DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year.

Revenue soared 444.87 percent last month to NT$12.02 billion (US$381.4 million), from NT$2.21 billion a year earlier. That brought fourth-quarter revenue to NT$30.17 billion, from NT$6.58 billion for the same period in 2024. On a quarterly basis, revenue jumped 60.65 percent from NT$18.78 billion.

Last year, revenue soared 95.09 percent to NT$66.59 billion from NT$32.13 billion in 2024, the company said.

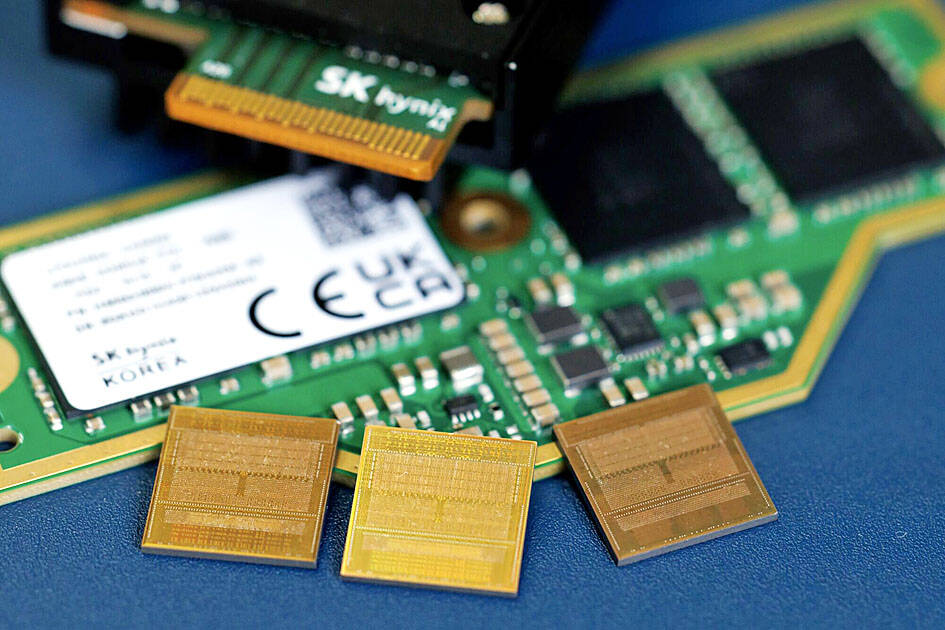

Photo: Bloomberg

Supply of conventional DRAM chips tightened after the world’s major memory makers, including Samsung Electronics Co, SK Hynix Inc and Micron Technology Inc, shifted production capacity to support booming demand for higher-margin, high-bandwidth memory and DDR5 DRAM chips used in artificial intelligence (AI) servers, it said.

Nanya Technology in October last year said supply would remain insufficient, sending memory prices even higher.

Market researcher TrendForce Corp (集邦科技) on Monday forecast that conventional DRAM chips’ prices would increase 55 to 60 percent sequentially this quarter on a contract basis, while prices of server DRAM chips are to soar 60 percent this quarter.

Prices of NAND flash memory are expected to grow 33 to 38 percent, TrendForce said.

Nanya Technology posted a combined net profit of NT$6.28 billion in October and November last year, or NT$2.03 per share. That had greatly exceeded its third-quarter net profit of NT$1.65 billion, or NT$0.5 a share, company data showed.

Separately, memory module supplier Adata Technology Co (威剛科技) yesterday reported that revenue last month rose to a record high of NT$5.81 billion.

That helped lift fourth-quarter revenue to an all-time high of NT$15.87 billion, up 9.37 percent from NT$14.51 billion in the third quarter, the company said in a statement.

Full-year revenue expanded 32.48 percent to NT$53.04 billion from NT$40.04 billion in 2024, it said.

The company said DRAM made up 60.79 percent of its total revenue last year.

Solid-state drive products accounted for 26.73 percent, while memory cards, flash drives and other items contributed 12.48 percent, it added.

Since the middle of the third quarter last year, demand for memory chips used in AI applications has risen rapidly, leading to a structural supply shortage, Adata chairman Simon Chen (陳立白) said in the statement.

The company has significantly increased stockpiles to support strategic customers’ demand, he said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.