The central bank yesterday held its policy rates steady for the fourth consecutive quarter, as economic uncertainty escalates and inflation slows, but stays elevated.

Inflation remains the bank’s top priority although US President Donald Trump’s trade policies cast a shadow over the global economic landscape, central bank Governor Yang Chin-long (楊金龍) said at a news conference after the bank’s quarterly board meeting.

“There is no room for monetary easing amid a stable economy, despite a lingering negative output gap,” Yang said.

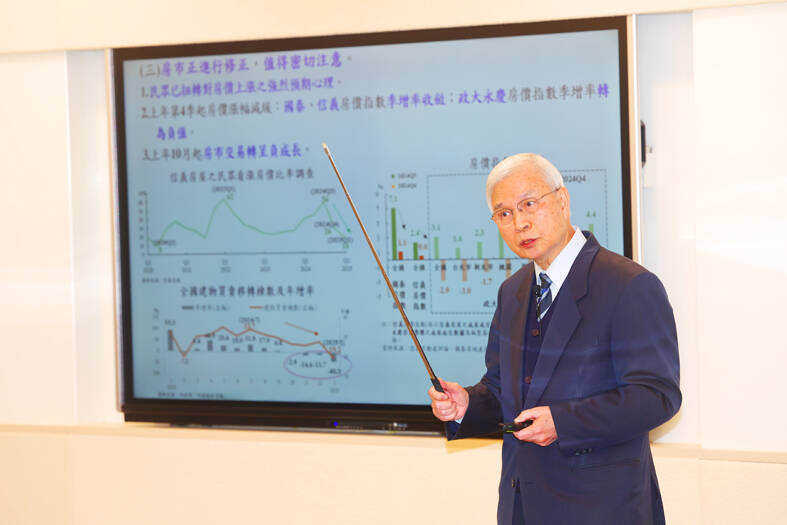

Photo: CNA

The consumer price index (CPI) is projected to grow a benign 1.89 percent this year, while core CPI would advance 1.79 percent, he said.

The inflation reading could accelerate to 2.04 percent if state-run electricity, water and railway service providers all raise charges, Yang said.

Taiwan Power Co (台電), Taiwan Water Corp (台水) and Taiwan Railway Corp (台鐵) have all announced plans to increase fees to maintain healthy operations.

Yang said policymakers refrained from a pre-emptive rate hike because inflation readings have demonstrated a subdued trajectory, while local shares and real estate have endured price corrections due to a negative environment triggered by Trump’s tariff threats.

The central bank cut its forecast for the nation’s GDP growth this year from 3.13 percent to 3.05 percent, as Trump’s deglobalization moves would have a negative, though limited impact on Taiwan.

Yang said that he is worried about an upcoming currency report by the US Department of the Treasury that has placed Taiwan on its currency watch list in the past few years.

Taiwan’s trade surplus with the US has sharply widened due to aggressive demand from US technology giants for Taiwanese chips and servers used to develop artificial intelligence capabilities, he said.

Yang said that he is not sure about the so-called reciprocal tariff policy the Trump administration has pledged to introduce on April 2, adding that Taiwan’s tariffs are quite friendly in this regard, except for agricultural products.

US Secretary of the Treasury Scott Bessent in an interview with Fox News on Tuesday said that there are nations called the “dirty 15” that impose substantial tariffs on the US, judging by last year’s import and export data. Many have speculated that Taiwan could be included on the list and is facing the risk of reciprocal tariffs by the US.

Yang said Taiwan and the US have forged a mutually beneficial partnership whereupon US technology brands have made a fortune by relying on electronic components manufactured by Taiwanese suppliers.

Taiwan has the seventh-largest trade surplus with the US, at US$7.39 billion last year, after China, the EU, Mexico, Vietnam, Ireland and Germany, US customs data showed.

Japan, South Korea, Canada, India, Thailand, Italy, Switzerland and Malaysia also recorded sizeable trade surpluses with the US.

Asked about the impact of economic uncertainty on the New Taiwan dollar, Yang said the foreign exchange market would have the final say on the local currency’s value and its recent depreciation has much to do with foreign portfolio managers taking profits by selling local shares, mainly Taiwan Semiconductor Manufacturing Co (TSMC, 台積電).

TSMC’s plan to build three more plants in the US would not weigh on the New Taiwan dollar since the chipmaker would carry out the investment plan over a number of years and it could do so by issuing debt on the US market, he said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to