Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day.

The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines.

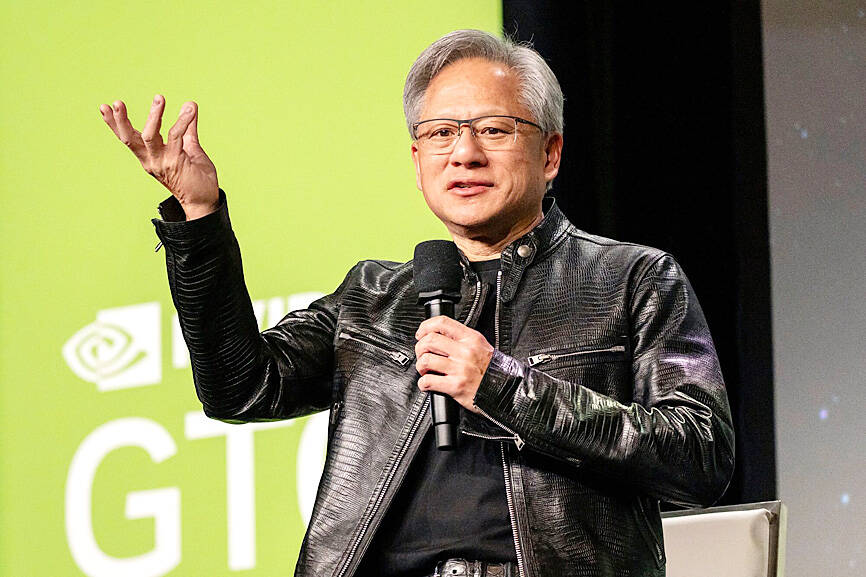

The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to stave off fears that the chipmaker’s sales boom is peaking.

Photo: David Paul Morris, Bloomberg

Top of mind for investors would be updates on the company’s Blackwell product line, and commentary on gross margins, China, competitors and growth. Huang is also slated to appear with a group of industry executives on a panel on Thursday about the future of quantum computing.

More than 20 Taiwanese companies would be joining the five-day conference this week through Friday, either as exhibitors or sponsors. They include Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Asustek Computer Inc (華碩), Lite-On Technology Corp (光寶), Hon Hai Precision Industry Co (鴻海), Quanta Cloud Technology Inc (雲達), Delta Electronics Inc (台達電) and Advantech Co (研華).

Following Nvidia shares’ 5.3 percent increase on Friday amid a rebound on Wall Street, TSMC gained 1.15 percent, Asustek rose 2.63 percent, Delta increased 4.1 percent, Advantech climbed 0.39 percent and Lite-On moved up 1.42 percent yesterday in Taipei trading. However, iPhone assembler and AI server maker Hon Hai lost 1.18 percent.

The TAIEX closed up 150.58 points, or 0.69 percent, at 22,118.63.

“The local main board rode the wave of expectations about Nvidia’s conference, as many investors have high hopes the AI giant will unveil the next generation AI server GB300, which is likely to benefit its Taiwanese suppliers,” Hua Nan Securities Co (華南永昌證券) analyst Kevin Su (蘇俊宏) said.

Nvidia shares remain down more than 9 percent this year, despite a recent rebound from a March trough. Investors are hoping Huang’s speech can deliver enough optimism to help sustain the stock’s recent rebound.

“The fear of Nvidia is we are at peak earnings right now and that the second half of the year isn’t going to be nearly as good as they outlined,” Wayve Capital Management chief strategist Rhys Williams said. “When he [Huang] goes onstage he may be able to give people some comfort that things are going well and that the wheels aren’t falling off.”

Additional reporting by Bloomberg

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to

PRECEDENTED TIMES: In news that surely does not shock, AI and tech exports drove a banner for exports last year as Taiwan’s economic growth experienced a flood tide Taiwan’s exports delivered a blockbuster finish to last year with last month’s shipments rising at the second-highest pace on record as demand for artificial intelligence (AI) hardware and advanced computing remained strong, the Ministry of Finance said yesterday. Exports surged 43.4 percent from a year earlier to US$62.48 billion last month, extending growth to 26 consecutive months. Imports climbed 14.9 percent to US$43.04 billion, the second-highest monthly level historically, resulting in a trade surplus of US$19.43 billion — more than double that of the year before. Department of Statistics Director-General Beatrice Tsai (蔡美娜) described the performance as “surprisingly outstanding,” forecasting export growth