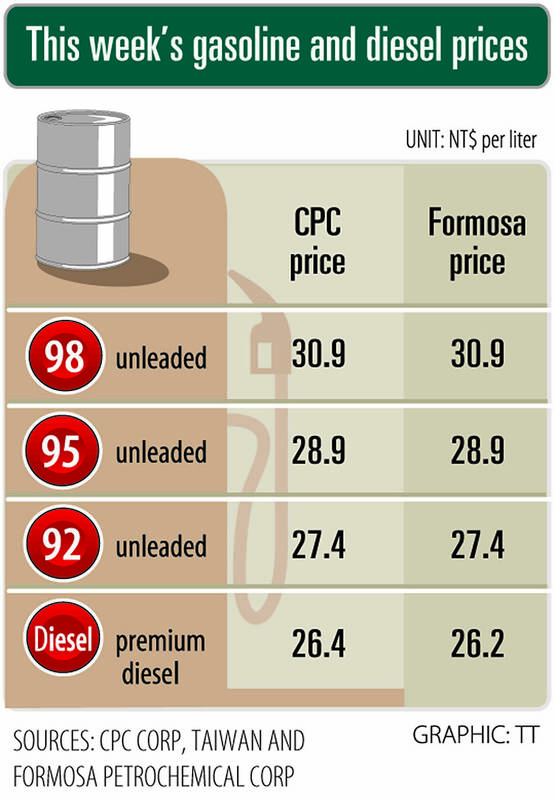

Gasoline and diesel prices at domestic fuel stations are to rise NT$0.1 and NT$0.2 per liter this week respectively, after international crude oil prices increased for two consecutive weeks, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday.

Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.4, NT$28.9 and NT$30.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

The price of premium diesel is to rise to NT$26.4 per liter at CPC stations and NT$26.2 at Formosa pumps, they said.

The announcements came after the latest data from the US Energy Information Administration showed that US crude oil inventories fell for the second consecutive week last week, pointing to strong demand and supporting oil prices.

Front-month Brent crude oil futures — the international oil benchmark — last week rose 0.58 percent to US$68.12 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — gained 0.55 percent to US$64.01 per barrel on the New York Mercantile Exchange.

Separately, CPC said it would keep liquefied natural gas prices unchanged for household and industrial users this month in accordance with a government policy to help stabilize domestic consumer prices.

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known

Artificial intelligence (AI) chip designer Cambricon Technologies Corp (寒武紀科技) plunged almost 9 percent after warning investors about a doubling in its share price over just a month, a record gain that helped fuel a US$1 trillion Chinese market rally. Cambricon triggered the selloff with a Thursday filing in which it dispelled talk about nonexistent products in the pipeline, reminded investors it labors under US sanctions, and stressed the difficulties of ascending the technology ladder. The Shanghai-listed company’s stock dived by the most since April in early yesterday trading, while the market stood largely unchanged. The litany of warnings underscores growing scrutiny of