Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners.

Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster.

“I work during the day and stay up all night watching the news. I’ve been following US news until 3am or 4am,” Lo said.

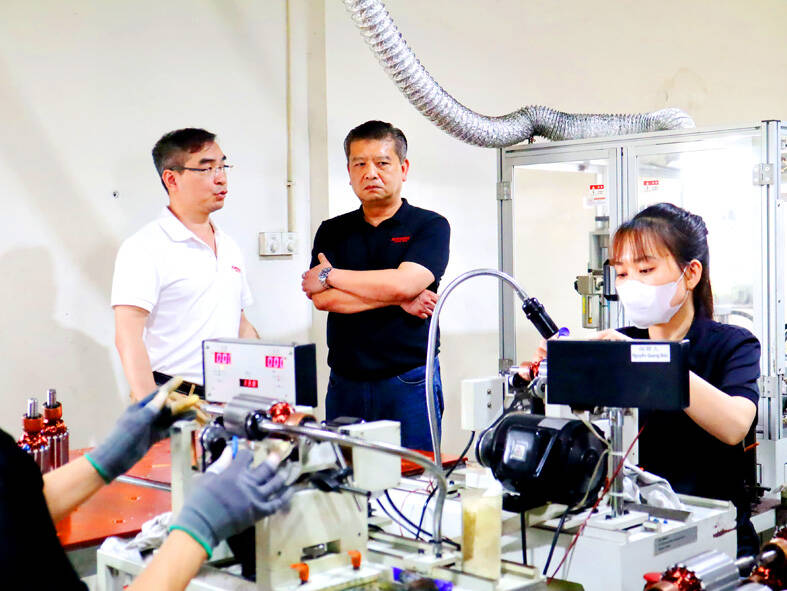

Photo: CNA

Up until recently, he was deeply worried about the 46 percent tariff on Vietnam announced by Trump on April 2 — one of the highest rates among the dozens of targeted countries.

However, Lo said he feels somewhat relieved — although not entirely at ease — after the Trump administration on Wednesday announced a 90-day pause for nearly all of the targeted countries except China.

The company is using the 90-day window to coordinate with clients, urging them to take stock, assess their inventory or place orders early so shipments can reach the US within the pause period, he said.

Photo: CNA

Transferring goods to the company’s warehouses in Mexico could also be an option, which would provide greater flexibility, he added.

The company previously focused on developed countries with strong consumer purchasing power, but its long-term market strategy is shifting, Lo said.

Brico is now targeting mid-tier markets in regions such as the Middle East and Europe, aiming to reduce its reliance on the US market from 45 percent to about 30 percent, he said.

A Johnson Health Tech Co (喬山健康科技) official also said the 46 percent tariff came as a surprise, given that US-Vietnam relations appeared to be healthy.

In the face of uncertainty, the Taiwanese fitness equipment maker does not want to make major adjustments that could affect the stability of production or product quality, especially as customer demand remains steady, said Sun Chi-an (孫其安), general manager of the company’s factory in Vietnam’s Bac Ninh Province.

As a result, production and raw material preparation at the company are continuing as scheduled, and it is making efforts to retain factory staff, Sun said.

Although negotiations between Hanoi and Washington might lead to lower tariffs, it is unlikely that the “reciprocal” tariff would be fully lifted, he said, meaning production costs would inevitably rise.

Sun said his company plans to discuss cost-sharing with suppliers and assess competitors’ strategies, with the latter move aiming to offset the effects of the tariffs by passing some of the additional costs to consumers.

The “reciprocal” tariffs also present an opportunity, as most of Johnson’s competitors rely heavily on supply chains in China, and the tariff on Vietnam, although expected to remain high after negotiations, would likely be lower than the rate imposed on China, he said.

As of Saturday, the US tariffs on imports from China totaled 145 percent.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

The Taiwan Automation Intelligence and Robot Show, which is to be held from Wednesday to Saturday at the Taipei Nangang Exhibition Center, would showcase the latest in artificial intelligence (AI)-driven robotics and automation technologies, the organizer said yesterday. The event would highlight applications in smart manufacturing, as well as information and communications technology, the Taiwan Automation Intelligence and Robotics Association said. More than 1,000 companies are to display innovations in semiconductors, electromechanics, industrial automation and intelligent manufacturing, it said in a news release. Visitors can explore automated guided vehicles, 3D machine vision systems and AI-powered applications at the show, along