles, however, are long-run trends. Annual labor productivity growth in the US has accelerated steadily in the past 30 years, from 1.2 percent in the period from the mid-1970s to the mid-1990s, to 2.3 percent in the late 1990s, and to 4.2 percent since 2000. How much of the second jump in productivity growth will be sustained is uncertain, but it is safe to bet that some of it will.

The more intriguing question is this: when will the rapid IT-driven productivity growth seen in the US spread to the rest of the rich countries? We do not know, but we do know that it will. Similarly, we do not know when world trade in information services like form processing, accounting and customer service will truly boom as a result of the Internet and the fiber-optic cable. But we do know that, like the late 19th-century boom in trade in staple goods fueled by the iron-hulled ocean-going steamship and the submarine telegraph, it will.

The lesson is that governments, firms, investors, workers and parents worldwide should begin betting on the long-run trends that have become visible over the past decade. Such bets probably won't pay off in the next year, or two, or three. But they surely will start to pay off in the next 10.

Karl Marx was not wholly wrong when he wrote that the most industrialized countries are mirrors in which the rest of the world can see its own future. The mirror that is the US shows that the returns from taking advantage of the economic changes made possible by the IT revolution are very high. The hard question for other countries is how to do this.

J. Bradford DeLong is professor of economics at the University of California at Berkeley and was assistant US Treasury secretary during the Clinton presidency. Copyright: Project Syndicate

In their recent op-ed “Trump Should Rein In Taiwan” in Foreign Policy magazine, Christopher Chivvis and Stephen Wertheim argued that the US should pressure President William Lai (賴清德) to “tone it down” to de-escalate tensions in the Taiwan Strait — as if Taiwan’s words are more of a threat to peace than Beijing’s actions. It is an old argument dressed up in new concern: that Washington must rein in Taipei to avoid war. However, this narrative gets it backward. Taiwan is not the problem; China is. Calls for a so-called “grand bargain” with Beijing — where the US pressures Taiwan into concessions

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s

During the “426 rally” organized by the Chinese Nationalist Party (KMT) and the Taiwan People’s Party under the slogan “fight green communism, resist dictatorship,” leaders from the two opposition parties framed it as a battle against an allegedly authoritarian administration led by President William Lai (賴清德). While criticism of the government can be a healthy expression of a vibrant, pluralistic society, and protests are quite common in Taiwan, the discourse of the 426 rally nonetheless betrayed troubling signs of collective amnesia. Specifically, the KMT, which imposed 38 years of martial law in Taiwan from 1949 to 1987, has never fully faced its