The nation’s machine tool exports for the first four months fell 10.7 percent year-on-year, but the pace of the decline improved from 14.9 percent for the first three months, Taiwan Machine Tool and Accessory Builders’ Association (台灣工具機暨零組件公會) statistics showed on Friday.

Cumulative exports totaled US$627.4 million, compared with US$702.29 million a year earlier, the data showed.

Exports of metal-cutting machines fell 13 percent year-on-year to US$505.72 million, shipments of machining centers declined 11.1 percent to US$185.99 million and lathes saw a 21.7 percent decrease to US$132.9 million, while exports of metal-forming machines edged up 0.7 percent to US$121.68 million, it showed.

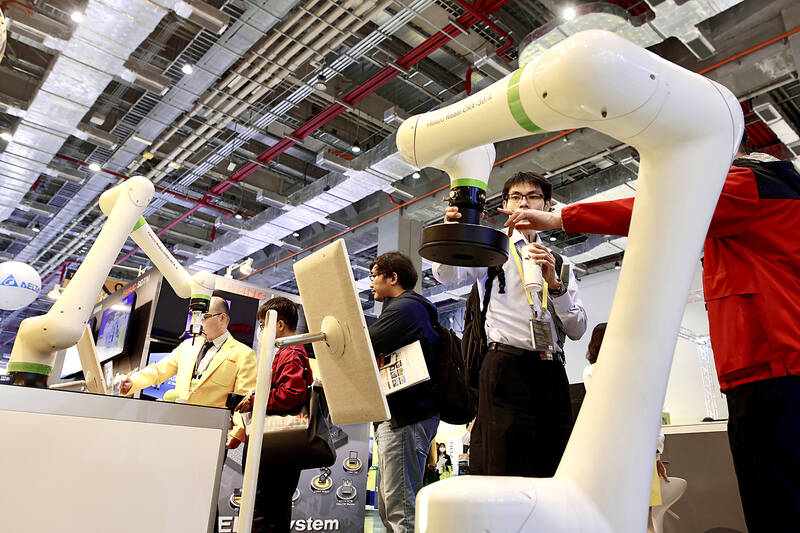

Photo:EPA-EFE

Machine tool exports to China, including Hong Kong — the sector’s largest export destination — fell 13.9 percent annually to US$176.08 million, shipments to the US, the second-largest market, declined 1.9 percent to US$102.39 million and exports to Turkey, the third-largest market, plunged 30.7 percent to US$46.73 million, the data showed.

Overall, machinery exports grew 4.7 percent year-on-year to US$9.41 billion, as increases in overseas shipments of inspection and testing equipment, and electronic equipment offset the fall in sales of machine tools, the Taiwan Association of Machinery Industry (台灣機械公會) said in a report on Friday.

The US remained the largest buyer of Taiwanese machinery goods, at US$2.47 billion, followed by China and Japan at US$2.14 billion and US$767 million respectively, the association said.

While the overall machinery industry is slowly recovering, the impact of the US’ “reciprocal” tariffs on the global economy and end-market demand continue to cloud local manufacturers’ business outlook in the near term, it said.

The unfavorable exchange rate of the New Taiwan dollar would also further weigh on local manufacturers’ orders and negatively affect their profit performance, as the NT dollar had jumped 8.7 percent against the US dollar, compared with increases in other currencies, such as the won, yen and yuan, which had risen 4.5 percent, 2.5 percent and 0.5 percent respectively between April 4 and May 8, the association said.

The NT dollar’s exchange rate has become a far more important factor affecting Taiwanese manufacturers’ ability to secure orders, the association said, urging the government to help ease the local currency’s faster-than-peers appreciation in a timely manner.

GROWING CONCERN: Some senior Trump administration officials opposed the UAE expansion over fears that another TSMC project could jeopardize its US investment Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is evaluating building an advanced production facility in the United Arab Emirates (UAE) and has discussed the possibility with officials in US President Donald Trump’s administration, people familiar with the matter said, in a potentially major bet on the Middle East that would only come to fruition with Washington’s approval. The company has had multiple meetings in the past few months with US Special Envoy to the Middle East Steve Witkoff and officials from MGX, an influential investment vehicle overseen by the UAE president’s brother, the people said. The conversations are a continuation of talks that

With an approval rating of just two percent, Peruvian President Dina Boluarte might be the world’s most unpopular leader, according to pollsters. Protests greeted her rise to power 29 months ago, and have marked her entire term — joined by assorted scandals, investigations, controversies and a surge in gang violence. The 63-year-old is the target of a dozen probes, including for her alleged failure to declare gifts of luxury jewels and watches, a scandal inevitably dubbed “Rolexgate.” She is also under the microscope for a two-week undeclared absence for nose surgery — which she insists was medical, not cosmetic — and is

Nintendo Co hopes to match the runaway success of the Switch when its leveled-up new console hits shelves on Thursday, with strong early sales expected despite the gadget’s high price. Featuring a bigger screen and more processing power, the Switch 2 is an upgrade to its predecessor, which has sold 152 million units since launching in 2017 — making it the third-best-selling video game console of all time. However, despite buzz among fans and robust demand for pre-orders, headwinds for Nintendo include uncertainty over US trade tariffs and whether enough people are willing to shell out. The Switch 2 “is priced relatively high”

Alchip Technologies Ltd (世芯), an application-specific integrated circuit (ASIC) designer specializing in artificial-intelligence (AI) chips, yesterday said that small-volume production of 3-nanometer (nm) chips for a key customer is on track to start by the end of this year, dismissing speculation about delays in producing advanced chips. As Alchip is transitioning from 7-nanometer and 5-nanometer process technology to 3 nanometers, investors and shareholders have been closely monitoring whether the company is navigating through such transition smoothly. “We are proceeding well in [building] this generation [of chips]. It appears to me that no revision will be required. We have achieved success in designing