"One bank takes you to a world of new solutions," read advertisements for the April debut of Mizuho Bank, the world's largest in terms of assets and one of the amalgamations that is supposed to represent the future power of post-crisis banking in Japan. A world of near- chaos has been more like it.

Maybe the mess at Mizuho ought to have been expected of a bank made of three dinosaurs in uncomfortable communion. Dai-Ichi Kangyo, Fuji and the Industrial Bank of Japan surprised everyone in August 1999 when they announced that they would merge into "a national champion," as a colleague who was there put it, "and a champion with a somewhat anti-foreign tilt to its ambitions."

A long time has passed since then, and the stock has traded well, especially during this spring's (manipulated) run-up in bank shares. But when Mizuho's doors formally opened for business on April 1, you would have thought the merger idea had been imposed upon the three participants more or less by force a few weeks earlier.

On the face of it, the problem is the information technology system chosen by the new bank. Automated teller machines across the country malfunctioned almost immediately. Some 2.5 million automated transfers from clients to utilities went unpaid -- a big deal in Japan, where "auto-pay" is the prevalent system for settling household and industry accounts.

Indeed, considering Mizuho's size, to impose a cease-business order on the bank while it cleans up its act would adversely impact something like a third of the Japanese economy, by the estimates I hear. The pols and the authorities have been breathing fire over this mess, but they are essentially stuck. "It's so big they can't do anything about it," a banking friend in Tokyo tells me.

You would think that the three banks of which Mizuho is comprised would now be fighting over the IT system and how best to fix it. Not so. The internal arguments, I'm told, are over which of the banks should take responsibility, how many managers from each bank should fall on their swords, and how the newly opened positions shall be apportioned.

Old habits die hard

There is a lesson in this of fundamental importance. Japanese banks may have a grand strategy for remaking themselves into global competitors able to take on foreign institutions in their domestic market, but they have yet to outgrow habits that extend back to the Meiji era (1868-1912), when Japan began to modernize.

The grand strategy, to put a complex matter simply, dates back 10 or 15 years, when the Finance Ministry set out to create three or four -- depending upon whom you talk to -- large universal banks based roughly on the German model. German banks may not strike readers as an efficacious model for anything now, but as the architecture of a system that would suit Japan, there is sense in the design.

Turf battle

But what problems -- what distance between concept and execution. And the IT fiasco at Mizuho is revealing in this respect. As a friend close to the situation puts it, "We've actually got, by way of an IT accident, a clear light to shine on the details of a classic Japanese turf battle. For a moment, at least, all the sociological behavior is in plain view."

Turf battles are old and notorious among the Japanese. In corporate Japan today, they resemble nothing so much as the castle-to-castle warfare characteristic of the days of the daimyos and their han, their small fiefdoms.

Consider briefly the chronology of the Mizuho mess, for it is in the progress of events since that August 1999 press conference that the reality of Japan's bank restructuring is made plain.

At the time of the merger announcement, all three banks had their own computer systems -- DKB's was from Fujitsu Ltd, Fuji's was from IBM Japan Ltd, and IBJ's from Hitachi Ltd. In one way or another each bank's technology tie-up reflected old keiretsu relationships. A few months later, the initial idea of developing a completely new system was scrapped in favor of the DKB system -- the argument being that Fujitsu was an important DKB client.

More arguments ensued. The folk at Fuji -- savvier than the others in banking technology -- were infuriated because they felt they were being forced to accept a system inferior to their own.

Ignoring the problem

Then what happened was most interesting indeed: Nothing happened for a year. At the end of 2000, a decision was made to run all three systems in parallel for the first year of operation, at which the point the DKB system would be expanded to serve the new bank. In the meantime, more changes in Mizuho's structure.

While the three banks would merge, the new entity would split into a retail bank and a corporate bank for large clients.

More nothing took place. Branch numbers changed, sorting codes changed, and a certain outside-inside schizophrenia came into being: Outside the bank, it would appear that clients were dealing with a single entity. Inside the bank they would actually be dealing with three.

"To senior management, which knows nothing about IT, all this seemed perfectly logical," my banking friend says. "In fact, it was crazy."

By mid-March of this year, it was clear by way of test runs that there were bugs in the system. By the weekend of March 30-31, pre-processing exercises made it clear that the system would not be able to service the 3 million transactions anticipated for the April 1 launch.

At that point, the new bank's senior management was taken up entirely with the quintessentially Japanese matter of face. "They couldn't go back, and they wouldn't go forward," one of my sources says. "So open their doors they did."

Now the plan has changed again, it seems. The DKB system is out -- or will be by 2004-05 -- and a wholly new system is to replace it. The climate inside has changed, too. Reports now are that an exodus of Mizuho staff has begun, prompted by concerns over the bank's stability.

Anyone with knowledge of Japanese banking history will recognize the story. When Dai-Ichi Bank and Kangyo Bank merged in the early 1970s, there wasn't one personnel structure in the new entity but three: Dai-Ichi's, Kangyo's, and the one created for DKB.

We can't end this tale by concluding merely that senior management at Japanese banks is (1) in certain respects incompetent and (2) stuck in historical identities and a corporate mentality wholly unsuited to the restructuring exercise Japan has embarked upon. We can't leave out the authorities.

The Financial Services Agency, under Minister Hakuo Yanagisawa, was aware of serious technology problems in the Mizuho merger as early as March 2001, when the FSA began a three-month review. But once again, nothing was done. And now an agency that is supposed to be policing the financial sector much in the Anglo- Saxon manner is left with its hands tied -- nothing can be done.

There are many books on my Japan shelf explaining "modern Japan." We will have to wait, it seems, for one to take up "modernized Japan." We're not quite there yet.

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

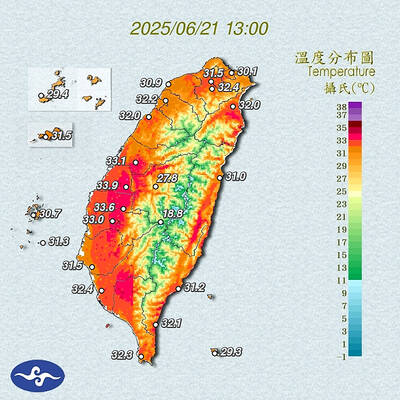

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist