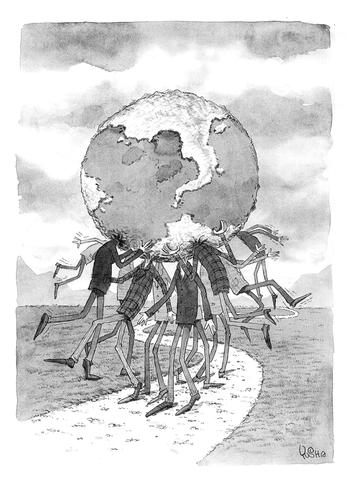

The rich-country G-8 summit will convene in Genoa, Italy later this week, anti-globalization protesters and riot police alongside. Both protesters and the G-8 leaders will accuse each other of not understanding the realities of globalization. The G-8 leaders will say that globalization is not only inevitable but good for development. Protesters will claim that the gap between rich and poor is widening.

Both groups are speaking half-truths.

The G-8 leaders stress that free trade is vital for a poor country to achieve sustained growth, for a poor country cut off from world markets won't develop. Yet there is a larger reality. Free trade, although a necessary condition for growth, is far from sufficient. Globalization helps part of the developing world to grow, but leaves hundreds of millions, even billions, behind, including many of the poorest people in the world. By pretending that globalization helps everybody, the G-8 countries are painting a unrealistic picture, one inviting backlash.

The most powerful way that poor countries grow is by becoming part of the global production systems of multinational companies. These firms create jobs in low-wage countries either through direct investment in those countries, or by finding suppliers in those countries that make products according to their specifications and are then exported to world markets, often back to the multinational firm's home country.

This process of global production helps rich countries in terms of lower-cost products and poor countries by creating jobs, experience with advanced technologies and investment. Eventually a poor country can "graduate" from being a mere supplier of components to becoming an innovator. Taiwan, South Korea, Israel and Ireland began their rapid industrialization one generation ago by producing standard products for multinational firms. Now they are high-tech economies in their own right.

The main problem with globalization is that much of the developing world is not part of the process. In the Americas, foreign direct investment is heavily concentrated in Mexico, parts of Central America and the Caribbean -- ie, countries near the US. South American countries further away from the US receive much less of this kind of investment. As a result, Mexico has been growing rapidly in recent years -- benefiting from a rapid rise of incomes, jobs, and exports to the US -- while South America has grown more slowly or even declined.

Similar situations exist in Europe and East Asia. European multinational firms invest heavily in low-wage countries such as Poland, Hungary and the Czech Republic, which are on the border of Western Europe, but not much in Romania, Ukraine or Russia, which are farther away. They invest in North African countries such as nearby Tunisia and Egypt but not much in Sub-Saharan Africa.

In Asia, foreign investments by Taiwanese firms flows into China's coastal provinces, not the poor interior. Japan prefers to invest mainly in neighboring East Asia rather than in distant India.

Developing countries that are neighbors of the rich thus have big advantages over other developing countries. Their natural advantages in lower transportation costs to the major markets are often augmented by trade policies in the rich countries.

Thus, Mexican exporters have preferred access to the US market as part of the North American Free Trade Agreement, and this gives Mexico yet another advantage over distant countries of South America. Similarly, Poland has trade and investment advantages over Russia, as Poland will soon become a member of the EU, with guaranteed access to Western European markets.

So, there are huge winners in the developing world from globalization but many countries are not beneficiaries. In fact, many countries are experiencing outright declines in living standards.

One problem is that in a world of high mobility of people and capital, skilled workers are moving out of remote regions to the more favored areas of the world. Thus, even though Africa has a profound crisis of disease, thousands of African doctors migrate to the US, Europe and the Middle East in search of decent living standards. Here, globalization may add to Africa's crisis.

For poor and remote parts of the world -- Sub-Saharan Africa, the Andean countries of Latin America, landlocked Central Asia and parts of Southeast Asia -- economic crisis is intensifying. Some regions are succumbing to disease and economic collapse.

A sensible dialogue between supporters and opponents of globalization must begin with a recognition that, although globalization is doing a huge amount of good in many poor countries, many are left behind in squalor, which may be intensifying in part because of globalization.

When they meet, the G-8 should face up to the harsh realities of Africa, the Andean region and other parts of the world. They should pledge debt cancellation for the most desperate of these countries and billions of dollars to fight disease, especially AIDS, malaria, tuberculosis and other killers. They should create new mechanisms to help the poorest of the poor share the benefits of advancing technologies.

If the G-8 show the world that they understand the realities of globalization, good and bad, and that they stand ready to assist those that are falling further behind, they would begin to close the widening and dangerous divide that separates supporters and opponents of globalization. In doing so, they would bring the world closer to real solutions.

Jeffrey Sachs is Galen L. Stone Professor of Economics and director of the Center for International Development at Harvard University.

PROJECT SYNDICATE

US President Donald Trump and Chinese President Xi Jinping (習近平) were born under the sign of Gemini. Geminis are known for their intelligence, creativity, adaptability and flexibility. It is unlikely, then, that the trade conflict between the US and China would escalate into a catastrophic collision. It is more probable that both sides would seek a way to de-escalate, paving the way for a Trump-Xi summit that allows the global economy some breathing room. Practically speaking, China and the US have vulnerabilities, and a prolonged trade war would be damaging for both. In the US, the electoral system means that public opinion

In their recent op-ed “Trump Should Rein In Taiwan” in Foreign Policy magazine, Christopher Chivvis and Stephen Wertheim argued that the US should pressure President William Lai (賴清德) to “tone it down” to de-escalate tensions in the Taiwan Strait — as if Taiwan’s words are more of a threat to peace than Beijing’s actions. It is an old argument dressed up in new concern: that Washington must rein in Taipei to avoid war. However, this narrative gets it backward. Taiwan is not the problem; China is. Calls for a so-called “grand bargain” with Beijing — where the US pressures Taiwan into concessions

The term “assassin’s mace” originates from Chinese folklore, describing a concealed weapon used by a weaker hero to defeat a stronger adversary with an unexpected strike. In more general military parlance, the concept refers to an asymmetric capability that targets a critical vulnerability of an adversary. China has found its modern equivalent of the assassin’s mace with its high-altitude electromagnetic pulse (HEMP) weapons, which are nuclear warheads detonated at a high altitude, emitting intense electromagnetic radiation capable of disabling and destroying electronics. An assassin’s mace weapon possesses two essential characteristics: strategic surprise and the ability to neutralize a core dependency.

Chinese President and Chinese Communist Party (CCP) Chairman Xi Jinping (習近平) said in a politburo speech late last month that his party must protect the “bottom line” to prevent systemic threats. The tone of his address was grave, revealing deep anxieties about China’s current state of affairs. Essentially, what he worries most about is systemic threats to China’s normal development as a country. The US-China trade war has turned white hot: China’s export orders have plummeted, Chinese firms and enterprises are shutting up shop, and local debt risks are mounting daily, causing China’s economy to flag externally and hemorrhage internally. China’s