Gasoline and diesel prices are to remain unchanged this week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday, despite a decline in global oil prices last week.

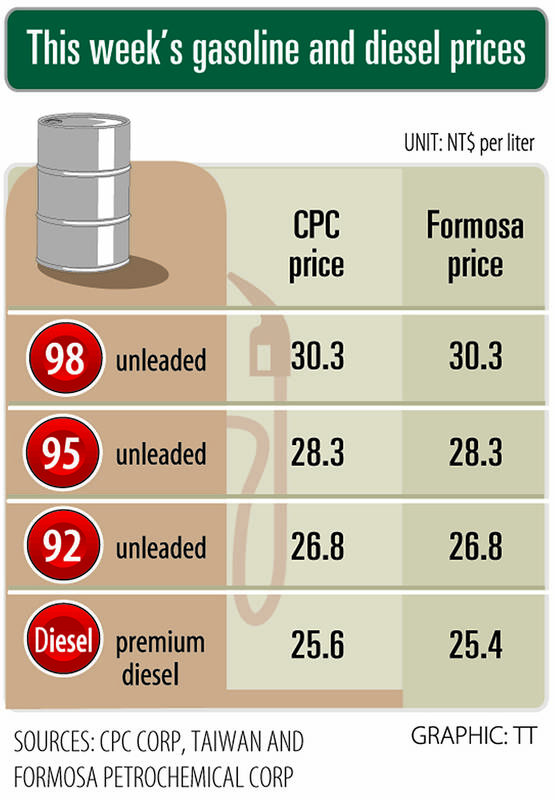

Gasoline prices at CPC and Formosa stations are to stay at NT$26.8, NT$28.3 and NT$30.3 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements.

The price of premium diesel is to remain at NT$25.6 per liter at CPC stations and NT$25.4 at Formosa pumps, they added.

CPC said it calculates its weekly fuel prices based on a weighted oil price formula that comprises 70 percent Dubai crude and 30 percent Brent.

Based on that mechanism, CPC’s gasoline and diesel prices should have increased by NT$0.8 and NT$0.5 per liter this week respectively.

However, CPC said it would absorb the costs to comply with a government policy of keeping domestic fuel prices lower than in major neighboring markets.

Formosa followed CPC after accounting for trends in the global oil market, the New Taiwan dollar exchange rate and fierce competition in the domestic market.

The companies’ announcements came after international crude oil prices last week snapped a two-week streak of gains earlier this month.

Front-month Brent crude oil futures — the international oil benchmark — last week fell 1.53 percent to settle at US$69.28 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — lost 1.62 percent to US$67.34 per barrel on the New York Mercantile Exchange.

EXPANSION: The investment came as ASE in July told investors it would accelerate capacity growth to mitigate supply issues, and would boost spending by 16 percent ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip assembly and testing service provider, yesterday said it is investing NT$17.6 billion (US$578.6 million) to build a new advanced chip packaging facility in Kaohsiung to cope with fast-growing demand from artificial intelligence (AI), high-performance-computing (HPC) and automotive applications. The new fab, called K18B, is to commence operation in the first quarter of 2028, offering chip-on-wafer-on-substrate (CoWoS) chip packaging and final testing services, ASE said in a statement. The fab is to create 2,000 new jobs upon its completion, ASE said. A wide spectrum of system-level chip packaging technologies would be available at

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

HEAVYWEIGHT: The TAIEX ended up 382.67 points, with about 280 of those points contributed by TSMC shares alone, which rose 2.56 percent to close at NT$1,400 Shares in Taiwan broke records at the end of yesterday’s session after contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) hit a fresh closing-high amid enthusiasm toward artificial intelligence (AI) development, dealers said. The TAIEX ended up 382.67 points, or 1.45 percent, at the day’s high of 26,761.06. Turnover totaled NT$463.09 billion (US$15.22 billion). “The local main board has repeatedly hit new closing highs in the past few sessions as investors continued to embrace high hopes about AI applications, taking cues from a strong showing in shares of US-based AI chip designer Nvidia Corp,” Hua Nan Securities Co (華南永昌證券) analyst Kevin Su

Nvidia Corp’s major server production partner Hon Hai Precision Industry Co (鴻海精密) reported 10.99 percent year-on-year growth in quarterly sales, signaling healthy demand for artificial intelligence (AI) infrastructure. Revenue totaled NT$2.06 trillion (US$67.72 billion) in the last quarter, in line with analysts’ projections, a company statement said. On a quarterly basis, revenue was up 14.47 percent. Hon Hai’s businesses cover four primary product segments: cloud and networking, smart consumer electronics, computing, and components and other products. Last quarter, “cloud and networking products delivered strong growth, components and other products demonstrated significant growth, while smart consumer electronics and computing products slightly declined,” compared with the