Global notebook computer shipments are expected to slide 9.4 percent annually this year, as PC vendors face price hikes for CPUs and memory chips, which elevate manufacturing costs, market researcher TrendForce Corp (集邦科技) said in a report on Monday.

The outlook in shipments is a steeper decline than the 5.4 percent reduction estimated by TrendForce previously amid unresolved chip supply bottlenecks and elusive brand strategies, the Taipei-based research house said.

As PC vendors make slim margins, rising costs of components are a substantial financial burden, TrendForce said.

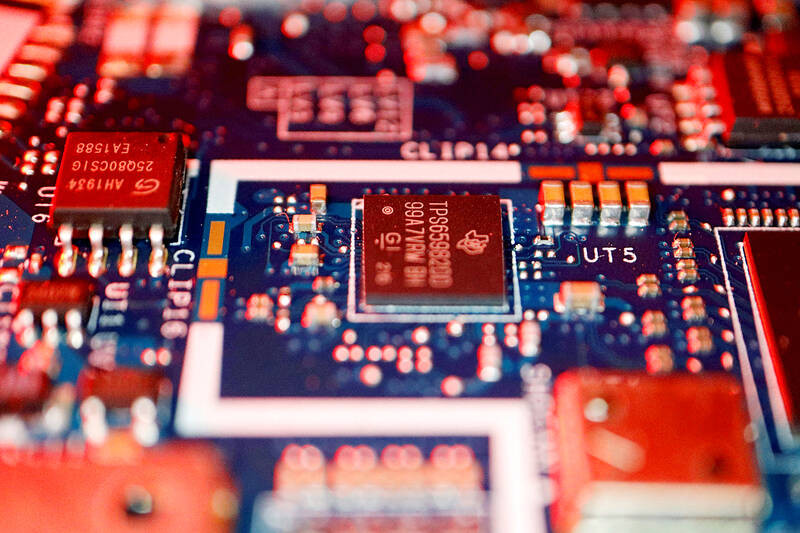

Photo: Reuters

“Memorychip prices continue to be high, and unstable CPU supplies are adding uncertainty to the notebook computer market in the short term,” the report said.

“To cope with supply-demand dynamics of key components, PC brands might adjust their cost [management], inventory levels and product strategies,” it said. “Those factors combined with consumers’ acceptance of pricier [notebook computers] are crucial factors affecting the market situation in the second half of this year.”

This quarter, notebook computer shipments worldwide are expected to slump 14.8 percent sequentially, possibly falling short of PC vendors’ expectations, TrendForce said.

The researcher attributed mounting costs to CPU supply constraints and a price uptrend of other key components such as printed circuit boards (PCBs), batteries and power management chips.

Intel Corp has raised CPU prices used in entry-level models due to a supply shortage, which is unlikely to ease through March, while the company’s expected increase in CPU supply would allow global notebook computer shipments to regain quarterly growth in the second quarter, TrendForce said.

The price hikes in CPUs are critical to PC vendors, given that CPUs account for 15 to 30 percent of a notebook computer’s bill of materials (BOM), the report said.

A majority of entry-level and mainstream models are equipped with Intel’s CPUs, it said.

PC vendors would have to adjust their product lineups and reschedule shipments to cope with higher CPU costs, it added.

Additionally, solid state drive (SSD) storage prices and PC DRAM chips are expected to soar more than 70 percent and 80 percent respectively this quarter from the previous quarter, the report said.

PC vendors stepped up notebook computer shipments in the fourth quarter last year, as they have been grappling with memorychip price surges since the second half of last year, it said.

As PC vendors are still unable to source adequate memory chips this quarter, their production schedules and shipment timelines have been disrupted, it added.

The higher costs of PCBs are due to an increase in design complexity and rising copper prices, TrendForce said.

PC vendors are facing a structural shift in PCB costs, as they are required to equip mid-to-high-range notebook computers with higher-quality motherboards to align with specification upgrades, it said.

Specification upgrades are expected to drive higher BOM costs due to greater demand for batteries and power management chips, TrendForce said.

The introduction of new-generation Wi-Fi 7 and USB chips would also push costs of components up, it added.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

MediaTek Inc (聯發科) shares yesterday notched their best two-day rally on record, as investors flock to the Taiwanese chip designer on excitement over its tie-up with Google. The Taipei-listed stock jumped 8.59 percent, capping a two-session surge of 19 percent and closing at a fresh all-time high of NT$1,770. That extended a two-month rally on growing awareness of MediaTek’s work on Google’s tensor processing units (TPUs), which are chips used in artificial intelligence (AI) applications. It also highlights how fund managers faced with single-stock limits on their holding of market titan Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are diversifying into other AI-related firms.