MediaTek Inc (聯發科), the world’s biggest supplier of smartphone chips, yesterday said the tape-out process for its first 2-nanometer chip would take place in September, paving the way for volume production of its most advanced chip, likely to be its next-generation flagship smartphone chip, around the year-end at the earliest.

MediaTek has been leveraging advanced process technologies from its foundry partner, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to build its flagship mobile phone chips, a segment it once relinquished and then recovered four years ago as it released its Dimensity series.

In the semiconductor industry, a tape-out refers to the final stage of the chip design cycle before it is sent for manufacturing.

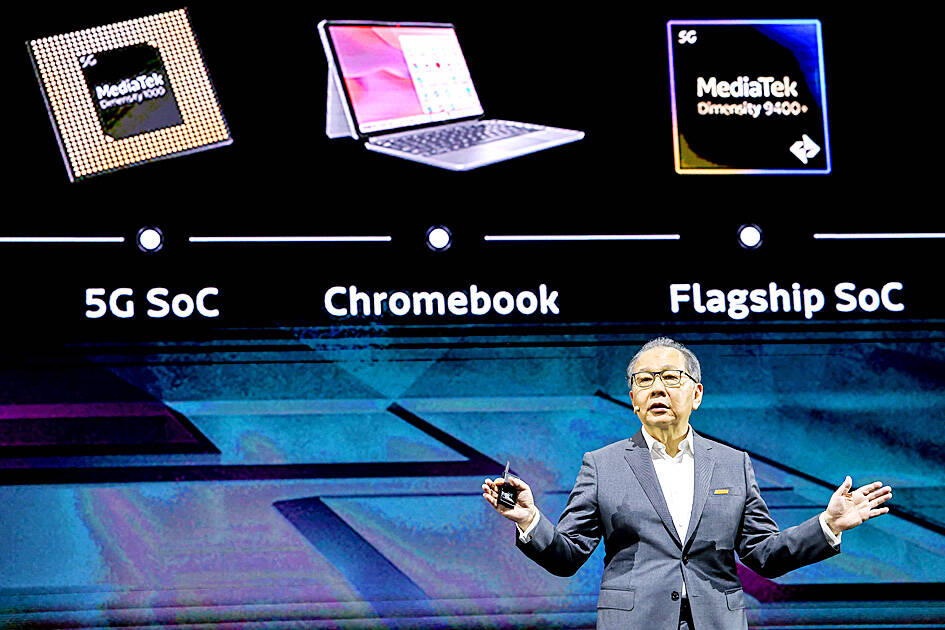

Photo: I-hwa Cheng, AFP

MediaTek’s most advanced mobile chip available is the Dimensity 9400, made on TSMC’s 3-nanometer process technology. The chip delivers a 25 percent power efficiency improvement and 15 percent enhancement in performance compared with its predecessor, MediaTek said.

“We are now moving into 2-nanometer [technology]. We will be taping out our first 2-nanometer device in September this year. Of course, this is a high-volume chip,” MediaTek chief executive officer Rick Tsai (蔡力行) said during his Computex keynote speech in Taipei themed “AI for Everyone: From Edge to Cloud.”

“You probably can guess what: 2 nanometers. I’m not allowed to announce, cause J.C. is here,” Tsai said, referring J.C. Hsu (徐敬全), MediaTek senior vice president in charge of wireless communications.

Tsai did not specify which product the 2 nanometer technology would be used to build.

MediaTek apparently would continue adopting next generations of technologies that follow Moore’s Law.

MediaTek said that as chip production technology is advancing to angstrom level, it would adopt 16A or 14A chips based on its long-term roadmap, Tsai said.

TSMC would start volume production of its 16A chips in the second half of next year.

“Whatever [technology] after that, MediaTek is in,” Tsai said.

MediaTek has been diversifying its product lines to minimize operational risks. Mobile chips remain the biggest revenue source of the company, making up about 56 percent of its total revenue last quarter.

Two years ago, MediaTek expanded its business scope to supply automotive chips, and most recently application-specific integrated circuits (ASIC), artificial intelligence (AI) accelerators for cloud-based data center operators and super chips, in collaboration with Nvidia Corp.

As AI data center chips are usually much larger than those for mobile phones or TVs, “people wonder if MediaTek can do that, as it is known as a consumer electronics company. Yes, we can,” Tsai said.

MediaTek has a record of accomplishment in developing ASICs for data centers, he said.

The company is ready to supply four different sizes of chips, from a type of mobile phone chip to an automotive chip and two big networking chips, including one equipped with high-band-width memory (HBM) chips, he said.

The company’s networking chip with HBM chips has been under volume production for more than one year, measuring 91x91mm2, he said.

As for super chips, MediaTek would be supplying chips used in Nvidia’s new AI-based personal device, DGX Spark, Tsai said.

Nvidia did not disclose the product’s launch date, but CEO Jensen Huang (黃仁勳) said that it would make a good Christmas present.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) secured a record 70.2 percent share of the global foundry business in the second quarter, up from 67.6 percent the previous quarter, and continued widening its lead over second-placed Samsung Electronics Co, TrendForce Corp (集邦科技) said on Monday. TSMC posted US$30.24 billion in sales in the April-to-June period, up 18.5 percent from the previous quarter, driven by major smartphone customers entering their ramp-up cycle and robust demand for artificial intelligence chips, laptops and PCs, which boosted wafer shipments and average selling prices, TrendForce said in a report. Samsung’s sales also grew in the second quarter, up

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

HEADWINDS: Upfront investment is unavoidable in the merger, but cost savings would materialize over time, TS Financial Holding Co president Welch Lin said TS Financial Holding Co (台新新光金控) said it would take about two years before the benefits of its merger with Shin Kong Financial Holding Co (新光金控) become evident, as the group prioritizes the consolidation of its major subsidiaries. “The group’s priority is to complete the consolidation of different subsidiaries,” Welch Lin (林維俊), president of the nation’s fourth-largest financial conglomerate by assets, told reporters during its first earnings briefing since the merger took effect on July 24. The asset management units are scheduled to merge in November, followed by life insurance in January next year and securities operations in April, Lin said. Banking integration,

LOOPHOLES: The move is to end a break that was aiding foreign producers without any similar benefit for US manufacturers, the US Department of Commerce said US President Donald Trump’s administration would make it harder for Samsung Electronics Co and SK Hynix Inc to ship critical equipment to their chipmaking operations in China, dealing a potential blow to the companies’ production in the world’s largest semiconductor market. The US Department of Commerce in a notice published on Friday said that it was revoking waivers for Samsung and SK Hynix to use US technologies in their Chinese operations. The companies had been operating in China under regulations that allow them to import chipmaking equipment without applying for a new license each time. The move would revise what is known