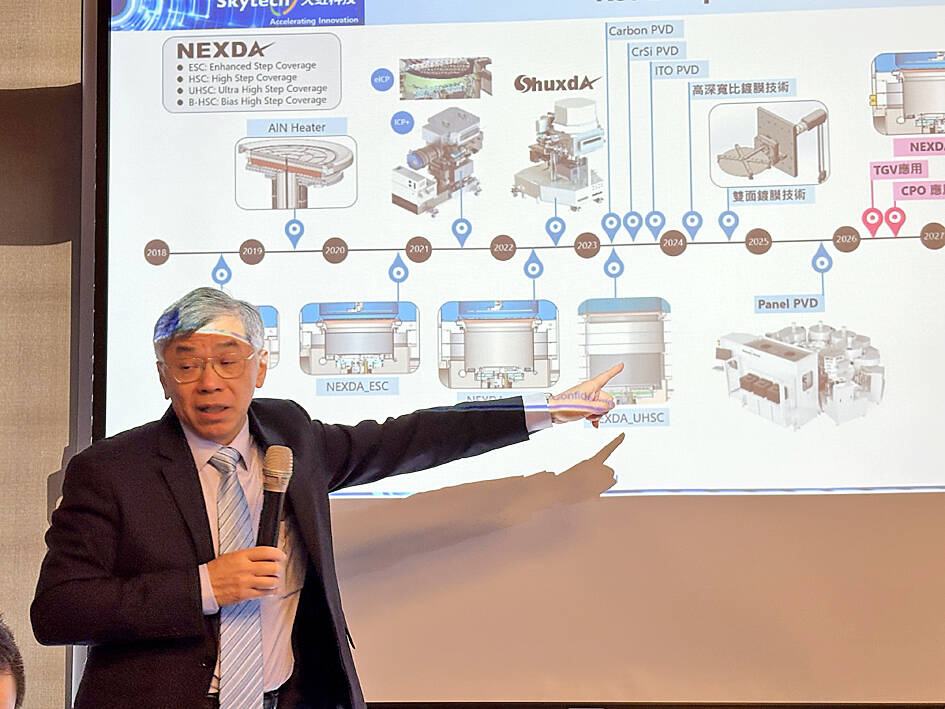

Semiconductor equipment manufacturer Skytech Inc (天虹科技) yesterday said that revenue this year would reach a historic high, driven mainly by robust demand for next-generation advanced packaging equipment and a pickup in demand for compound semiconductor equipment.

Skytech said it last month delivered its first equipment for commercializing fan-out panel-level packaging (PLP) technology to a strategic customer, a Kaohsiung-based outsourced semiconductor assembly and test company, Skytech CEO George Yi (易錦良) told reporters in Hsinchu City.

That put Skytech ahead of its rivals in supplying physical vapor deposition used in PLP technology on a 310mm x 310mm square substrate.

Photo: Lisa Wang, Taipei Times

The company did not disclose the name of the customer, but it is widely believed to be ASE Technology Holding Co (日月光投控), the world’s biggest outsourced semiconductor assembly and test service provider, which has shown interest in fan-out PLP technology.

“We have landed a substantial number of new orders during the first quarter to support equipment delivery in the first half of this year,” Yi said. “We have clear order visibility for this year.”

Overall, this year would be another growth year for the semiconductor equipment sector, as an artificial intelligence (AI) boom would not only benefit chipmakers, but also advanced chip packaging suppliers, he said.

Skytech aims grow its revenue to an all-time high this year, surpassing 2024’s NT$2.59 billion (US$82.02 million), company chairman Paul Huang (黃見駱) said.

Revenue last year contracted 13.26 percent year-on-year to NT$2.24 billion.

Fan-out PLP is considered a successor to chip-on-wafer-on-substrate (CoWoS) technology, which is used in packaging for Nvidia Corp’s AI chips produced by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電).

TSMC is also developing its version of panel-level packaging technology dubbed chip-on-panel-on-substrate (CoPoS) technology, which is likely to enter volume production in 2028, supply chain sources said.

“The CoPoS technology offers a new business opportunity for Skytech,” Yi said, adding that the company currently only supplies spare parts used in CoWoS equipment. “The customer base should be broader as multiple companies aim to tap into the market.”

Aside from robust demand for new advanced packaging equipment, nascent signs showed that compound semiconductor equipment, such as those for silicon carbide semiconductor equipment, is recovering from a slump last year, given improving demand for electric vehicles and autonomous cars, as well as low Earth orbit satellites, Huang said.

To cope with growing demand, Skytech has acquired new sites in Hsinchu City and Tainan to expand capacity, the company said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the