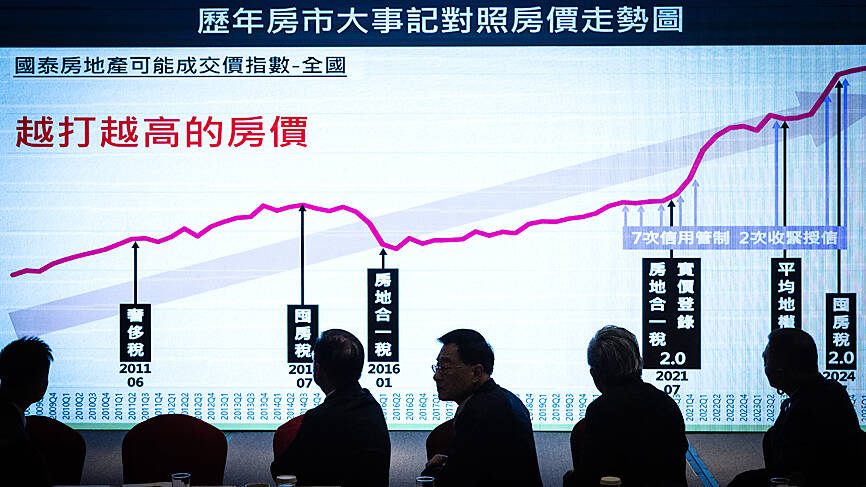

Taiwan’s property market is poised for a rebound next year after hitting a cyclical low this year, with presale transactions plunging about 70 percent under stringent credit controls, the Real Estate Alliance of the ROC (Republic of China), Taiwan (中華民國不動產聯盟總會) said at its year-end news conference yesterday.

The Taipei-based trade group’s chairman Emerson Lin (林正雄), also head of Taichung-based developer Full Wang International Development Co (富旺國際開發), said buyer traffic has begun to return in the past few months, laying the groundwork for recovery.

The market cooled sharply after the central bank rolled out sweeping mortgage restrictions in September last year, triggering a 30 percent contraction in new-home transactions and a 70 percent slump in presale sales.

Photo: CNA

As of September, presale volumes totaled just 28,100 units, a 73 percent annual decline.

Nationwide property transfers of existing homes and presale projects are expected to fall to 256,000 units this year, marking a 27 percent drop and the second-weakest level in 35 years, Lin said.

Despite the downturn, underlying demand remains solid, he said, pointing to the creation of more than 135,000 new households annually and expectations that Taiwan’s economy would record its fastest GDP growth in 15 years this year.

“Unfortunately, the construction sector — a key domestic engine — has stalled,” Lin said, adding that a recovery in domestic demand would help rebalance economic growth.

To support the market, the alliance urged the government to expand first-home subsidies, ease loan restrictions on second homes and accelerate regulatory reforms related to building-space calculations, he said.

Taiwan’s high public-area ratios inflate effective prices and worsen affordability for young buyers, he said.

Lin said he saw five major trends reshaping the market: mounting economic pressures, shifting family structures, evolving social patterns, the rise of the rental sector and a wave of downsizing among seniors.

These forces are likely to steer next year’s housing market toward smaller and more refined units, with hotel-style serviced apartments that offer comprehensive property management services emerging as standout favorites, he said.

With preferential mortgage terms for first-homes set to expire in July next year, policymakers should relax credit controls, Lin said, adding that prolonged tightening could widen loan-to-value disparities, disadvantage first and second-home buyers, and increase default risks.

He also urged more flexible lending for growing families, saying such measures could help support Taiwan’s low birthrate and encourage owners to release vacant homes into the rental market, increasing supply for households priced out of ownership.

Lin said he expects “real-demand” buyers to re-enter the market next year, adding that governments often ease credit conditions ahead of major elections, referring to next year’s local elections.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.