Taiwanese companies that build clean room systems are seeing a surge in orders, as global semiconductor makers, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), ramp up production abroad.

Clean rooms are an essential part of chip production, and are designed to eliminate dust, airborne particles and other contaminants that could damage sensitive components.

TSMC supplier United Integrated Services Co (UIS, 漢唐集成) is one of the biggest beneficiaries of this trend.

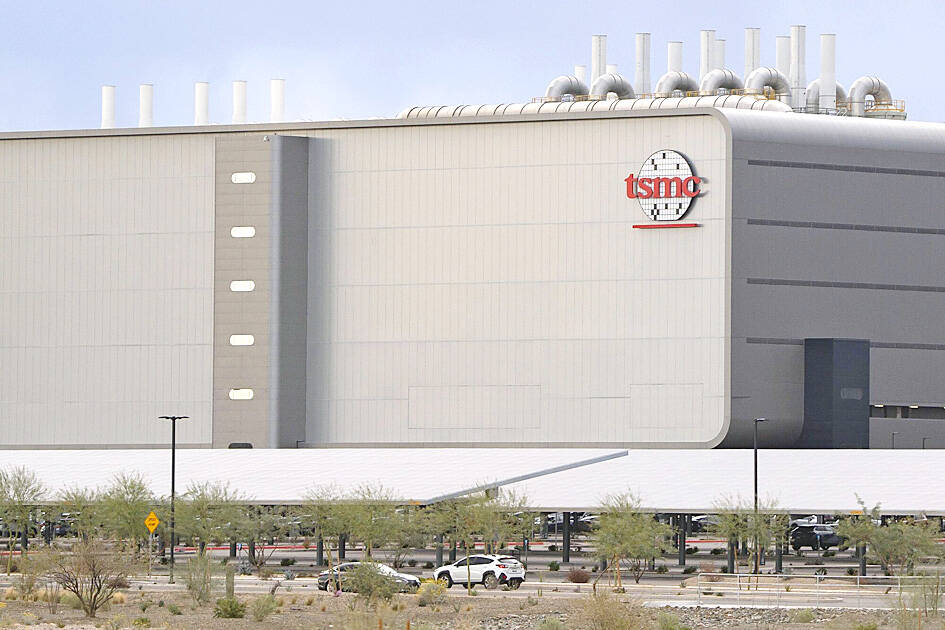

Photo: Bloomberg

Data obtained by Central News Agency showed that UIS secured NT$83.68 billion (US$2.83 billion) in clean room-related contracts from January to last month. That marked a record for the company, with the increase largely driven by TSMC’s US$65 billion investment in three advanced chip fabrication plants in Arizona. TSMC’s first fab in Arizona began mass production this year and the second is nearly complete.

UIS, which now holds a backlog of NT$132.27 billion in orders, is expected to receive more large orders in the second half of this year, leading analysts to forecast record-high sales for the company.

L&K Engineering Co (亞翔工程), another major clean room system provider, has also seen strong growth, reporting NT$95.76 billion in new orders in the first five months of this year, many of which came from Taiwanese clients expanding into Southeast Asia.

L&K’s total backlog has reached NT$208.49 billion, bolstered by projects for United Microelectronics Corp (聯電), which recently opened the first phase of its new fab in Singapore. Mass production there is expected to start next year, with a second phase in development.

L&K also worked for Vanguard International Semiconductor Corp (世界先進), which is partnering with NXP Semiconductors NV to build a 12-inch fab in Singapore, set to begin production in 2027.

Meanwhile, Acter Group Corp (聖暉) and Yankey Engineering Co (洋基工程) are reporting steady demand from local clients.

Acter has more than NT$46 billion in orders, up from NT$38 billion at the end of last year, thanks in part to business from Siliconware Precision Industries Co (矽品精密), a major chip packaging and testing firm.

Yankey Engineering has NT$40.67 billion in orders, partly supported by ASML Holding NV’s expansion in Taiwan.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the