The global sell-off in semiconductor stocks accelerated on concern over lofty valuations for some of the artificial intelligence (AI) boom’s biggest winners.

Memory makers Samsung Electronics Co and SK Hynix Inc dragged South Korea’s benchmark KOSPI down as much as 6.2 percent yesterday before it pared much of the loss and ended the day down 2.9 percent.

Japan’s Nikkei 225 finished 2.5 percent off, with the world’s largest chip testing equipment supplier Advantest Corp dropping as much as 10 percent and tech investment giant Softbank Group Corp also down 10 percent. In Taipei, Asia’s largest stock, Taiwan Semiconductor Manufacturing Co (台積電), fell 2.99 percent, driving the TAIEX to end 1.42 percent lower.

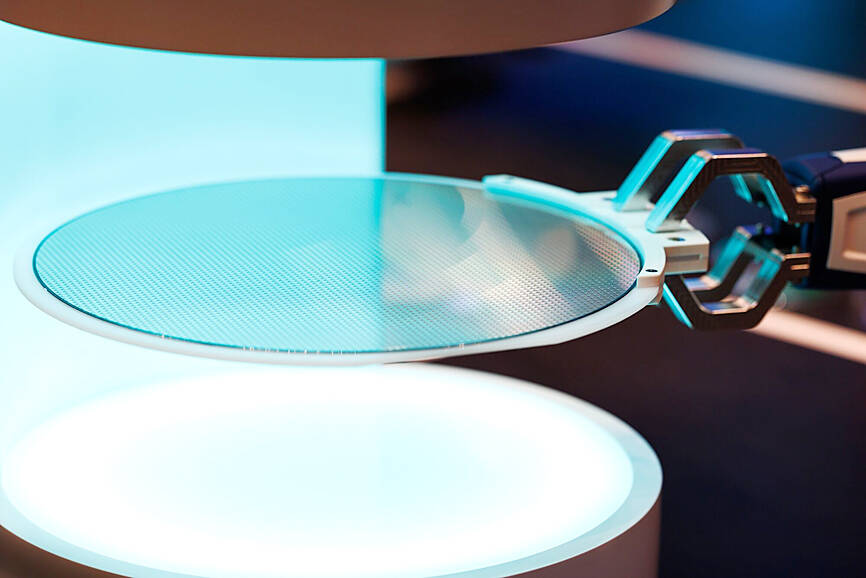

Photo: Bloomberg

Hong Kong, Singapore, Sydney, Manila, Bangkok and Jakarta also fell, but Shanghai and Wellington edged up.

Selling pressure trimmed roughly US$500 billion in combined market capitalization from the Philadelphia Semiconductor Index on Tuesday, amid a slump on Wall Street, where the tech-rich NASDAQ closed down more than 2 percent and the S&P 500 off more than 1 percent.

The pullback signals the growing unease over the sector’s earnings potential and elevated stock valuations, particularly if interest rates stay higher for longer. At the same time, a sense of fear of missing out is driving some investors to rush back in.

The warning of an overdue correction from Wall Street chiefs, including Morgan Stanley chief executive officer Ted Pick and Goldman Sachs Group Inc CEO David Solomon, has weighed on the sector this week, alongside reduced expectations for US Federal Reserve rate cuts and the prolonged US government shutdown.

Hedge fund manager Michael Burry added to the sell-off with his disclosure of bearish wagers on Palantir Technologies Inc and Nvidia Corp.

US software firm Palantir helped trigger the meltdown on Wall Street with a forecast that failed to impress investors. The stock slumped 8 percent despite reporting a 63 percent surge in revenue and profit. A similar reaction to Advanced Micro Devices Inc’s post-market results and outlook amplified the impact on Asia’s trading session yesterday.

“It’s a sea of red across broad markets, and one that offers a gloomy and damp portrayal of risk,” Pepperstone Group Ltd research head Chris Weston said. “We need to remain open-minded to the possibility that this could still further build. Simplistically, there aren’t many reasons to buy here.”

Some see the pullback as a good thing, letting some steam out of a rally that had gotten ahead of itself and making stocks a bit cheaper.

With global hyperscalers such as Amazon.com Inc and Meta Platforms Inc pouring more cash into AI, chipmakers and other tech firms are expected to reap further benefits in their results and share prices.

“The AI boom has pushed the ‘Magnificent’ names to new highs, but under the surface, their stories have begun to diverge between companies monetizing AI today and those still investing for tomorrow,” Saxo Markets chief investment strategist Charu Chanana said.

Additional reporting by AFP

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.