US President Donald Trump’s administration has lifted recent export license requirements for chip design software sales in China, as Washington and Beijing implement a trade deal for both countries to ease some restrictions on critical technologies.

The US Department of Commerce informed the world’s three leading semiconductor design software providers — Synopsys Inc, Cadence Design Systems Inc and Germany’s Siemens AG — that requirements to seek government licenses for business in China are no longer in place, according to company statements.

Siemens has restored full access to its software and technology for Chinese customers, the company said, while Synopsys and Cadence said that they are in the process of resuming such services in the Asian country.

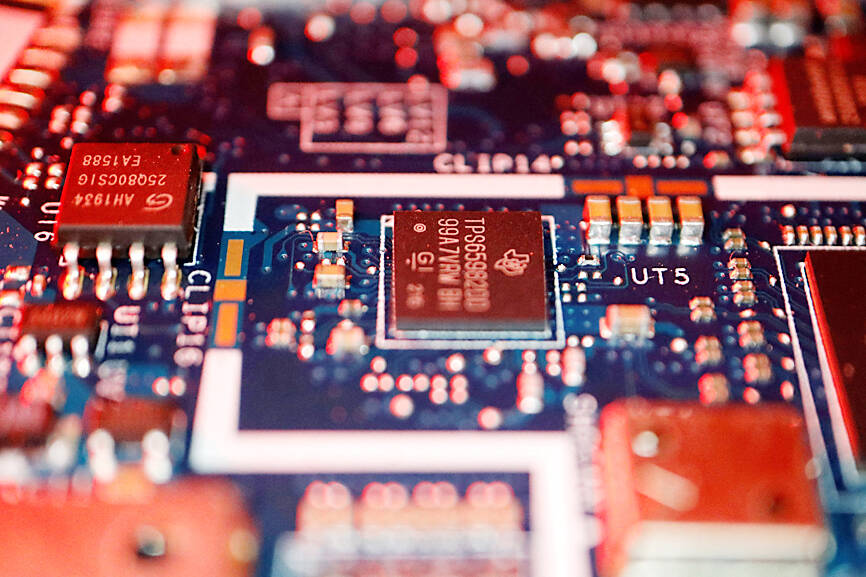

Photo: Reuters

White House officials cracked down on sales of electronic design automation (EDA) tools to China in May as part of a raft of measures responding to Beijing’s limits on shipments of essential rare earth minerals. Under a trade agreement finalized last week, Washington promised to allow shipments of EDA software, as well as ethane and jet engines, to China — provided that Beijing first honors its pledge to accelerate export approvals for critical minerals used in everything from wind turbines to airplanes.

The move to lift EDA curbs is a sign that the accord reached in London — which would bring the countries back to the terms of a deal struck the previous month in Geneva, Switzerland — is indeed being implemented.

In addition to chip software sales, the US last week allowed makers of a critical petroleum product to transport gas tankers to Chinese ports and then fully removed those license requirements this week, ethane companies said on Wednesday.

Beijing also achieved a higher-level longtime goal: Washington has now put export controls, a national security tool historically treated as non-negotiable, on the table in trade talks.

The US for years used export controls to limit China’s access to advanced chips and the equipment needed to make them, in an effort to prevent Beijing from developing advanced artificial intelligence that could benefit its military.

Expanding that campaign to encompass EDA software — used to design everything from high-end Nvidia Corp and Apple Inc processors to simple parts like power-regulation components — was a longtime priority for some China hawks in Washington.

The Trump administration had just shown it would intensify China chip curbs by tightening restrictions on Nvidia’s sales.

The EDA measures were unusual because US officials offered little detail on what was and was not allowed — parameters that typically are discussed at length during a formal regulatory process.

Then, barely two weeks after their imposition, US National Economic Council Director Kevin Hassett, speaking at the start of London trade talks, said that the US might ease semiconductor controls he described as “very important” to China.

While Hassett and other senior Trump officials said curbs on Nvidia chips were not up for discussion, the industry lacked clarity throughout the London meetings — and for weeks thereafter — about when, and whether, the EDA curbs would be lifted.

Ultimately, some Washington officials were relieved to see the US offer what they saw as lower-priority semiconductor concessions to Beijing, Bloomberg has reported — safeguarding, at least for now, the Nvidia chip export limits they view as vital.

However, some also see controls on EDA as a crucial step in their own right, one that should not be negotiated away as part of a trade deal.

“EDA software sales had been one of the few remaining inputs to Huawei’s chip development left untouched,” said Ryan Fedasiuk, a former US Department of State China adviser, in reference to the telecom giant Huawei Technologies Co (華為) at the center of Beijing’s semiconductor ambitions. “Restricting EDA licenses would have dealt a decisive blow to the company’s next-gen chip design timelines and hobbled its competitiveness in global markets.”

Meanwhile, EDA companies are contending with a new worry, Bloomberg has reported.

Even with access to the Chinese market restored, customers there might hunt for other suppliers or further develop domestic capabilities in response to heightened geopolitical risks.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.