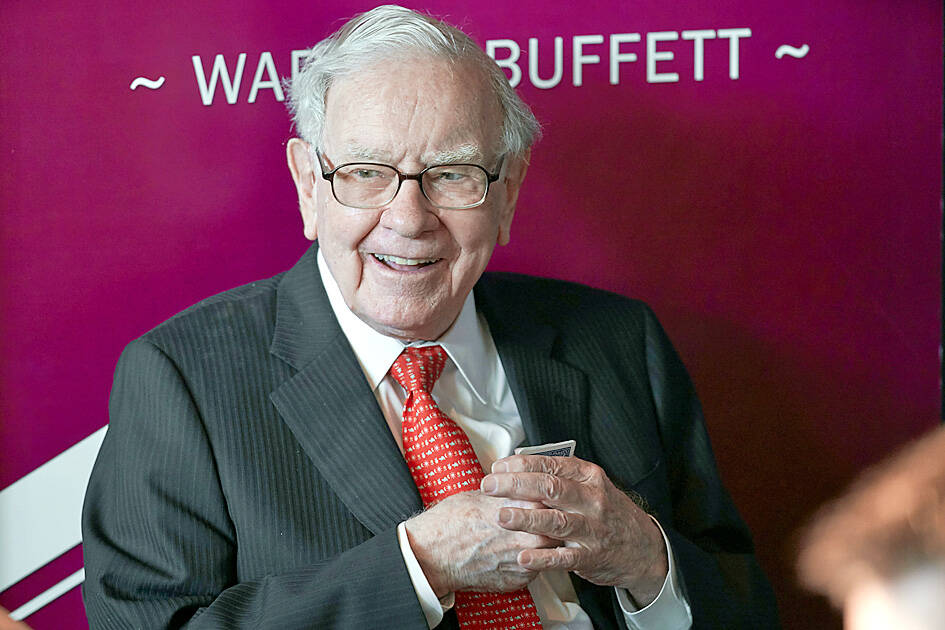

Famed investor Warren Buffett is donating US$6 billion worth of his company’s stock to five foundations, bringing the total he has given to them since 2006 to about US$60 billion, based on their value when received.

Buffett late on Friday said that the shares of Berkshire Hathaway Inc would be delivered today. Berkshire Hathaway owns Geico Corp, Dairy Queen and a range of other businesses, and Buffett is donating nearly 12.4 million of the Class B shares of its stock.

Those shares have a lower and easier-to-digest price tag than the company’s original Class A shares, and each of the B shares was worth US$485.68 at their most recent close on Friday.

Photo: AP

The largest tranche is going to the Bill & Melinda Gates Foundation Trust, which would receive 9.4 million shares. The Susan Thompson Buffett Foundation would receive 943,384 shares, and the Sherwood Foundation, Howard G. Buffett Foundation and NoVo Foundation would each receive 660,366 shares.

Buffett made waves a year ago when he said he plans to cut off donations to the Bill & Melinda Gates Foundation after his death and let his three children decide how to distribute the rest of his fortune.

Berkshire Hathaway’s Class B stock has climbed 19.1 percent over the past 12 months, topping the broad US stock market’s return of 14.1 percent, including dividends.

Buffett is famous on Wall Street for buying companies at good prices and being more conservative when prices look too high. The bargain-hunting approach has helped him amass a fortune worth about US$145 billion, with basically all of it in Berkshire Hathaway’s stock.

“Nothing extraordinary has occurred at Berkshire; a very long runway, simple and generally sound decisions, the American tailwind and compounding effects produced my current wealth,” Buffett said in a statement. “My will provides that about 99.5 percent of my estate is destined for philanthropic usage.”

Taiwan’s foreign exchange reserves hit a record high at the end of last month, surpassing the US$600 billion mark for the first time, the central bank said yesterday. Last month, the country’s foreign exchange reserves rose US$5.51 billion from a month earlier to reach US$602.94 billion due to an increase in returns from the central bank’s portfolio management, the movement of other foreign currencies in the portfolio against the US dollar and the bank’s efforts to smooth the volatility of the New Taiwan dollar. Department of Foreign Exchange Director-General Eugene Tsai (蔡炯民)said a rate cut cycle launched by the US Federal Reserve

Handset camera lens maker Largan Precision Co (大立光) on Sunday reported a 6.71 percent year-on-year decline in revenue for the third quarter, despite revenue last month hitting the highest level in 11 months. Third-quarter revenue was NT$17.68 billion (US$581.2 million), compared with NT$18.95 billion a year earlier, the company said in a statement. The figure was in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$17.9 billion, but missed the market consensus estimate of NT$18.97 billion. The third-quarter revenue was a 51.44 percent increase from NT$11.67 billion in the second quarter, as the quarter is usually the peak

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Pegatron Corp (和碩), a key assembler of Apple Inc’s iPhones, on Thursday reported a 12.3 percent year-on-year decline in revenue for last quarter to NT$257.86 billion (US$8.44 billion), but it expects revenue to improve in the second half on traditional holiday demand. The fourth quarter is usually the peak season for its communications products, a company official said on condition of anonymity. As Apple released its new iPhone 17 series early last month, sales in the communications segment rose sequentially last month, the official said. Shipments to Apple have been stable and in line with earlier expectations, they said. Pegatron shipped 2.4 million notebook