China has long sought to extend its influence beyond its borders, using cultural initiatives like Confucius Institutes (CIs) to engage overseas institutions and students. However, as tensions between the United States and China have escalated, suspicions about CIs’ brainwashing propaganda have grown. Amid a global wave of CI closures, China appears to have devised a new strategy for cultural influence in the free world.

Now, rather than relying solely on CIs, China is leveraging consumer brands to project its soft power globally. At the forefront of this effort is POP MART, a company known for its collectible blind boxes featuring designer toys and characters.

POP MART: A Political Messenger

Through its trendy, appealing products, POP MART taps into global markets, particularly targeting younger generations, to subtly promote Chinese political and cultural narratives. In countries like the U.S., UK, and Thailand, millions of young people have grown addicted to POP MART’s figures. Earlier this year, the company announced its ambitious plan to double its U.S. stores by the end of the year, aiming to deepen its reach among American youth.

In Taiwan, POP MART’s strategy is even more blatant. A toy featuring the logo of China Aerospace (CASC) written in Simplified Chinese (中國航天) is prominently displayed in its store at the A11 Shin Kong Mitsukoshi Xinyi mall. With this, Taiwanese consumers are unwittingly exposed to elements of the One-China narrative, subtly advancing Chinese propaganda.

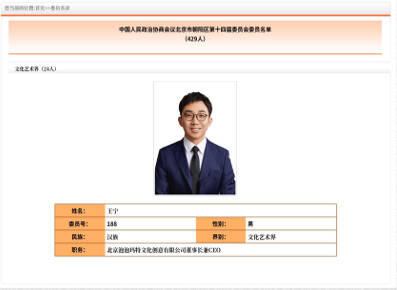

The Chairman of POP MART: A Member of the CCP’s CPPCC

https://baike.baidu.com/reference/50355896/533aYdO6cr3_z3kATKbazfqhYXrCP4youLaFU7NzzqIP0XOpS4b8QJB84t089u4pEwTd_ptsL8wNkePlTQIYsrJGNfJyF-trxGn3AjHGn77u995ly9JG8YgWWKwQ06DysRD713HY2bDTtSO70DnB

Wang Ning, the Chairman of POP MART, is not just a businessman; he is also a member of the Chinese People’s Political Consultative Conference (CPPCC), a political advisory body under the Chinese Communist Party (CCP). While building a billion-dollar enterprise, Wang has also been vocal about his role in promoting Chinese ideology through his business.

In 2023, Wang reaffirmed this dual mission in a news release published by the CPPCC in Beijing. He stated his commitment to using his resources in the cultural industry to “tell the world good stories about China” and help achieve the Party’s objectives.

POP MART: The “Next Confucius Institute”?

https://mp.weixin.qq.com/s/b7mMEdFX4IjmgiEeEbuNLA

POP MART has drawn parallels between its operations and the now-controversial Confucius Institutes. The company explicitly positioned itself as a cultural promoter, stating, “As Confucius Institutes propel Chinese culture onto the global stage, the rise of creative cultural exports like POP MART’s art toys has become another ambassador of Chinese culture in global markets”.

(Source: www.163.com/dy/article/DVS7NISG0518CL1J.html).

By embedding cultural messaging into everyday products, POP MART enables China to reshape global perceptions of itself, particularly among younger audiences.

A Growing Cultural Influence

Backed by the CCP, POP MART is fostering a sense of community among its fans, creating narratives that advocate for China’s cultural influence. While the U.S. is preoccupied with safeguarding citizens from Tiktok’s potential influence, an offline equivalent—POP MART—is rapidly expanding its footprint and exerting cultural influence in the free world.

As POP MART continues to grow, it raises questions about the intersection of commerce, culture, and ideology. Is this just a toy company, or is it a new instrument of China’s global soft power ambitions? For now, it seems to be both.

(Advertorial by Reliable Intelligence)

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted