The Ministry of Finance is open to expanding the NT$500 billion (US$15.38 billion) National Stabilization Fund (NSF) to more effectively counter the effects of negative external factors on the local stock market, Minister of Finance Chuang Tsui-yun (莊翠雲) said yesterday.

A possible expansion could make the fund more effective given a significant rise in market capitalization in the past decade, Chuang said at a meeting of the legislature’s Finance Committee in Taipei.

The ministry would address the issue after Democratic Progressive Party Legislator Kuo Kuo-wen (郭國文) initiates an amendment to the Statute for the Establishment and Administration of the National Financial Stabilization Fund (國家金融安定基金設置及管理條例) that would raise the size of the fund to NT$1 trillion.

Photo: Liao Chen-hui, Taipei Times

Under the statute, the NSF can utilize two sources of funding.

It can borrow from financial institutions, collateralized by stock held by the National Treasury Administration in public and private enterprises, with a ceiling of NT$200 billion.

It can also borrow from the postal deposit system, Postal Life Insurance Fund, Labor Insurance Fund, Labor Pension Fund and Civil Servant Pension Fund, with a ceiling of NT$300 billion.

Kuo has proposed removing the ceilings of the two borrowing sources to allow the NSF flexibility in raising funds to counter turbulence in the market.

The stabilization fund was set up in 2000 to serve as a buffer against unexpected external factors that might disrupt the local stock market.

The market’s value has soared to more than NT$70 trillion from NT$8 trillion in 2000, Kuo said.

When the local stock market encountered headwinds from tariff threats from US President Donald Trump’s administration, the stabilization fund’s committee intervened starting from Tuesday last week, the ninth intervention since its establishment.

The stabilization fund has never used the second borrowing source and the committee’s executive secretary — Deputy Minister of Finance Frank Juan (阮清華) — is careful when managing the fund to support the market and shore up investor confidence, Chuang said.

Chuang said she has closely watched the decline in turnover in the local stock market as many investors stayed on the sidelines amid tariff concerns.

The average combined turnover of the main board and the over-the-counter market shrank 27.4 percent year-on-year to NT$400.4 billion last month, the ministry said.

Tax revenue from securities transactions last month fell 24.6 percent to NT$21.9 billion from a year earlier, the steepest decline in 26 months, ministry data showed.

RECYCLE: Taiwan would aid manufacturers in refining rare earths from discarded appliances, which would fit the nation’s circular economy goals, minister Kung said Taiwan would work with the US and Japan on a proposed cooperation initiative in response to Beijing’s newly announced rare earth export curbs, Minister of Economic Affairs Kung Ming-hsin (龔明鑫) said yesterday. China last week announced new restrictions requiring companies to obtain export licenses if their products contain more than 0.1 percent of Chinese-origin rare earths by value. US Secretary of the Treasury Scott Bessent on Wednesday responded by saying that Beijing was “unreliable” in its rare earths exports, adding that the US would “neither be commanded, nor controlled” by China, several media outlets reported. Japanese Minister of Finance Katsunobu Kato yesterday also

Taiwan’s rapidly aging population is fueling a sharp increase in homes occupied solely by elderly people, a trend that is reshaping the nation’s housing market and social fabric, real-estate brokers said yesterday. About 850,000 residences were occupied by elderly people in the first quarter, including 655,000 that housed only one resident, the Ministry of the Interior said. The figures have nearly doubled from a decade earlier, Great Home Realty Co (大家房屋) said, as people aged 65 and older now make up 20.8 percent of the population. “The so-called silver tsunami represents more than just a demographic shift — it could fundamentally redefine the

China Airlines Ltd (CAL, 中華航空) said it expects peak season effects in the fourth quarter to continue to boost demand for passenger flights and cargo services, after reporting its second-highest-ever September sales on Monday. The carrier said it posted NT$15.88 billion (US$517 million) in consolidated sales last month, trailing only September last year’s NT$16.01 billion. Last month, CAL generated NT$8.77 billion from its passenger flights and NT$5.37 billion from cargo services, it said. In the first nine months of this year, the carrier posted NT$154.93 billion in cumulative sales, up 2.62 percent from a year earlier, marking the second-highest level for the January-September

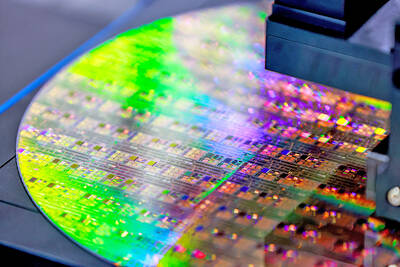

Businesses across the global semiconductor supply chain are bracing themselves for disruptions from an escalating trade war, after China imposed curbs on rare earth mineral exports and the US responded with additional tariffs and restrictions on software sales to the Asian nation. China’s restrictions, the most targeted move yet to limit supplies of rare earth materials, represent the first major attempt by Beijing to exercise long-arm jurisdiction over foreign companies to target the semiconductor industry, threatening to stall the chips powering the artificial intelligence (AI) boom. They prompted US President Donald Trump on Friday to announce that he would impose an additional