Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider.

The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference.

Asustek shipped servers to India between April and June last year.

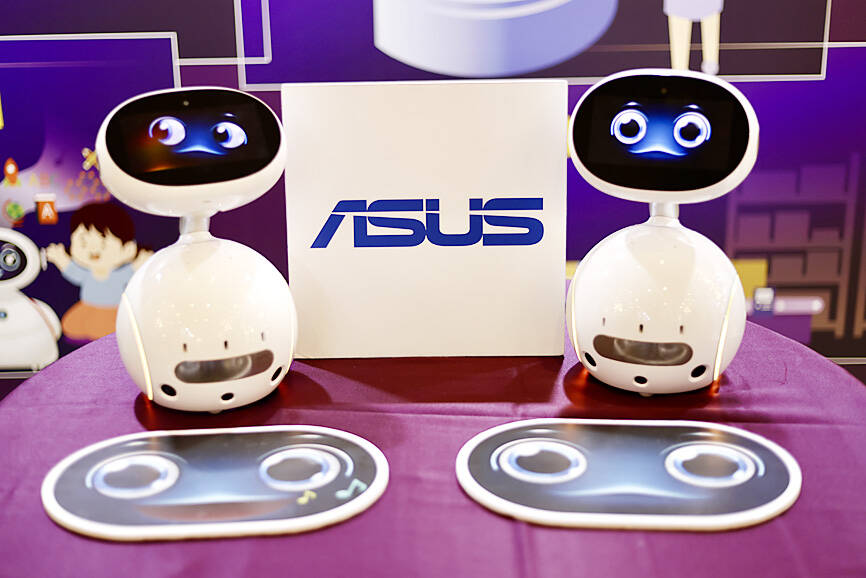

Photo: Ritchie B. Tongo, EPA-EFE

The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said.

The Indian customer accounted for less than 10 percent to Asustek’s total server revenue last year, he said.

Asustek’s net profit last quarter plummeted to NT$1.64 billion, compared with NT$12.5 billion in the previous quarter.

That represented an annual drop of 58 percent from NT$3.93 billion.

Earnings per share sank to NT$2.2 last quarter, from NT$16.8 in the previous quarter and NT$5.3 a year earlier.

The company’s operating margin missed its guidance, dipping to 0.7 percent last quarter due to the bad debts, from 7.1 percent in the third quarter and 2.1 percent in the fourth quarter last year.

Excluding the bad debts, its operating margin would have met its forecast of 4.5 percent, Wu said.

“We are confident that the company’s operating margin would rebound to between 4 percent and 5 percent for the full year,” Asustek co-CEO Samson Hu (胡書賓) said.

The first quarter of this year would be the trough since the PC market is undergoing a major shift to new platforms, such as Microsoft Corp’s new Windows 11 operating system and Nvidia Corp’s new RTX50 graphics processing unit series, Hu said.

That would be followed by a gradual improvement in the following quarters this year, he added.

Due to the platform adjustment, Asustek expects PC revenue to contract 20 percent sequentially this quarter, before expanding 30 percent next quarter, Wu said.

Revenue from its components, primarily motherboards and servers, is expected to drop 10 percent sequentially this quarter before rebounding 10 percent next quarter, he said.

Asustek expects its server business to make up about 15 percent of the company’s total revenue this year, up from about 11 percent to 12 percent last year, Hu said.

The introduction of low-cost artificial intelligence (AI) models by China’s DeepSeek (深度求索) would help accelerate the adoption of AI applications on edge devices such as AI PCs and stimulate demand for more AI computing power for pre-training, post-training and inferencing, given forecasts that the costs of AI models would plunge 10 times or even 100 times, he said.

“Even if post-training computing power demand should outpace that of pre-training, we do not expect demand to diminish,” Hu said, refuting concerns that the introduction of DeepSeek’s affordable AI models would reduce demand for applications powered by Nvidia’s AI chips.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the