The US has ordered a broad swathe of companies to stop shipping goods to China without a license and revoked licenses already granted to certain suppliers, three people familiar with the matter said.

The new restrictions — which are likely to escalate tensions with Beijing — appear aimed at choke points to prevent China from getting products necessary for key sectors, one of the people said.

Products affected include design software and chemicals for semiconductors, butane and ethane, machine tools and aviation equipment, the people said.

Photo: Reuters

Many companies received letters from the US Department of Commerce over the past few days informing them of the new restrictions.

Firms that supply electronic design automation (EDA) software for semiconductors were sent letters on Friday last week that licenses would now be needed to ship to Chinese customers, two of the sources said.

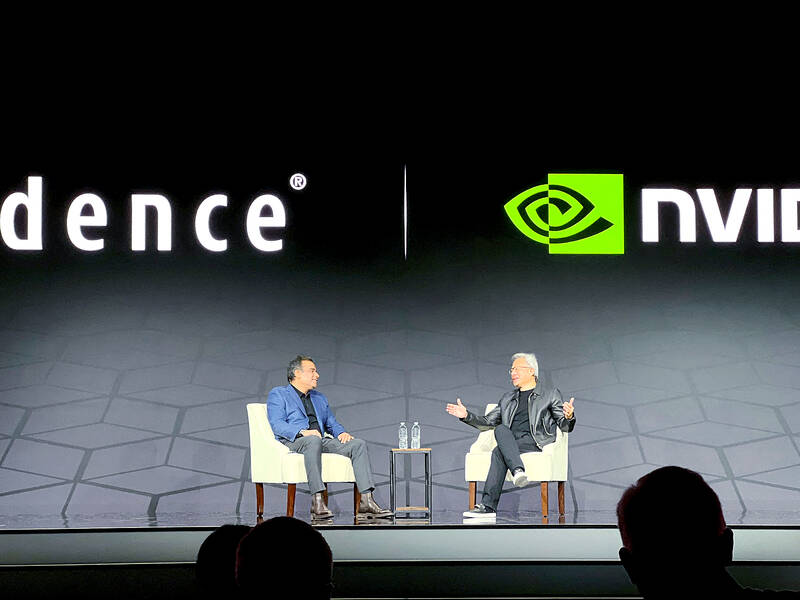

The EDA makers include Cadence, Synopsys and Siemens EDA, one source said.

The two sources said the commerce department would review requests for licenses to ship to China on a case-by-case basis, suggesting the action was not an outright ban.

It is unclear whether the new restrictions are part of a broader strategy to create leverage for trade talks during a pause in the imposition of higher tariffs.

The commerce department said it is reviewing exports of strategic significance to China, adding that “in some cases, Commerce has suspended existing export licenses or imposed additional license requirements while the review is pending.”

Shares of Cadence, which declined to comment, closed down 10.7 percent, and shares of Synopsys fell 9.6 percent.

Synopsys CEO Sassine Ghazi said in a call with analysts that the company had not received a letter nor had it heard from the commerce department’s Bureau of Industry and Security (BIS), which enforces export controls.

“We are aware of the reporting and speculations, but Synopsys has not received a notice from BIS... We have not received a letter,” Ghazi said.

After the market closed, Synopsys reaffirmed its revenue forecast for this year. Its shares and those of Cadence bounced back 3.5 percent in trading after the close.

Any move to strip the software makers of their Chinese customers could deal a blow to their bottom line and to their Chinese chip design customers, which rely heavily on top-of-the-line US software.

“They are the true choke point,” said a former commerce department official, who added that rules restricting the export of EDA tools to China have been under consideration since the first administration of US President Donald Trump, but were then ruled out as too aggressive.

Synopsys relies on China for about 16 percent of its annual revenue, and China accounts for about 12 percent of annual revenue for Cadence.

Synopsys, which partners with chip companies such as Nvidia, Qualcomm and Intel, provides software and hardware used for designing advanced processors.

The Financial Times earlier reported that the Trump administration had ordered the software firms to stop selling their services to Chinese groups.

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

The US government on Wednesday sanctioned more than two dozen companies in China, Turkey and the United Arab Emirates, including offshoots of a US chip firm, accusing the businesses of providing illicit support to Iran’s military or proxies. The US Department of Commerce included two subsidiaries of US-based chip distributor Arrow Electronics Inc (艾睿電子) on its so-called entity list published on the federal register for facilitating purchases by Iran’s proxies of US tech. Arrow spokesman John Hourigan said that the subsidiaries have been operating in full compliance with US export control regulations and his company is discussing with the US Bureau of

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September