Suddenly, smart cards -- credit cards embedded with tiny computer chips -- are everywhere. American Express put a chip on its sparkly new Blue card, and issued 2.2 million of them in just 14 months. Rushing to mimic Blue's success, Visa says at least four of its banks will issue 7 million credit cards with chips on them this year. And MasterCard says it is getting into the smart card business, too.

The cards may be smart, but so far they have been mute. In contrast to Europe, where smart cards have been used for a decade, there are hardly any ways to actually use a smart card in the US. Few stores have readers for them. Nor do most wireless phones here take the cards. The companies using them say the cards add security for shopping on the Internet, but a survey showed that only six of every 1,000 Blue card holders have actually used the chip on the Web.

PHOTO: NY TIMES

So far, smart cards in the US are little more than a silicon and plastic fashion statement. Credit cards have long been marketed with insubstantial distinctions, like the rise a few years ago in "platinum" cards that differed from gold cards in little more than color. Now some bankers see smart cards as this year's platinum fad, said Michael Auriemma, president of Auriemma Consulting in Westbury, New York, only more expensive for the issuers.

"One of my clients said, at least half seriously, that he wanted to put a picture of a chip on the card," Auriemma said. "It has the same functionality and it costs US$3 less."

The credit card companies do worry that customers will eventually notice that the future they have been promising has not arrived. And so they are scrambling to find useful things to do with the chips that are already in millions of wallets.

"We have to look for ways to justify the chip and create a consumer-value proposition in the marketplace," said Carl F. Pascarella, president of Visa USA.

Thus the card companies are all experimenting with different uses for the card, like electronically storing supermarket coupons and frequent-flier rewards.

If smart cards proliferate in the US and eventually find significant uses, it will be another reminder that technology is often adopted in unpredictable ways. None of the companies that first introduced videocassette recorders, for example, predicted that their main use would be to play movies rented from corner stores.

Up to now, nearly every attempt to find sound business reasons forsmart cards here has failed.

In Europe, chips were added to cards starting in 1990 to combat fraud and to compensate for high costs of sending data. The chips are harder to forge than are traditional cards with magnetic stripes, and they can store data like how much money the cardholder has available to spend. That means they can be used in card readers that do not have to connect to a central computer for authorization.

In the US, computer networks are so fast and inexpensive that even the smallest purchase is now electronically verified by the bank that issued the card.

"In the United States, our telecommunications costs are low and our fraud rate, knock on wood, has been so low that the rationale for the chip card has never existed," Pascarella of Visa said.

In the 1990s, the card companies experimented with various electronic cash systems, notably in a trial of smart cards in 1997 in New York City. The systems allowed actual electronic cash to be loaded on to the card for use in even small-change transactions at newsstands and vending machines. Response was tepid as transactions took longer than before, and electronic cash turned out to be a novelty hardly worth the expense of such an elaborate system.

American Express turned to smart cards as it was developing Blue, a credit card intended to lure younger customers. Blue was introduced at the end of 1999, just as Internet stocks were pushing the NASDAQ to record heights and technology was the word of the day.

At the same time, American Express surveys showed that many people were worried about using their cards on the Internet, even though it and all credit card companies promised not to hold cardholders liable for unauthorized online charges.

So American Express positioned the chip as a tool for more secure online shopping. Customers had to order separate smart card readers and connect them to their personal computers. Some got the readers free; others had to pay US$25. American Express will not say how many were ordered.

Then, users found that setting up and using the system was cumbersome. Indeed, one of the two methods of using the Blue card online, the American Express Wallet, had so many problems the company canceled it earlier this year. The other system, American Express Private Payments, has so many complications that Amazon.com, by far the largest online store, explicitly recommends that its customers not use it.

Blue card users, of course, can still shop at Amazon by typing in their credit card numbers. And so, of course, can a thief who steals a Blue card.

"The chip on Blue had a lot of sizzle, but when they brought the plate there wasn't much steak there," said Bruce Brittain, president of Brittain Associates, the survey firm that found there was little use of the Blue card readers.

Kathleen Marryat, an American Express vice president for marketing, said the company's surveys showed that card holders were very satisfied with the chip, despite its limited applications.

"Customers are very aware of the chip, and they identify the chip with security," she said. "It's very important to them, and they feel good about it."

She added that American Express was continuing to develop new functions for the chip.

"We certainly wouldn't issue a card with the intent of not having applications for it," she said. Blue card holders, she said, now get 30 percent discounts on five CDs a month at Virgin Megastores. But that could be done without a chip as well.

If someone does come up with a useful application for smart cards, there are millions of cards in circulation that could potentially use it. That is even easier with the latest technology, based on the Java programming language, which allows multiple applications to be loaded onto one card.

And using the cards online may get easier. Compaq said recently that it would put smart card readers on the keyboards of some of its new computers, and Visa hopes to persuade other computer makers to do the same. The prices of the cards are falling, along with other sorts of computers. Visa's smart cards cost about US$3 each and each has more power than a card that cost US$10 two years ago.

But what should the smart cards do? Much discussion has centered on various forms of electronic coupons, discounts and rewards programs that stores could put on the cards. Essentially, a smart card could double as a high-tech version of the punch card used by so many coffee bars: buy 10 and get one free. But this talk is so hypothetical that none of the card companies have any proposals for how it would work if, say, a coffee bar wanted to create such a program.

And there are other technologies available to do the same things. Airlines, of course, keep track of tens of millions of frequent fliers using cards that identify fliers with simple magnetic stripes.

Ultimately it is not at all clear that American customers actually want any of these things. When Auriemma Consulting asked people about a list of potential applications for smart cards, none got much more than a tepid response. There were some pockets of interest; young renters thought electronic cash would allow them to save quarters for the laundry, for example, a service some laundries already provide.

"Our theory is we need to be focused on small wins," Auriemma said. "There will not be a universal answer."

The Target Corp. will put chips on several million of its new Target Visa credit cards and will install smart card readers at all of its cash registers. It hopes that customers will download coupons from its Web site for use at its stores.

But Gerald Storch, the company's vice chairman, said the origin of the Target smart card was an effort to make the card look different from those of its competitors. "What is most important to us is to keep our brand hip and hot and innovative," he said.

Shailesh Mehta, chief executive of Providian Financial, which has already issued more than a million Visa smart cards, agrees that it is not clear whether any of these applications will take off. But he said it did not matter, because the chips pay for themselves as a way to attract new credit card customers.

"We can't tell if there will be enough momentum to make this a success or whether it will be another fad," he said. "The downside is manageable for us, and the upside is interesting."

FREEDOM OF NAVIGATION: The UK would continue to reinforce ties with Taiwan ‘in a wide range of areas’ as a part of a ‘strong unofficial relationship,’ a paper said The UK plans to conduct more freedom of navigation operations in the Taiwan Strait and the South China Sea, British Secretary of State for Foreign, Commonwealth and Development Affairs David Lammy told the British House of Commons on Tuesday. British Member of Parliament Desmond Swayne said that the Royal Navy’s HMS Spey had passed through the Taiwan Strait “in pursuit of vital international freedom of navigation in the South China Sea.” Swayne asked Lammy whether he agreed that it was “proper and lawful” to do so, and if the UK would continue to carry out similar operations. Lammy replied “yes” to both questions. The

‘OF COURSE A COUNTRY’: The president outlined that Taiwan has all the necessary features of a nation, including citizens, land, government and sovereignty President William Lai (賴清德) discussed the meaning of “nation” during a speech in New Taipei City last night, emphasizing that Taiwan is a country as he condemned China’s misinterpretation of UN Resolution 2758. The speech was the first in a series of 10 that Lai is scheduled to give across Taiwan. It is the responsibility of Taiwanese citizens to stand united to defend their national sovereignty, democracy, liberty, way of life and the future of the next generation, Lai said. This is the most important legacy the people of this era could pass on to future generations, he said. Lai went on to discuss

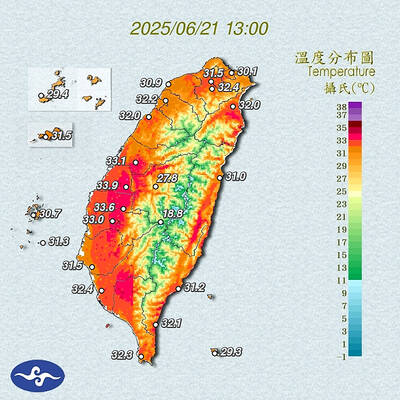

AMENDMENT: Climate change is expected to increase the frequency of high-temperature days, affecting economic productivity and public health, experts said The Central Weather Administration (CWA) is considering amending the Meteorological Act (氣象法) to classify “high temperatures” as “hazardous weather,” providing a legal basis for work or school closures due to extreme heat. CWA Administrator Lu Kuo-chen (呂國臣) yesterday said the agency plans to submit the proposed amendments to the Executive Yuan for review in the fourth quarter this year. The CWA has been monitoring high-temperature trends for an extended period, and the agency contributes scientific data to the recently established High Temperature Response Alliance led by the Ministry of Environment, Lu said. The data include temperature, humidity, radiation intensity and ambient wind,

SECOND SPEECH: All political parties should work together to defend democracy, protect Taiwan and resist the CCP, despite their differences, the president said President William Lai (賴清德) yesterday discussed how pro-Taiwan and pro-Republic of China (ROC) groups can agree to maintain solidarity on the issue of protecting Taiwan and resisting the Chinese Communist Party (CCP). The talk, delivered last night at Taoyuan’s Hakka Youth Association, was the second in a series of 10 that Lai is scheduled to give across Taiwan. Citing Taiwanese democracy pioneer Chiang Wei-shui’s (蔣渭水) slogan that solidarity brings strength, Lai said it was a call for political parties to find consensus amid disagreements on behalf of bettering the nation. All political parties should work together to defend democracy, protect Taiwan and resist