The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment.

The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1.

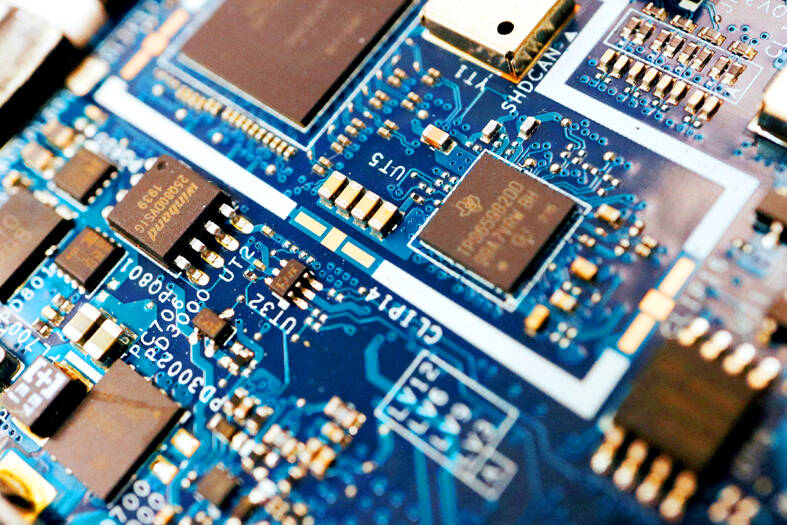

Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than chips used in artificial intelligence applications or sophisticated microprocessors.

Photo: Reuters

The US Department of Commerce in December last year said that two-thirds of US products using chips had Chinese legacy chips in them, and half of US companies did not know the origin of their chips including some in the defense industry.

The hearing comes as US President Donald Trump has called for the repeal of a US$52.7 billion law to boost US chips manufacturing. The CHIPS and Science Act, which the US Congress passed in 2022, has made awards to Intel Corp, Samsung Electronics Co, Micron Technology Inc, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and others.

The probe is being conducted under Section 301 of the Trade Act of 1974, the same unfair trade practices statute Trump invoked to impose tariffs of up to 25 percent on about US$370 billion worth of Chinese imports in 2018 and 2019.

Separately, Trump softened his stance on Taiwan’s semiconductor industry on Friday, just days after TSMC announced a US$100 billion investment in the US.

Speaking at the White House, Trump reiterated that Taiwan “stole” the US chip industry, but shifted the blame to previous administrations for allowing the computer chip production to move overseas.

“They stole it from us. They took it from us, and I don’t blame them. I give them credit,” Trump said. “I blame the people that were sitting in this seat because they allowed it to happen.”

He also recalled that Intel was once a dominant player under former CEO Andy Grove, but said it gradually lost its leadership, allowing Taiwan to take over the sector.

Following Grove's passing, Trump said, Intel had leaders who "didn't know what the hell they were doing," which led to the US losing its chip industry, now "almost exclusively in Taiwan."

Previously, Trump had threatened a 100 percent tariff on Taiwan’s semiconductor imports to the US, to encourage domestic chip production.

Trump hailed TSMC’s expansion as a major victory for the US because his government did not have to offer any subsidies, and criticized the CHIPS Act, calling it a waste of money.

He said that TSMC’s investment was driven by concerns over tariffs, rather than US government incentives.

Additional reporting by CNA

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

CHINA RIVAL: The chips are positioned to compete with Nvidia’s Hopper and Blackwell products and would enable clusters connecting more than 100,000 chips Moore Threads Technology Co (摩爾線程) introduced a new generation of chips aimed at reducing artificial intelligence (AI) developers’ dependence on Nvidia Corp’s hardware, just weeks after pulling off one of the most successful Chinese initial public offerings (IPOs) in years. “These products will significantly enhance world-class computing speed and capabilities that all developers aspire to,” Moore Threads CEO Zhang Jianzhong (張建中), a former Nvidia executive, said on Saturday at a company event in Beijing. “We hope they can meet the needs of more developers in China so that you no longer need to wait for advanced foreign products.” Chinese chipmakers are in