Chunghwa Precision Test Technology Co (CHPT, 中華精測), a chip testing and wafer probing services provider, yesterday said that revenue this quarter would climb to an all-time high, benefiting from increased demand for chips used in artificial intelligence (AI) applications and smartphones.

The company also said that it has a clearer outlook for its orders over the next eight to nine months, exceeding the average of three months in the semiconductor industry.

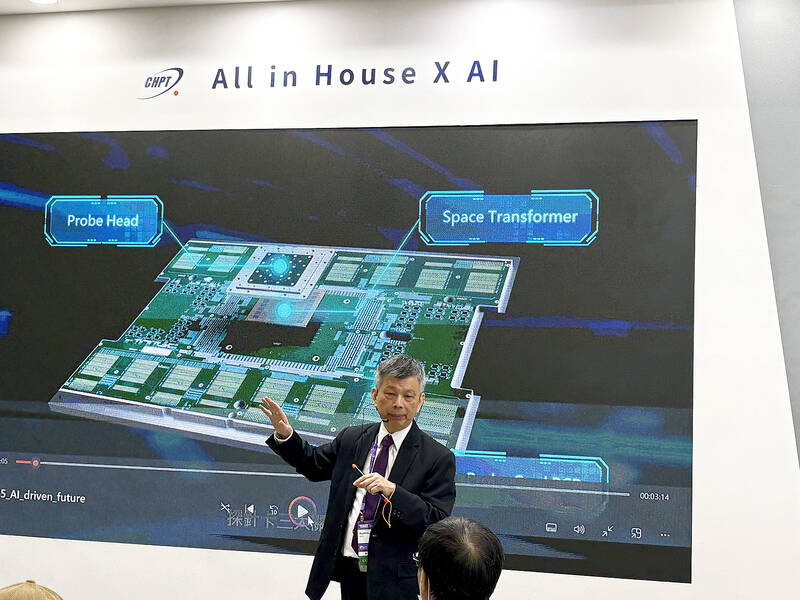

“We are positive about the third quarter thanks to growing demand for AI and high-performance computing [HPC] applications. Revenue in the third quarter is likely to hit a record high,” CHPT president Scott Huang (黃水可) told reporters on the sidelines of the launch of an upgraded intelligent product design and manufacturing software system during the Semicon Taiwan trade show in Taipei.

Photo: Lisa Wang, Taipei Times

As customer demand seems to be sustainable, revenue in the fourth quarter would only drop slightly on a quarterly basis during the traditional low season for the industry, Huang said.

The company aims to increase its revenue next year at the same rate as this year, driven by AI and HPC applications, he said.

He did not give a detailed growth forecast.

The firm’s revenue soared nearly 60 percent annually during the first eight months of this year to NT$3.19 billion (US$105.25 million).

HPC applications, primarily AI chips, are the biggest revenue contributor to CHPT, making up 42.5 percent in the second quarter, replacing application processors.

That was a significant jump from a 21 percent share a year earlier.

CHPT said that it is ready to provide its services in the US if customers ramp up production of 2-nanometer chips, as it has a small assembly line in San Jose, California.

The company would expand its capacity in accordance with demand, given expensive labor costs in the US, it said.

CHPT said it has more than quadrupled capacity at a factory there to cope with AI chip and smartphone processor testing demand.

Separately, California-based semiconductor equipment supplier ACM Research Inc yesterday said it is seeking to set up a subsidiary in Taiwan, as it plans to build a research-and-development (R&D) team and potentially a manufacturing line here, eyeing the nation’s fast-growing semiconductor equipment market.

ACM operates an R&D center in China and Oregon, ACM chairman David Wang (王暉) said at Semicon.

The company makes wet-process cleaning tools, atomic layer deposition equipment and advanced packaging plating equipment.

The company aims to sell its panel-level chip packaging equipment to Taiwan Semiconductor Manufacturing Co (台積電) and ASE Technology Holding Co (日月光投控), Wang said.

Taiwan’s contract chipmaker United Microelectronics Corp (聯電) and silicon wafer suppliers including Wafer Works Corp (合晶科技) and GlobalWafers Co (環球晶圓) are customers of ACM, he said.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their