Weblink International Inc (展碁國際), a distributor of a power bank model recalled last week by Chinese manufacturer Anker Innovations Co (安克創新), yesterday said that it has contacted all of its retailers to remove the product from sale.

Weblink distributes Anker’s A1257 model, one of the seven models recalled by the Chinese company on Friday over overheating concerns or risks of fire hazard, the Taiwanese firm said in a statement.

The company has contacted all of its sales channels, and most of the Anker power banks have been taken off shelves as part of the recall, it said.

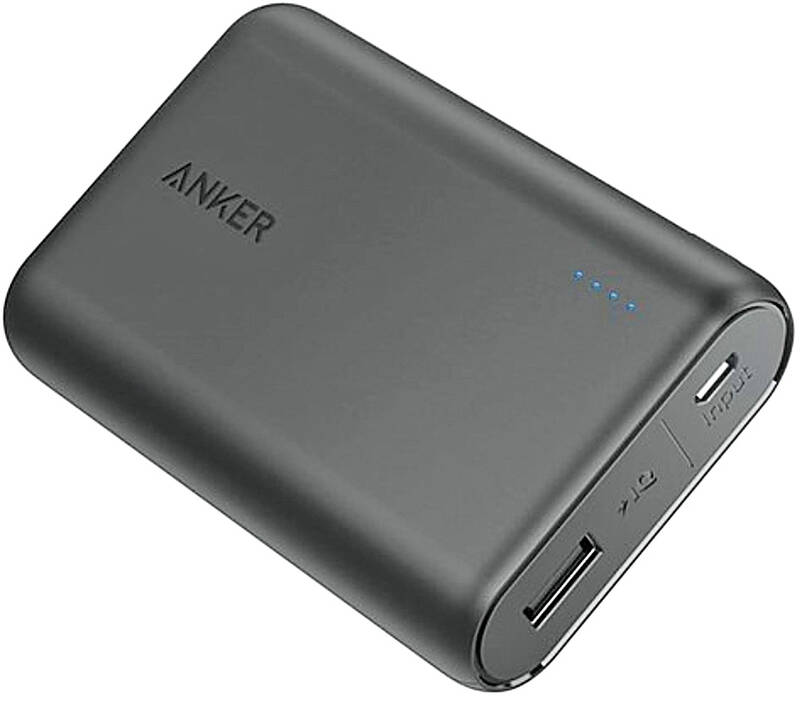

Photo: AP

However, the sales channels do not include unlicensed or unauthorized retailers selling Anker power banks as gray market goods, Weblink said.

Anker’s operations in Taiwan have submitted the model to the Bureau of Standards, Metrology and Inspection for further checks and examinations, and would be responsible for announcements and comments on the situation.

Weblink’s statement follows the confirmation made on Saturday by another distributor of Anker products in Taiwan, Chicony Electronics Co (群光電子), which said that it has not imported any of the seven recalled power bank models.

Anker’s e-commerce platform for Taiwan’s market is operated by electronics retailer Liang Shing EcLife Corp (良興), which handles logistics and customer service, including complaints.

Anker announced the recall of 712,964 power banks from all global markets after the products were linked to fire hazards and incidents. The power banks were from the A1642, A1647, A1652, A1680, A1681, A1689 and A1257 series.

In a notice released on June 12, the US Consumer Product Safety Commission requested the recall of 1.158 million power banks from Anker’s A1263 series.

According to the notice, Anker had received 19 reports from consumers of the company’s power banks causing fires or explosions.

Of the incidents, two resulted in minor injuries that did not require medical attention, while 11 were cases of property damage totaling US$60,000.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address