Only days after the World Trade Center collapsed on top of the evacuated New York Coffee Exchange, obliterating the most important coffee auction in the Western Hemisphere, traders moved into backup office space across the East River and quickly put the exchange back in business.

At first, all was not well. Trading was limited to just 90 minutes, and the low ceilings in the building that is the exchange's temporary headquarters make the trading pits as noisy as the elevated subway that rumbles overhead in Long Island City, Queens. But order was restored with impressive speed, and contracts for most of the US$18 billion of coffee consumed annually in the US were bought and sold at the same volume as before.

Trying as it was, responding to the crisis in the coffee exchange may have been the easy part of handling the crisis in coffee.

PHOTO: NY TIMES

The price of raw coffee -- in decline for several years -- plummeted to a record low last week. The fall has been dizzying. Futures contracts on the coffee exchange, the benchmark for prices around the world, had been as high as US$7.32 a kilo, in May 1997. But last Monday, they bottomed out at US$1.02 a kilo, then rose slightly. And the future looks no brighter.

Bountiful rainfall in coffee-growing regions of South America is expected to help produce a record coffee harvest of more than 44 million bags next year in Brazil, the largest coffee-growing country in the world. Each bag weighs 60kg.

The emergence of Vietnam as a major coffee producer contributes to the oversupply. The Vietnamese government has helped farmers in the central highlands plant coffee trees by the thousands. A minor coffee exporter just a decade ago, Vietnam will swamp the market with 12 million bags of generally low-quality coffee this year, which could drive prices to new lows.

"Coffee is dead," said Dov Blumenthal, a trader whose pit name on the trading floor of the coffee exchange is Bear. He said the absence of frost, floods or other natural disasters in South America, good news for the people there, spells disaster for the oversupplied coffee industry. "I've never seen things as bad as this," he said.

The glut could prolong the boom-bust cycle that has haunted coffee for decades. As prices fall, farmers stop fertilizing and pruning trees. Eventually, they may yank out trees, reducing future supply. An unexpected frost or hurricane could wipe out the crop, causing shortages that would push prices sharply higher.

For now though, crumbling prices are causing havoc in the coffee-producing countries, which are on the verge of shutting down the cartel they formed a few years ago to control supplies and support prices. The impact on countries like Nicaragua and Ivory Coast has been devastating, as many farmers sell coffee at less than the cost of production. Some have to choose between starvation and switching to other crops, including illicit harvests like coca.

To the dismay of US consumers, the price collapse has not made its way to supermarket shelves. Prices for the most familiar brands -- including Folgers, Maxwell House, Chock Full O' Nuts and Nescafe -- which account for more than 65 percent of the retail market in the US, have dropped only slightly.

According to Information Resources, a market research company based in Chicago that tracks sales nationwide, the cost of a can of one brand, Yuban, is selling for US$3.77 a pound, only US$0.16, or 4 percent, less than it was in January last year. But the price of green coffee has been slashed by about 50 percent during that time.

"If the income of coffee producers is less than half of what it was a year ago, why hasn't any of that been passed on to consumers?" asked Deborah James, a director at Global Exchange, an organization that supports better treatment for coffee farmers and other agricultural workers. "We're in the midst of a profit bonanza right now."

Although they often cite sharp increases in the cost of green coffee supplies when they raise prices, the big coffee-roasting companies refuse to discuss their pricing now that unroasted coffee is cheaper than at any time in the last 30 years. "We never discuss our pricing," said MaryJane Kinkade, a spokeswoman for Kraft Foods, which produces Maxwell House and Yuban coffees.

Margaret Swallow, a spokeswoman for Procter & Gamble, which produces the Folgers brand, said the company had cut prices to retail chains seven times since March, last year, but she declined to say what those decreases were. According to Information Resources, the supermarket price of Folgers ground coffee has declined about 16 percent in that time and most recently has sold for US$2.80 a pound.

The price disparity between producers and consumers is nowhere greater than at the gourmet coffee level. Starbucks, the largest specialty coffee chain with 2,900 company-owned stores in the US, actually raised its prices US$0.05 to US$0.10 since January last year and does not plan to lower prices this year.

"Pricing takes into account many elements, not just the cost of coffee beans," said Audrey Lincoff, a Starbucks spokeswoman. Labor costs, rent for high-traffic locations and even the cost of milk and sugar must be factored into the total package, she said.

Starbucks still charges US$11.45 a pound for coffee in its stores, although the company has acknowledged the plight of farmers who receive less than US$0.50 a pound for their crops. The company promised this month to provide US$1 million in financial support to coffee farmers. Starbucks also plans to buy one million pounds of coffee under Fair Trade, an international program that sets a minimum price of US$3.02 a kg. Starting next spring, Starbucks plans to increase its use of Fair Trade coffee by making it the "Coffee of the Day" one day each month.

Amid the coffee industry's problems, Americans are showing no sign of surrendering their claim to being the world's biggest coffee consumers. They spend US$9.2 billion a year on retail coffee in supermarkets and specialty stores and an additional US$8.7 billion for brewed coffee, espresso and cappuccino in restaurants and coffee bars.

According to the American Coffee Association, a trade organization based in New York, orders for roasted coffee beans -- an indication of coffee consumption -- took a fall immediately after the terrorist attacks but have recovered.

As for the New York Coffee Exchange, its trading floor was at 4 World Trade Center, a nine-story building at the foot of the twin towers. When the towers came crashing down, tonnes of debris fell on the building, which had already been evacuated. Cocoa, sugar, cotton and some other commodities also were traded there.

Mark Fichtel, chief executive of the New York Board of Trade, which oversees the trading for coffee and all the other commodities, said it would have been technically possible to resume trading on Sept. 12, because a duplicate trading floor had been built in Long Island City five years ago in response to the 1993 bombing of the trade center. The delay of four trading days was caused by logistics, Fichtel said.

The cost of keeping that backup system equipped and ready to go, with duplicate files and computer systems, was about US$300,000 a year. Fichtel said there was some resistance to the concept "especially around the time the bills had to be paid." But having such a detailed contingency plan meant the exchanges could resume trading soon after the disaster, and did not have to fear losing business to competing exchanges like the London Coffee Exchange.

Right now, the two carpeted trading pits are used in rapid-fire 90-minute sessions by traders buying and selling futures and options on coffee and all the other commodities. Before Sept. 11, each crop was traded for five hours a day in its own trading pit. Now there are only two pits for all of the commodities. Fichtel said that by the middle of November, two additional pits would be opened, increasing daily trading time to two hours for each commodity. By the end of January, two more pits will be added, lengthening the daily trading sessions to three hours.

While that will help restore the trading process to normal in New York, it will not help resolve the serious problems in the world coffee market, which is of vital importance to 50 developing countries.

"There's definitely a temporary glut that's driven prices so low it's become a crisis," said John M. Talbot, an assistant professor of sociology at Colby College in Maine, who is writing a book on coffee.

"Chances are that after a few years, supply will be brought back into balance with demand. But the devastation that will happen in the meantime is morally unacceptable."

Talbot said the instability in coffee prices had been caused in large part by the cancellation of the International Coffee Agreement in 1989. The agreement was an attempt by the US and other democracies in the Cold War to support the economies of developing countries and prevent the Communists from making political inroads. The agreement kept prices high and established production quotas to balance supply and demand.

DEFENSE: The first set of three NASAMS that were previously purchased is expected to be delivered by the end of this year and deployed near the capital, sources said Taiwan plans to procure 28 more sets of M-142 High Mobility Artillery Rocket Systems (HIMARS), as well as nine additional sets of National Advanced Surface-to-Air Missile Systems (NASAMS), military sources said yesterday. Taiwan had previously purchased 29 HIMARS launchers from the US and received the first 11 last year. Once the planned purchases are completed and delivered, Taiwan would have 57 sets of HIMARS. The army has also increased the number of MGM-140 Army Tactical Missile Systems (ATACMS) purchased from 64 to 84, the sources added. Each HIMARS launch pod can carry six Guided Multiple Launch Rocket Systems, capable of

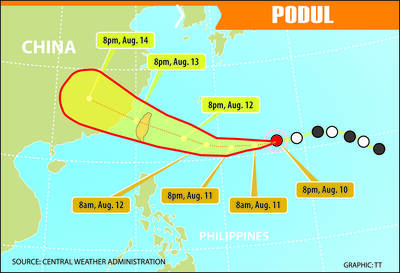

TRAJECTORY: The severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday, and would influence the nation to varying degrees, a forecaster said The Central Weather Administration (CWA) yesterday said it would likely issue a sea warning for Tropical Storm Podul tomorrow morning and a land warning that evening at the earliest. CWA forecaster Lin Ting-yi (林定宜) said the severe tropical storm is predicted to be closest to Taiwan on Wednesday and Thursday. As of 2pm yesterday, the storm was moving west at 21kph and packing sustained winds of 108kph and gusts of up to 136.8kph, the CWA said. Lin said that the tropical storm was about 1,710km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, with two possible trajectories over the next one

Tropical Storm Podul strengthened into a typhoon at 8pm yesterday, the Central Weather Administration (CWA) said, with a sea warning to be issued late last night or early this morning. As of 8pm, the typhoon was 1,020km east of Oluanpi (鵝鑾鼻), Taiwan’s southernmost tip, moving west at 23kph. The storm carried maximum sustained winds of 119kph and gusts reaching 155kph, the CWA said. Based on the tropical storm’s trajectory, a land warning could be issued any time from midday today, it added. CWA forecaster Chang Chun-yao (張竣堯) said Podul is a fast-moving storm that is forecast to bring its heaviest rainfall and strongest

CRITICISM: It is deeply regrettable that China, which is pursuing nuclear weapons, has suppressed Taiwan, which is pursuing peace, a government official said Representative to Japan Lee Yi-yang (李逸洋) yesterday accused Beijing of interference after Taiwan’s official delegation to the Nagasaki Peace Memorial Ceremony in Japan was assigned seating in the “international non-governmental organizations [NGO]” area. “Taiwan is by no means an international NGO, but a sovereign nation that is active on the international stage,” Lee said. Lee and Chen Ming-chun (陳銘俊), head of the Taipei Economic and Cultural Office (TECO) in Fukuoka, attended the ceremony in Nagasaki yesterday, which marked the 80th anniversary of the atomic bombing of the city. That followed Lee’s attendance at the Hiroshima Peace Memorial Ceremony on Wednesday